Chinese lenders not keen on staff cuts, says adviser

Chinese banks are reluctant to boost their profits by reducing costs through lay-offs

Banks are eager to cut costs and find efficiencies and, in some cases, believe that a third of their cost savings can be achieved by laying off staff, said financial advisory group Promontory Financial.

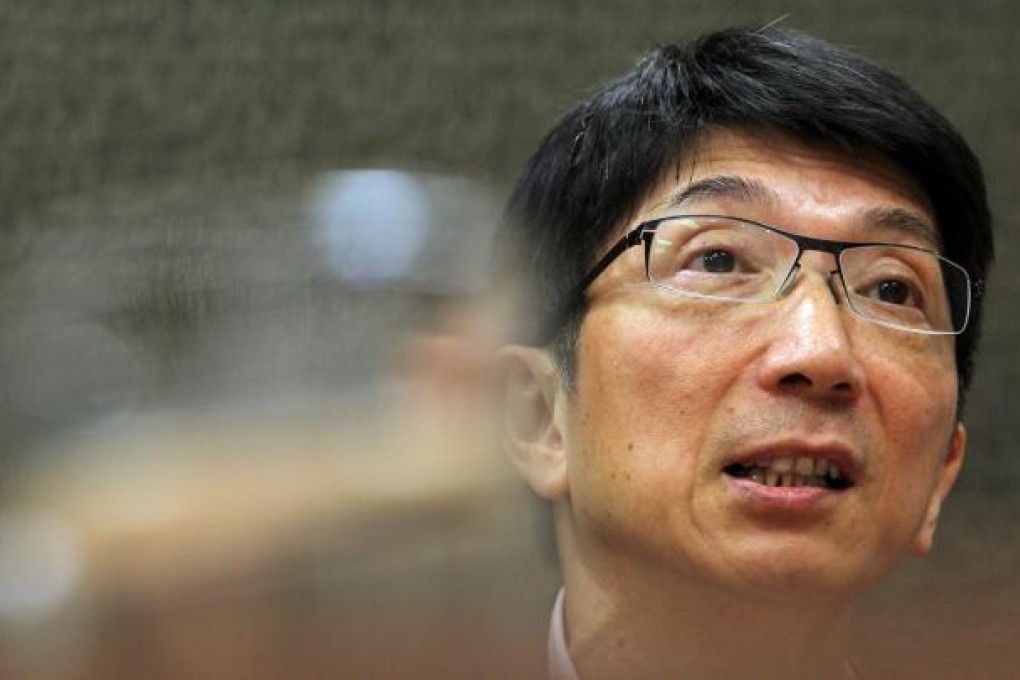

While European and United States financial institutions will trim costs by cutting staff levels "without a second thought", Frederic Lau, the managing director of the firm's China operations, said mainland lenders would be more reluctant to do so.

"Banks are eager to improve net revenues by cutting their costs in the present regulatory and competitive operating environment," said Lau, after his company asked several lenders how they planned to raise their efficiency and maximise their profits.

Global banking giant HSBC last year axed 30,000 staff around the world to improve its cost efficiency, followed by Citi, which announced a further lay-off of 11,000 staff last year.

Human resources were a major element in the cost structure of the banking industry, said Lau, and returns on equity could be raised by between 20 and 70 per cent, depending on the level of redundancies targeted by management.

The Chinese arm of Promontory was set up in 2011 and Lau said the company targeted mainland banks that ventured overseas.