China interest rate liberalisation to hit banks' interest margin: Ernst & Young

Bad loans could increase if mainland banks adjust portfolios by lending to riskier borrowers

The impact of interest rate liberalisation on mainland banks will be reflected in a further compression of their net interest margin in their results this year, Ernst & Young says.

Net interest margin is a profitability measure based on the difference between interest income and interest outlays.

Geoffrey Choi, a partner at the firm's China practice specialising in banking and financial services, said mainland banks would adjust the structure of their loan portfolios to maintain their margin.

"Banks could get a higher return on lending to small and medium-sized enterprises, and they might put more resources into such high-yield business," Choi said, as the firm released a report on the outlook for mainland banks.

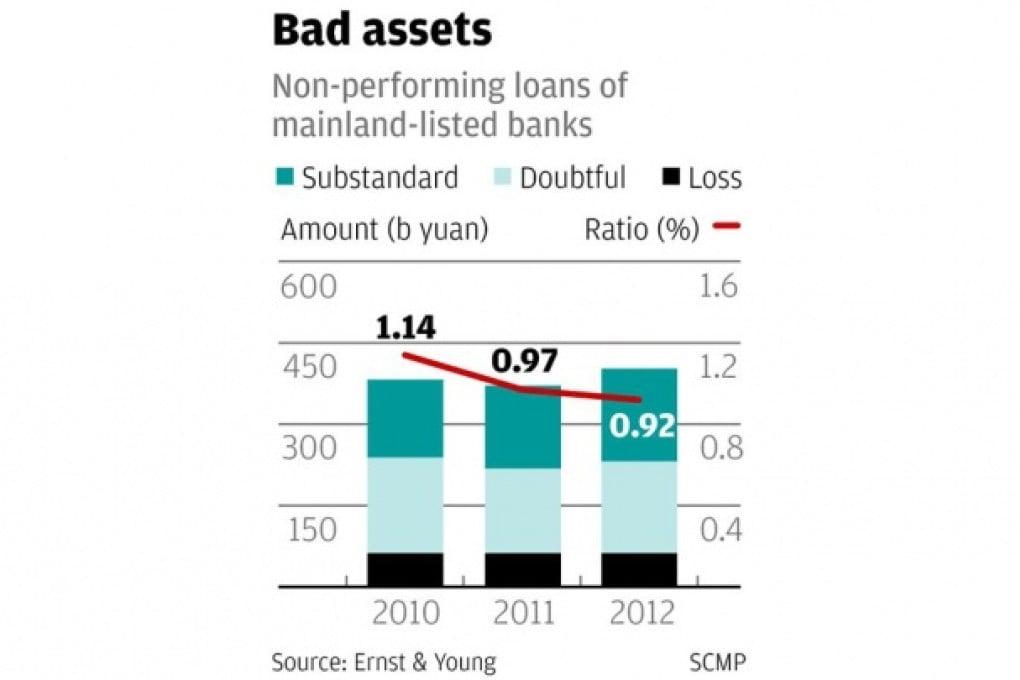

The banks' response might result in an increase in the amount of bad loans. The asset quality of listed banks remained stable last year, with the average non-performing loan ratio having fallen to 0.92 per cent by the end of the year, compared with 0.97 per cent in 2011, the firm said in a report.