Exclusive | Why bailouts can do more harm than good

Beijing can afford to let some small lenders fail, to avert bigger problems and serve as a lesson to others, says former SFC chief Andrew Sheng

Beijing should not bail out all domestic financial institutions that get into trouble, particularly the smaller ones that might face a squeeze as the risk of credit default rises in the world's No 2 economy.

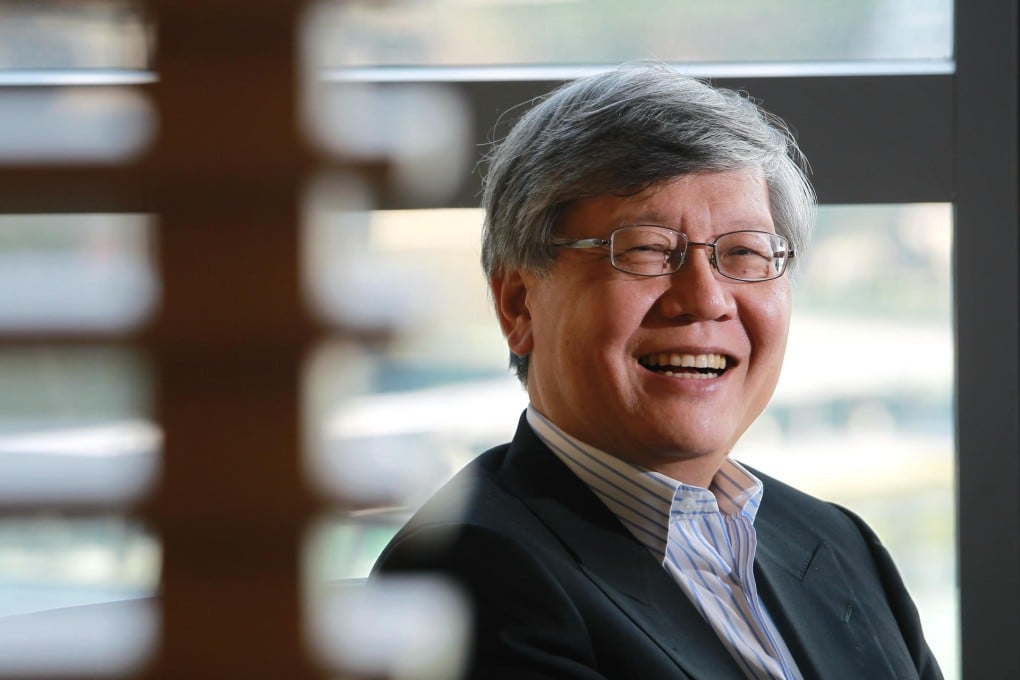

That is the view of Andrew Sheng, the former chairman of the Securities and Futures Commission in Hong Kong.

"Chinese banks largely have sufficient capital. But this doesn't mean small banks might not get into trouble, because if you are a local bank lending to a local industry, and the local area gets into trouble, you will be in trouble, too," said Sheng, a Chinese Malaysian who is now the chief adviser to the China Banking Regulatory Commission, the mainland's banking industry watchdog.

"In a large system of banks, some will get into trouble. There will not be zero failure just because there is prevention. If you prevent failure, what happens in the system is that it will become fragile and as a whole will become unstable. So allowing small mistakes actually prevents big mistakes," Sheng said in an exclusive interview with the South China Morning Post.

Amid the worsening economic slowdown on the mainland, concerns are growing about how strong the domestic banking system is. In late June, the mainland's interbank market was hit by a liquidity crisis for about one week, which was its worst cash crunch for decades. Some bankers privately complained about the central bank's slow reaction to the hike in interbank lending rates.