CIMB puts China at heart of growth push

Building on burgeoning trade flows, Malaysian bank is opening offices on the mainland and linking with key companies such as Alibaba

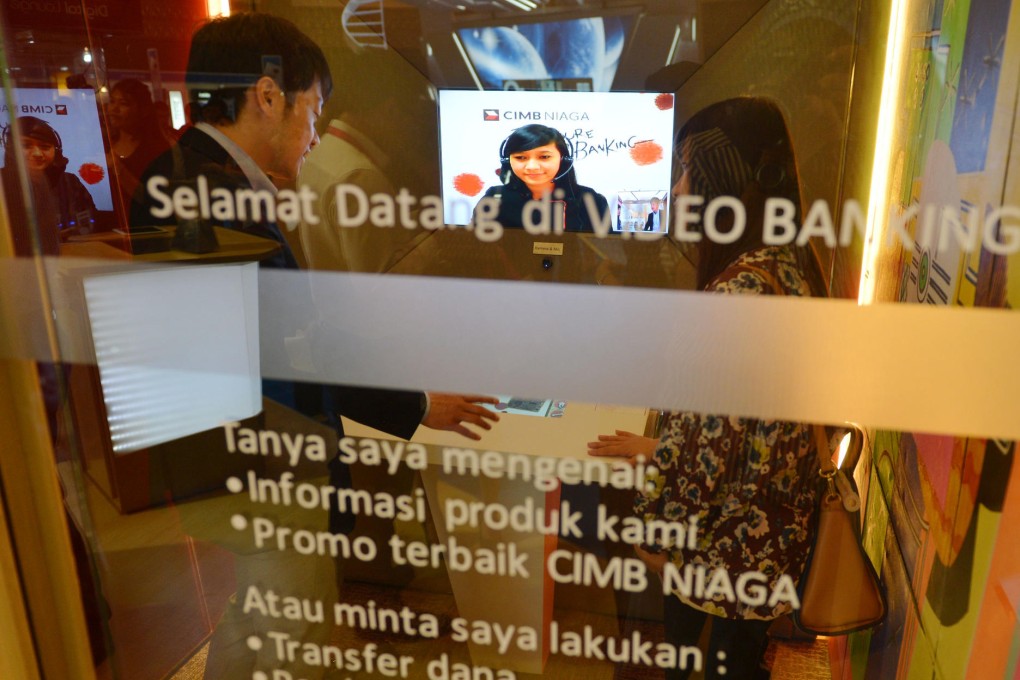

Regional banking group CIMB, which acquired key Asian assets of Royal Bank of Scotland last year, is targeting China for rapid business expansion outside its home market in Malaysia.

In April last year, the Kuala Lumpur-based investment and consumer banking group agreed to pay US$140 million for some Asian assets of loss-making RBS, which was bailed out by the British government during the 2008 financial crisis.

"We want to be part of the growth story and help bilateral trade grow further," added Zhao, a former senior RBS banker in Hong Kong who decided to stay with CIMB following the CIMB-RBS deal last year.

China is already the largest trading partner of the Association of Southeast Asian Nations, which includes most of the major economic powers in the region, such as Singapore, Malaysia and Indonesia.