OCBC unit to boost discretionary services

Bank of Singapore wants to boost assets under management to US$80 billion as more wealthy Asians let private banks decide on investments

More rich Asians are turning to private banks to make the final investment decisions in managing their wealth, demanding more so-called discretionary services that allow them to shrug off day-to-day management of their assets.

Bank of Singapore, the private banking arm of OCBC Bank, says it will step up efforts to grow its discretionary business as a result - part of its efforts to nearly double its assets under management by 2016.

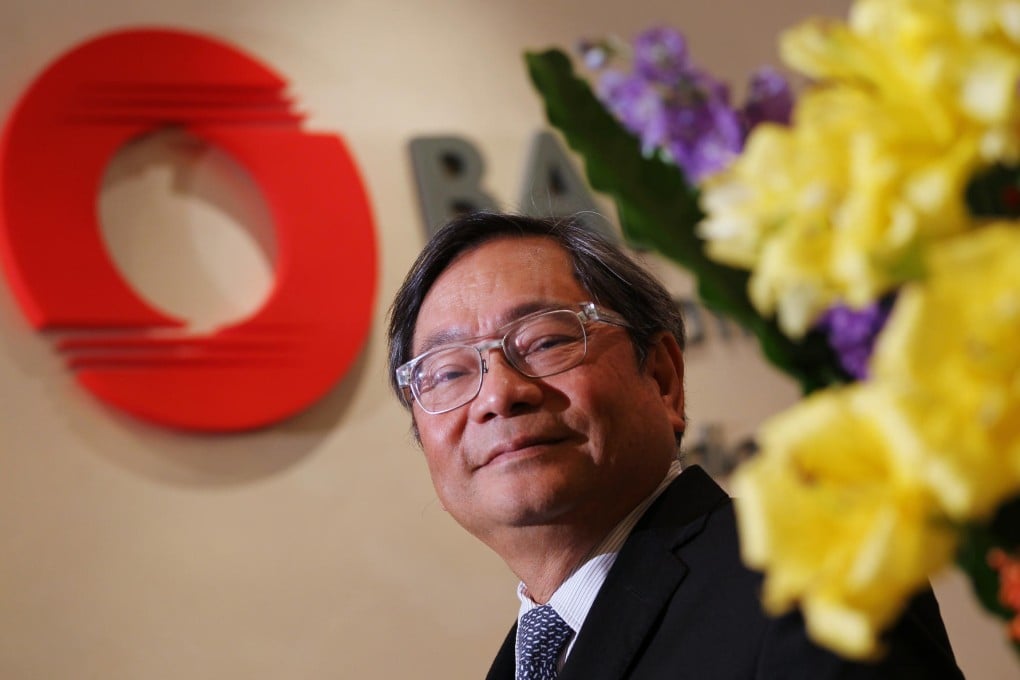

"We have seen [Asian] investors becoming more mature," said Renato de Guzman, the bank's chief executive. "In a discretionary business, you take a longer-term view of securities that you take in your portfolio. It is not just in and out of securities."

The private bank, acquired from Netherlands-based ING in 2010, aims to grow its assets under management to US$80 billion by 2016, from US$45 billion at the end of June, de Guzman said.

"We have been successfully developing an investor base that has invested their money using professional managers," he said. "It is an increasing trend as more investors are seeking professional managers to manage their wealth."

Discretionary and advisory services are two major business models of a private bank. The key difference is the investment decision-making body - in the former case, it is the private bank while in the latter, it is the owner of the assets.