London jumps queue in race to be yuan hub

Beijing grants British investors quota under scheme for direct investment in securities

London has stolen a march over Singapore in the race to become a yuan hub, becoming the first foreign city to be allowed to invest directly in domestic securities on the mainland.

They will be able to apply for licences to invest yuan directly into the mainland under its renminbi qualified foreign institutional investor (RQFII) scheme, it was announced after the fifth China-Britain economic and financial dialogue.

RQFII started in 2011 in Hong Kong, allowing yuan funds raised in the city to be invested in mainland stocks and bonds.

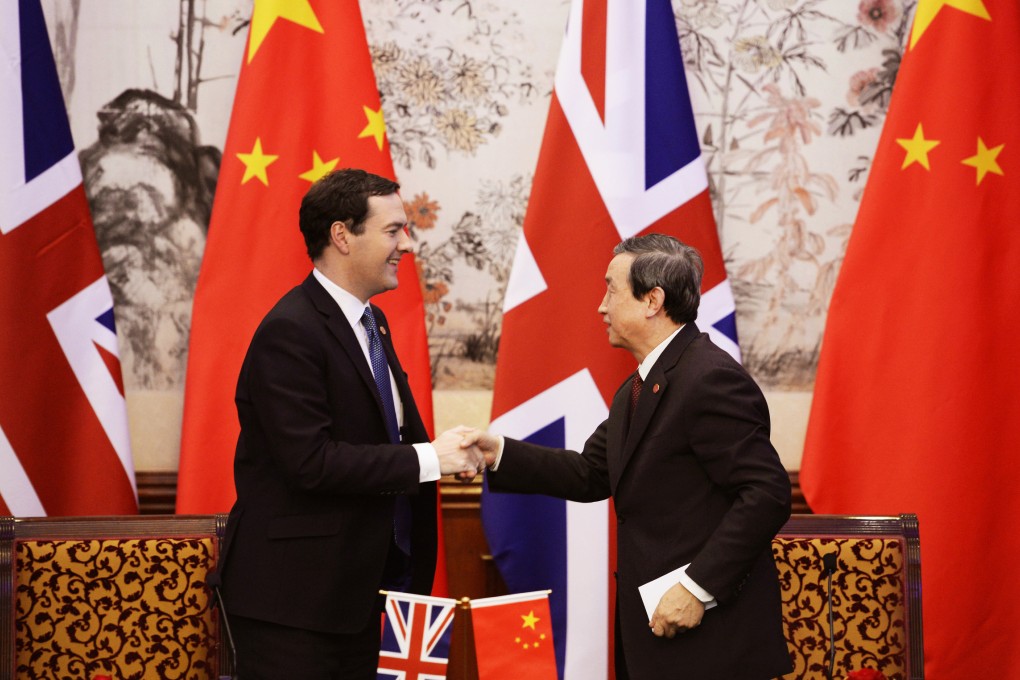

UK Chancellor of the Exchequer George Osborne said he wanted the quota to be used as quickly as possible. "My ambition is to make sure London becomes the Western hub for yuan business," he said after meeting Vice-Premier Ma Kai .

Ma said the two countries had also reached an agreement on direct trading between the yuan and the British pound, but did not elaborate. This follows the 200 billion yuan currency swap agreement between the People's Bank of China (PBOC) and the Bank of England in June. The European Central Bank and the PBOC also signed a 350 billion yuan swap agreement last week.