China to provide Africa with US$1tr financing

Funds over next 12 years will come in the form of investments and loans, with most of them for building infrastructure, says mainland analyst

The central government, including state-owned banks, will provide US$1 trillion of financing to Africa in the years to 2025, says Zhao Changhui, the chief country risk analyst at Export-Import Bank of China (Eximbank).

Eximbank, a leading lender to overseas Chinese projects, will account for 70 to 80 per cent of that US$1 trillion, which will include direct investments, soft loans and commercial loans, Zhao said at the recent Africa Investment Summit in Hong Kong.

"We have plenty of money to spend," he said. "We have the budget for major projects. China has US$3.5 trillion of reserves, which cannot just buy US treasuries. We need to use part of them in overseas investments.

"Africa for the next 20 years will be the single-most important business destination for many Chinese mega corporations."

The US$1 trillion of future financing was a big increase from China's previous financing of Africa, Zhao said without giving exact numbers. Last year, Eximbank provided tens of billions of dollars to Africa.

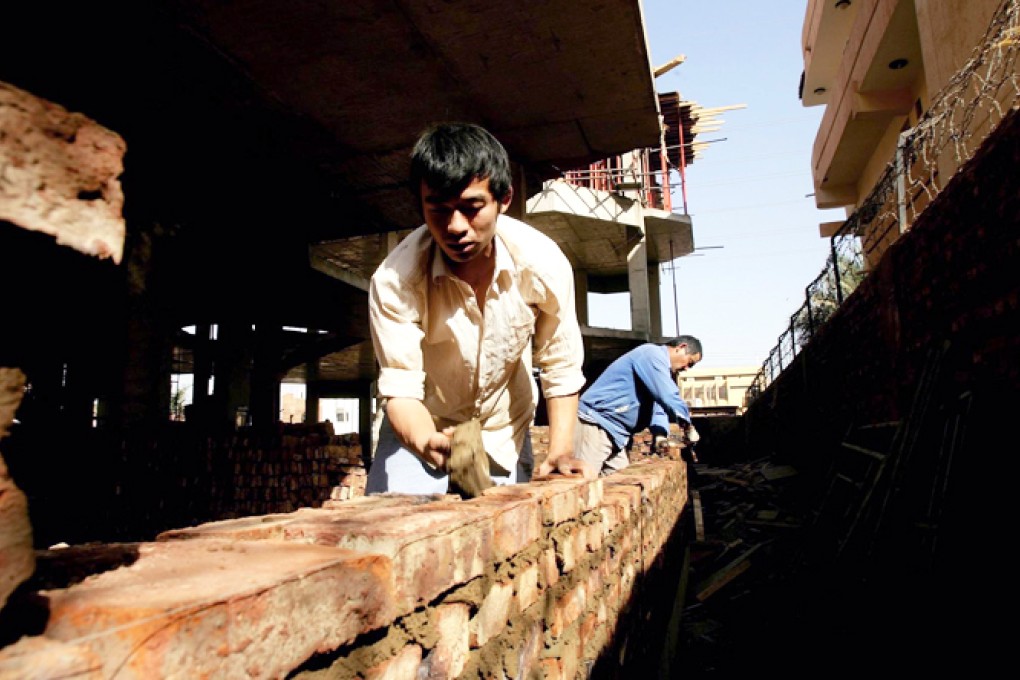

Zhao said Eximbank was looking to participate in infrastructure projects in Africa, including transnational highways, railways and airports. He estimated it would cost US$500 billion to build a continental rail network.

"Africa is infrastructure-light right now. There is intense need for electrification," said Jeff Gable, the managing principal of Africa non-equity research at Barclays.