New | China’s Bocom says it will buy 7 per cent of local government bond issues this year

Bank of Communications (Bocom) pledged to buy up to 7 per cent of all mainland local government bond issues this year, as a central government plan to get indebted localities to swap their loans into bonds gathers pace.

The announcement by the mainland’s fifth largest bank came as finance ministry figures on Wednesday showed the gross balance of local government debt would reach 10.7 trillion yuan (HK$12.9 trillion) this year, up from an estimated 9.9 trillion yuan in 2015, in spite of efforts to keep it down.

Local governments will owe another 6.4 trillion by the end of this year that has gone into big infrastructure projects, up from 6.1 trillion in 2015. Last August the central government set a cap on total local government debt at 16 trillion yuan last year.

Rising indebtedness among local governments has given rise to concerns both in China and globally of risk to financial stability, and has sparked measures including the loans-for-bonds swap programme.

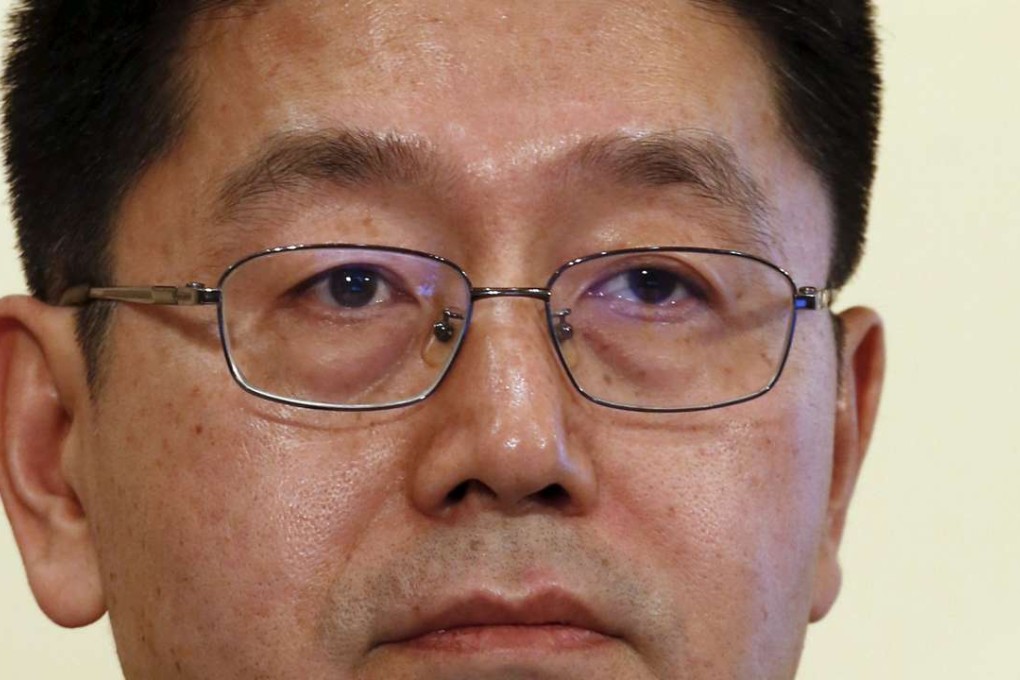

“Local governments now understand the importance of local government debt to their local economies. In terms of the management of their pricing, working with banks, they have released a series of supportive policies. We will work with them in a positive manner,” said Wu Wei, Bocom’s chief financial officer.

Speaking at the company’s results briefing on Tuesday, he added that Bocom would aim to buying 7 per cent of all issuance this year, adding to the 280 billion yuan of local government debt it bought last year. That figure made up most of the bank’s new 320 billion yuan of bond investments in 2015, a total that was in turn 40 per cent above that of 2014.