Yunnan Tin’s debt-for-equity swap raises market concerns

As China’s first debt-for-equity swap case after new guidelines were issued by the central government, the deal between China Construction Bank and Yunnan Tin Group has raised concerns over whether market disciplines were applied given that authorities have set this as a priority.

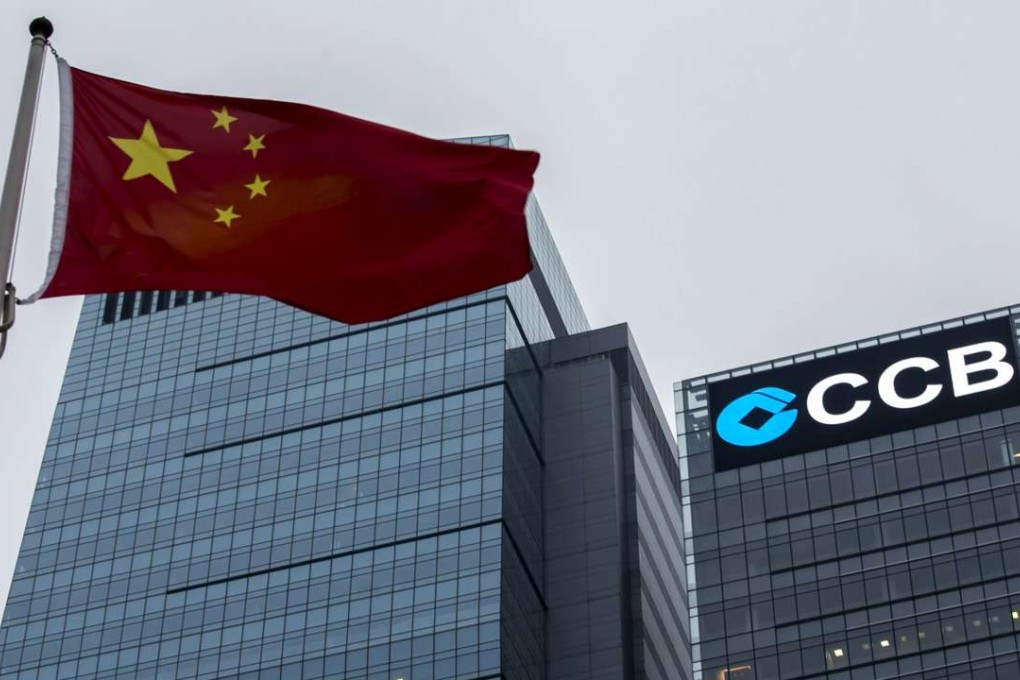

China Construction Bank (CCB), the nation’s second-largest bank, agreed to a debt-for-equity deal worth almost 5 billion yuan with Yunnan Tin Group, the country’s biggest tin producer, owned by the south-western Yunnan province.

The agreement is part of a larger 10 billion yuan deal the two companies signed to reduce Yunnan Tin’s debt ratio, Beijing-based CCB said in a statement on Sunday.

The deal is the first debt-for-equity swap after the State Council released new guidelines for the scheme last week. The deal sheds some light on how the scheme will be implemented as it is also the first case involving a local government-owned company.

The CCB will set up a separate new fund to raise 10 billion yuan to take on Yunnan Tin’s debt with other partners, said Zhang Minghe, the bank’s executive in charge of the debt-for-equity swap scheme.

The CCB said it will buy debt from Yunnan Tin at face value, as most of the debt is “normal”, a category of debt not subject to impairments.

There has been discussion in the market that the purchase of debt in the swap should be at a discounted price to reflect market principles.