Yunnan Tin’s debt-for-equity swap raises market concerns

As China’s first debt-for-equity swap case after new guidelines were issued by the central government, the deal between China Construction Bank and Yunnan Tin Group has raised concerns over whether market disciplines were applied given that authorities have set this as a priority.

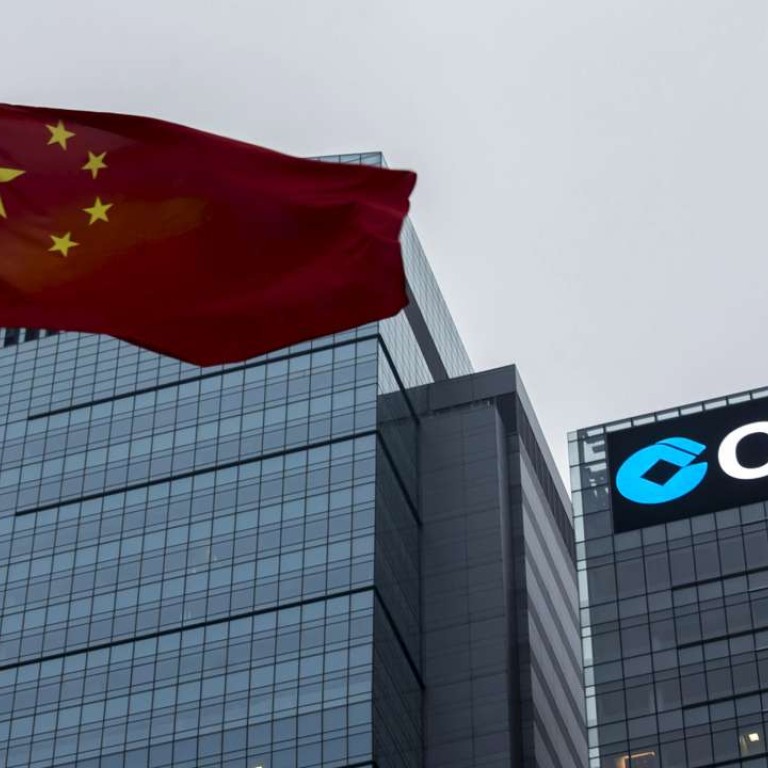

China Construction Bank (CCB), the nation’s second-largest bank, agreed to a debt-for-equity deal worth almost 5 billion yuan with Yunnan Tin Group, the country’s biggest tin producer, owned by the south-western Yunnan province.

The agreement is part of a larger 10 billion yuan deal the two companies signed to reduce Yunnan Tin’s debt ratio, Beijing-based CCB said in a statement on Sunday.

The deal is the first debt-for-equity swap after the State Council released new guidelines for the scheme last week. The deal sheds some light on how the scheme will be implemented as it is also the first case involving a local government-owned company.

The CCB will set up a separate new fund to raise 10 billion yuan to take on Yunnan Tin’s debt with other partners, said Zhang Minghe, the bank’s executive in charge of the debt-for-equity swap scheme.

The CCB said it will buy debt from Yunnan Tin at face value, as most of the debt is “normal”, a category of debt not subject to impairments.

There has been discussion in the market that the purchase of debt in the swap should be at a discounted price to reflect market principles.

There is a contradiction here. If the debts are absolutely ‘normal’, why does the company need a debt for equity swap?

“The pricing of the debt raises doubts over whether the swap is really carried out in line with market disciplines,” said Liao Qiang, a senior director for financial institution ratings at Standard & Poor’s.

“There is a contradiction here. If the debts are absolutely ‘normal’, why does the company need a debt for equity swap?”

Yunnan Tin generated a total loss of more than 6 billion yuan in the past three years, with its net assets shrinking to less than 10 billion yuan from 15 billion yuan during that period, according to Zhang.

In addition, CCB plans to raise the majority of capital from financial institutions and facilities, including insurance companies, pension funds, China Cinda Asset Management and wealth management products(WMPs), according to the bank’s statement.

“The fact that the bank plans to raise capital through wealth management products (WMPs) also raises concerns over whether the bank remains exposed to the debts through providing implicit financial support to the WMPs, as Chinese banks normally do for their WMPs," said Liao.

“Chinese banks have long adopted the practice of ensuring 'rigid repayment' with their own WMPs, which poses great pressure to banks,” added Liao.

Liao’s worries were echoed by Fitch Ratings, which has expressed concerns that Chinese banks could use related parties as implementing agencies.

The rating agency said in its latest report that because debt-to-equity swaps are now allowed to be funded by “social capital” – likely to include mutual funds and WMPs – it raises the possibility of banks retaining their exposure to corporates through complicated ownership and transaction structures that lack transparency.

For example, banks’ exposure to troubled companies might simply move off-balance sheet if bank-linked WMPs are used to fund swaps, said Fitch.