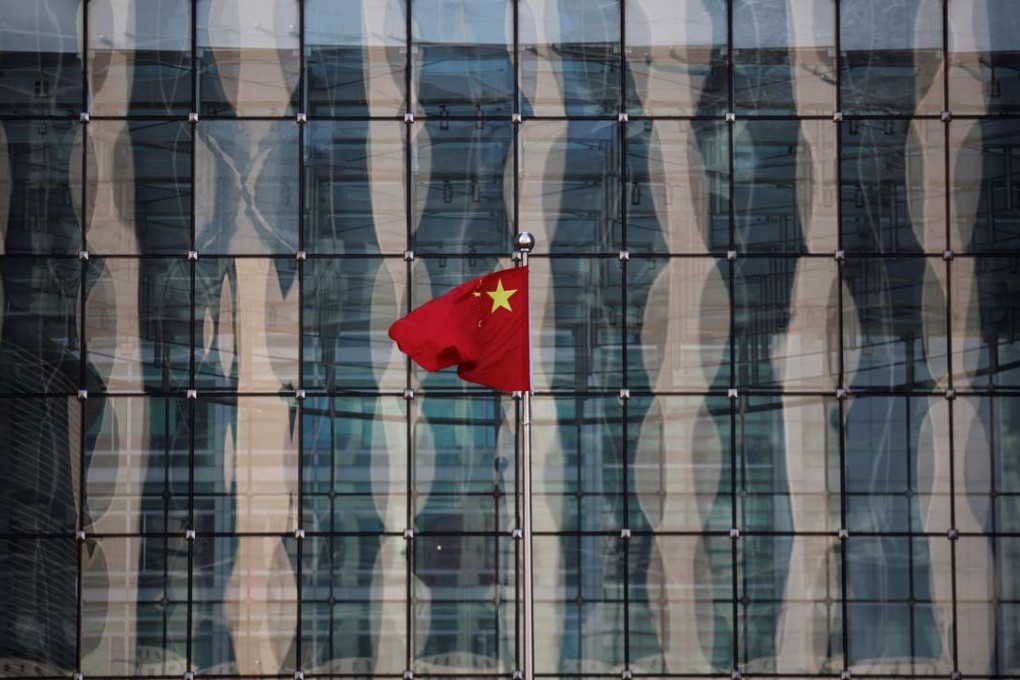

Money Matters | Banks assume the ‘burden of proof’ in China’s crackdown on capital flight

How bad will Beijing’s latest tightening of capital exodus be? KYC is what mainland bankers are comparing it to.

That’s the short form for “know your client”, a verification process widely used by western banks for new account openings, but one that bankers frown upon because it is cumbersome to manage. KYC also shuts out small and medium businesses while leaving big corporates largely unscathed.

This is what you get when bankers are made the frontline gatekeepers in the battle against capital flight .

Mainland Chinese authorities are reportedly banning overseas investment above a certain size and of a certain nature. Yet, the numbers and the definition are designed to be circumvented.

The State Administration of Foreign Exchange (SAFE) is therefore putting the burden on banks. They have to verify “authenticity” of overseas investments and the need for the remittance in the first place, according to its directive to the banks.

It also said banks have to report to SAFE on each verified deal before making any loans or authorising currency conversions.