Mind the Gap | Why Hong Kong start-ups find it hard to raise funds

In Hong Kong, watching where the money flows gives you an idea of the past and future for the year ahead. This city has always been about following the cash and buying and selling into trends - no matter how irrational.

Hong Kong’s strange financial dilemma is that despite easily having enough billionaires to fund a manned expedition to Mars, there is little to no interest in funding start-ups or new ideas. The amount of start-up money is paltry given the amount of wealth in this town.

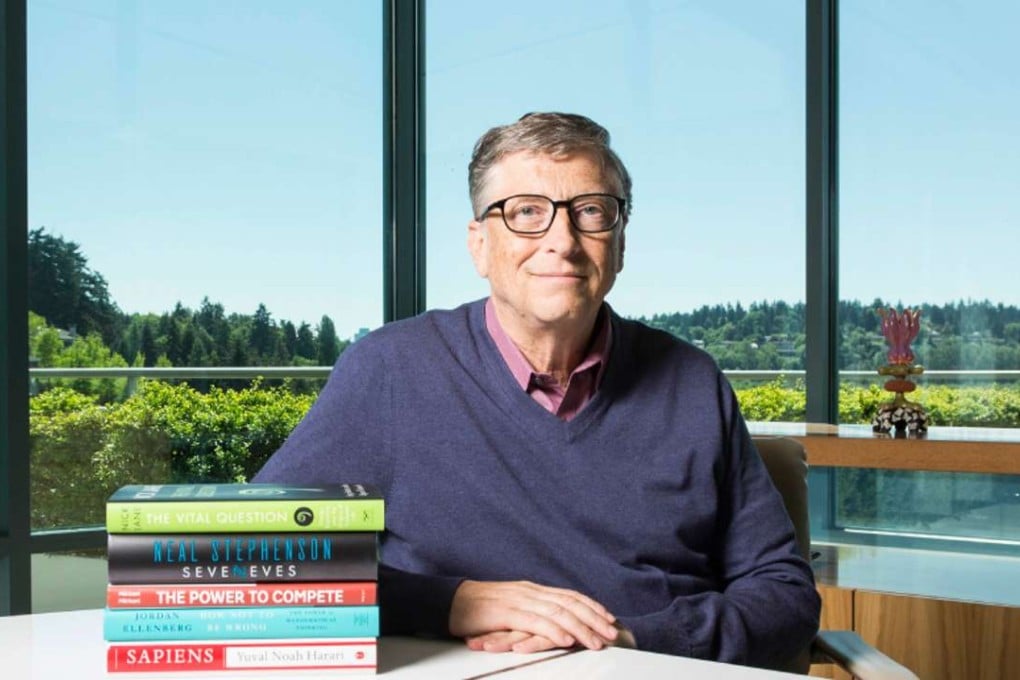

One explanation can be found in Alibaba founder Jack Ma’s recent investment in Microsoft founder Bill Gates’ US$1 billion Breakthrough Energy Ventures fund. It was recently launched to seek new energy technologies in a sign of how the private sector is continuing to invest in reducing greenhouse gas emissions. It aims to be “patient capital”, according to Gates, potentially holding investments for 15 to 20 years.

Ma will sit on the fund’s board, chaired by the Microsoft founder. Other members include John Doerr of Klein Perkins Caulfield & Byers and Amazon CEO Jeff Bezos.

One could justifiably ask why Ma chose to invest in Gates’ high risk venture rather than back a massive start-up fund in Hong Kong. However, private bankers in town tell me that many high net worth Hong Kong and mainland individuals are actually keen to access other famous venture capital funds such as ones managed by Marc Andreessen, a seed investor in Facebook and co-founder of Netscape.

The paradox in raising funds, as any banker will tell you, is that famous investors love the company of other famous investors. Billionaires like to network with other billionaires. The actual returns really don’t matter.