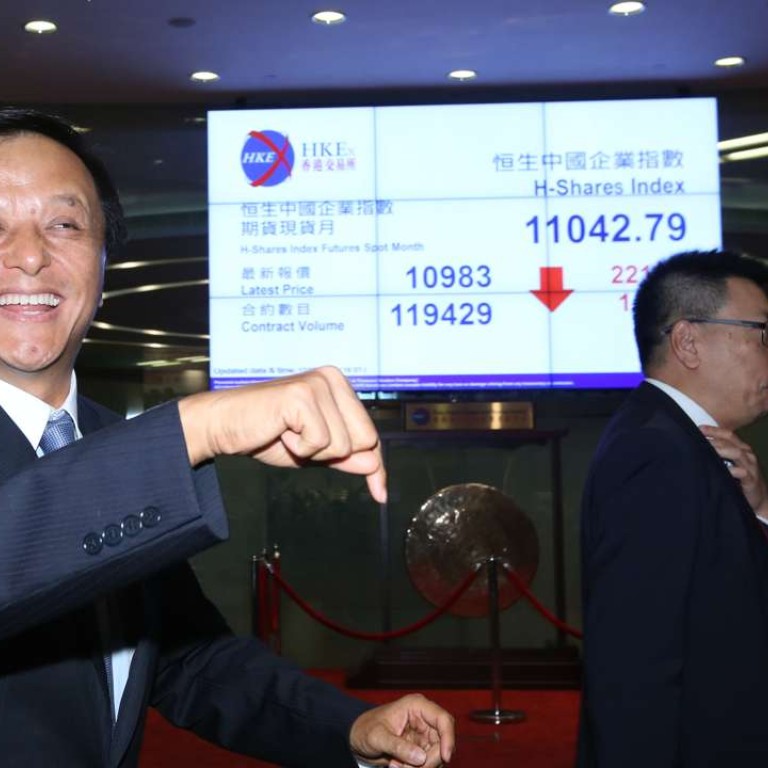

Update | Charles Li’s 2016 bonus may be cut as HKEX turnover shrinks

Shrinking turnover, profit declines may mean smaller bonus for Hong Kong’s highest-paid regulator

Charles Li, the highest-paid among Hong Kong’s financial regulators, is likely to take home a smaller bonus cheque this year, sharing the gloom that has befallen the city’s brokers as the number of stocks that change hands everyday shrank 36 per cent to a three-year low.

A former JPMorgan investment banker, Li was paid HK$45 million last year, comprising HK$9 million in basic salary, HK$15 million in cash bonus, and HK$19.92 million in stock, according to the annual report of the Hong Kong Exchanges & Clearing Ltd (HKEX). Li got a 27-per cent raise in the non-stock portion of his package last year, the report showed.

Li’s 2016 bonus may be cut by between 10 per cent and 20 per cent, according to Christopher Cheung Wah-fung, the Hong Kong lawmaker who represents the financial services sector.

“Every broker is facing the same fate this year” in Hong Kong, said Cheung, chairman of Christfund Securities Ltd. “2016 had been a very bad year in terms of turnover. Most brokers will only pay two weeks’ salary or a month’s salary as bonus.”

Hong Kong’s stock market had been having a dismal year. Average daily turnover shrank to a three-year low of HK$67.396 billion in mid-December, down 36 per cent from last year when HK$105.63 billion of shares changed hands every day.

As a destination for new companies raising capital, Hong Kong saw US$39.4 billion raised on its bourse, 57 per cent less than 2015, even as the city remained the world’s largest market for initial public offerings for the second year, according to Thomson Reuters data.

For the HKEX, which operates as a for-profit business, 2016 revenue may decline 14 per cent to HK$11.46 billion, while net profit falls 23 per cent to HK$7.95 billion, according to Bloomberg’s estimates.

“It’s the duty of the HKEX chief executive to think of ways to improve turnover, and to enhance the financial performance of the bourse,” said Benny Mau, chairman of Hong Kong Securities Association.

“When the bourse’s profit is down, it’s natural that the bonus of the CEO and senior managers will be affected.”

To be sure, HKEX executives won’t be judged purely on market turnover. The Hong Kong bourse successfully introduced a circuit breaker that eased the market’s trading volatility, and avoided the kind of mess that caused a market meltdown in mainland China. In addition, the HKEX plans to launch a metal trading platform in Qianhai.

The HKEX’s remuneration committee comprises five independent directors, including the chairman of the bourse Chow Chung Kong.

Mclagan International Inc, the consultant hired by HKEX to review the salaries of the exchange’s non-executive directors, recommended a raise in the 2015 financial year, with no change in 2016.

“In consideration of the benchmark information, macroeconomic factors and the competitive environment, the remuneration committee recommended that the remuneration level for the non-executive directors should remain unchanged for 2016/17,” the committee said.

An HKEX spokeswoman said details of the bourse’s salaries will be in the annual report, declining to elaborate.

Chow received a 33 per cent raise last year, enabling him to take home HK$3.14 million. Other independent HKEX directors received between HK$700,000 and HK$950,000 in fees.

Hong Kong’s Securities & Futures Commission (SFC), which relies on trading fees for income, has also been hit hard by the slump in the city’s market turnover, reporting two consecutive quarterly losses.

Its loss widened to HK$50.58 million in the quarter ended September, from HK$31.46 million a year ago.

Still, the SFC’s losses are unlikely to crimp the pay packet of its chief executive Ashley Alder, the city’s third-highest paid regulator.

After a 3.4 per cent raise, his package for the financial year ended March rose to HK$9.73 million, comprising HK$6.8 million in base salary, and a discretionary bonus of HK$2.25 million, plus HK$680,000 in retirement benefits.

“Alder and other SFC senior executives are not working for profit as their major duties are to maintain an orderly market and investor protection,” Cheung said. “Their bonus should not be hard hit by the lower market turnover.”

The SFC’s chairman Carlson Tong was paid HK$1.01 million in the 2016 financial year. His pay is likely to remain unchanged in 2017, a source familiar with the regulator’s board told the South China Morning Post. The SFC’s spokesman declined to comment.

The Hong Kong Monetary Authority (HKMA) doesn’t disclose the exact remuneration of its executives. The city’s de facto central bank did disclose that its highest-paid employee -- most likely chief executive Norman Chan -- received between HK$10 million and HK$10.5 million last year, with a raise of 5 per cent from 2014. That makes Chan the second-highest paid regulator in Hong Kong.

Chan and his HKMA senior managers are employed and assessed by Hong Kong’s Financial Secretary, based on a pay review by the government’s Exchange Fund Advisory Committee.

The HKMA executives’ salaries will be reviewed annually “taking into account the government’s assessment of the performance of the HKMA in the preceding year, the pay-survey findings of financial sector conducted by independent human resources consultants and any other relevant factors,” the regulator’s spokesperson said in an e-mailed response to the Post’s query.

The Exchange Fund, equivalent to Hong Kong’s reserves used for defending the currency’s peg to the US dollar, reported an investment gain of HK$42.5 billion in the third quarter, more than double the previous quarter and a turnaround from last year’s loss of HK$63.8 billion.

“This would support Mr Chan’s case to have a good raise and bonus payout,” Cheung said.