Chinese funds find sweet spot in city’s insurance sector

Wave of acquisitions in insurance sector began building momentum in 2014, say analysts

Hong Kong insurance companies remain attractive acquisition targets for mainland entities, a trend that has helped to inject fresh capital into the local industry, yet one which also ushers in new regulatory and management challenges, according to industry players.

“The life insurance business in Hong Kong has achieved double-digit growth over the last decade and there is still room for growth in future with the expanding middle class and ageing population,” Peter Tam, chief executive of the Hong Kong Federation of Insurers said in an interview with the South China Morning Post.

“The rule of law and regulation has also bolstered the confidence of mainland buyers to acquire Hong Kong insurance companies in recent years. This trend is going to continue.”

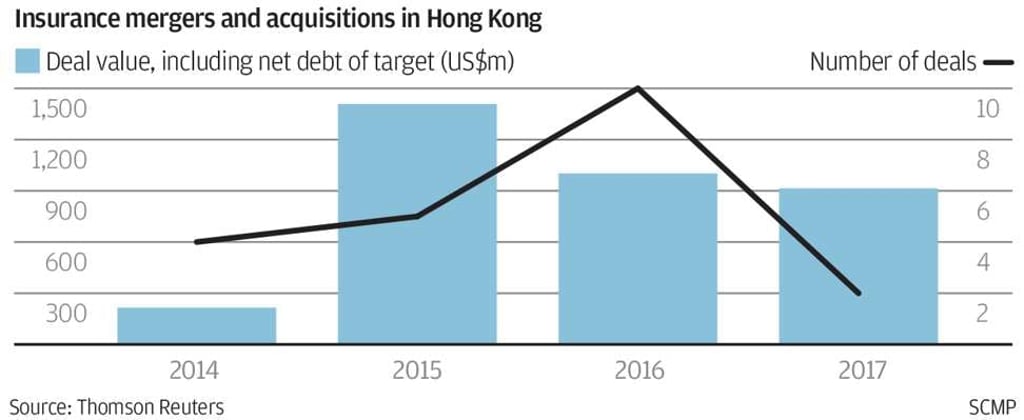

A wave of acquisitions in the insurance sector began building momentum in 2014, resulting in 21 proposed takeovers worth US$4 billion, of which mainland entities are the largest buyers by country of origin, according to Thomson Reuters.

Among the 21 proposed takeovers, nine are led by mainland companies.