Employees win, providers lose in Hong Kong MPF’s low-fee reform

Introduction of a compulsory Default Investment Strategy fund could force out small providers by cutting income from fees by up to 40 per cent

Hong Kong’s Mandatory Provident Fund market may see more consolidation as reforms taking effect on April 1 slash income from fees by up to 40 per cent, forcing smaller providers out of the market.

From Saturday onwards, all 18 MPF providers are required to introduce a Default Investment Strategy fund, which has a management fee capped at 0.95 per cent. That compares with the 1.56 per cent average fee across the 435 MPF investment funds.

The reform will benefit the 2.8 million members under the MPF, Hong Kong’s compulsory retirement pension scheme, as they will pay less if they choose to shift their investment to the new fund. The HK$8.2 billion (US$1.06 billion) in assets of the 600,000 employees who do not choose how to invest their MPF contributions will be automatically moved into the default fund.

The introduction of DIS is a step in the right direction because it will help MPF members save more over time

The other members also have the option of diverting their contributions to the default fund, putting additional pressure on other funds to cut their fees.

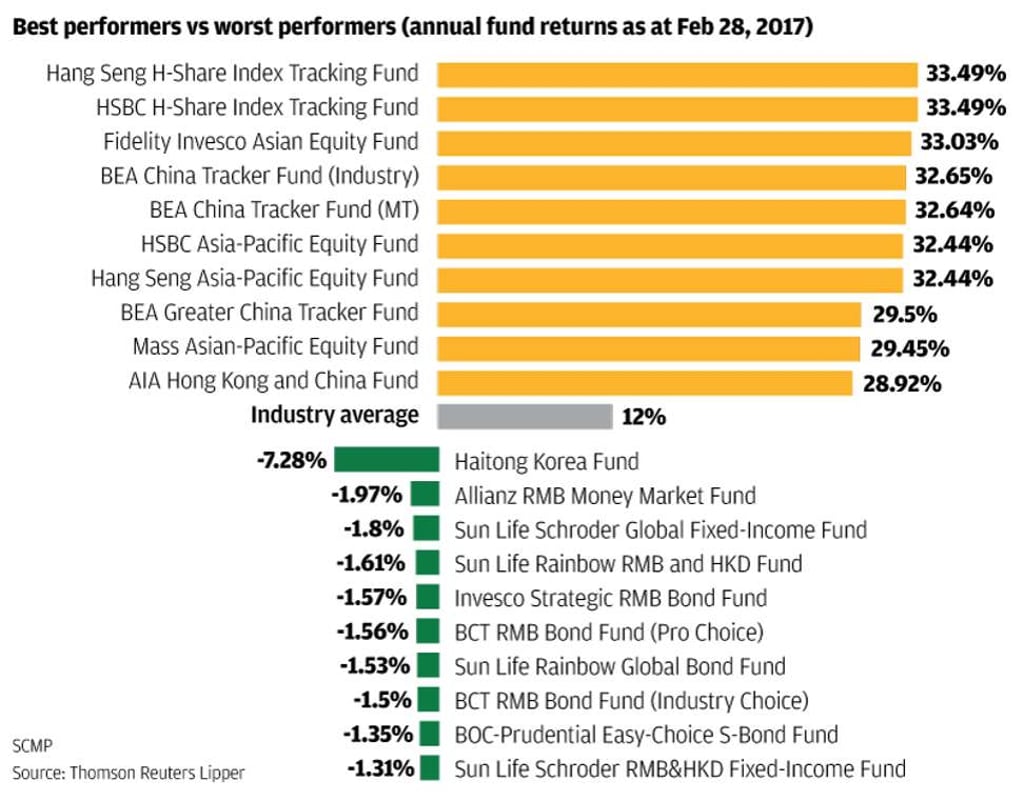

It is the largest shake-up of the MPF scheme since it was launched in 2000 and is intended to address years of fierce criticism about high management fees and low returns.

“With a total fee cap of 0.95 per cent, as opposed to the current average fee of 1.73 per cent for other mixed-asset MPF products, the introduction of DIS is a step in the right direction because it will help MPF members save more over time,” said Jackson Loi, managing director for institutional business of Vanguard Hong Kong.

“Vanguard supports the MPF reforms, including the DIS initiative, and we believe MPF members will be the biggest winners.”