HKEX to begin consultation for a new third board end of May

HKEX will begin public consultation for a new third board at the end of the month. The board aims to draw more technology and new-economy firms to list in Hong Kong

Hong Kong is up for another round of market reform as the stock exchange will solicit views from the public at the end of the month for a new board to allow more technology firms like Alipay and Lufax, as well as foreign giant companies such as Saudi Aramco, to list here.

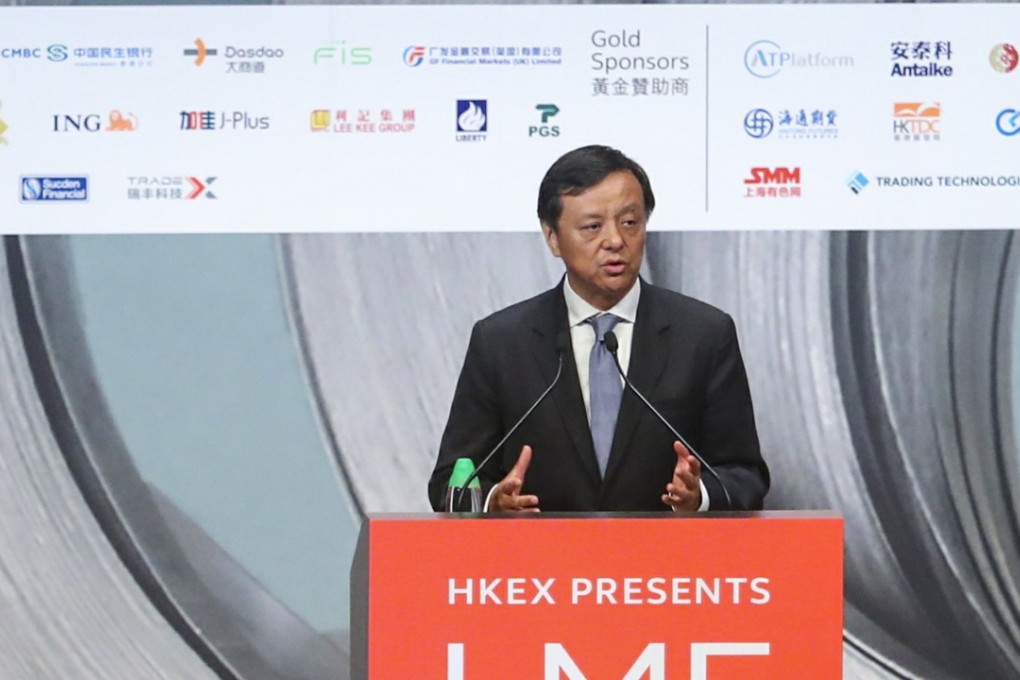

Speaking at the sideline of the LME Week Asia forum on Wednesday, Li said they were keen to have a bigger variety of companies to list here, including Saudi Aramco, the world’s largest IPO that is expected to raise US$100 billion, in a 5 per cent stake sale of the oil giant valued at US$2 trillion. Hong Kong is in the running for the listing, but is facing competition from London and New York.

The new market which brokers call the third board, will be the third market in Hong Kong after the Main Board and the Growth Enterprise Market.

Li said in January that the new board would have different listing rules from the other two markets to allow more foreign firms, infrastructure firms, overseas companies on the “Belt and Road Initiative”, technology or new-economy companies, and firms that want to be listed in a dual-class shareholding structure, to list.