Chance of China A-shares added to MSCI is less than half, says UBS

Chinese regulatory approval for derivative products for overseas markets remains a major obstacle

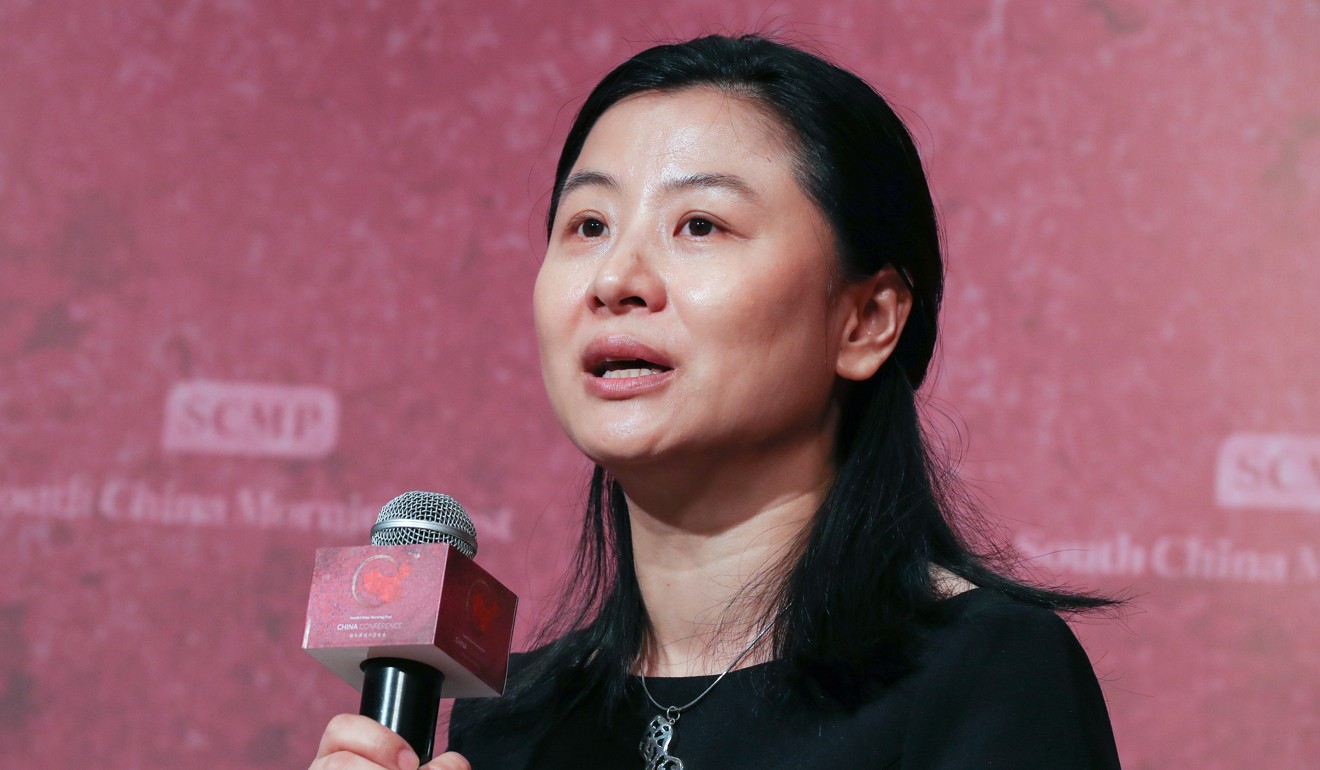

The probability of China’s A-shares being included in the MSCI next Tuesday will be below 50 per cent, due to a Chinese regulatory hurdle tied to derivative products and the recent regulatory tightening that mayincite counter-market factors, says Hu Yifan, chief China economist of UBS Wealth Management.

This is the fourth consecutive year that MSCI, the global equity benchmark provider, has tabled the inclusion of A-shares in its benchmarks in the annual review. If the decision on June 20 was positive, formal inclusion will start a year later.

“The market has put a lot of hope (into the inclusion) this year, but we think the chance could be below 50 per cent,” said Hu.

“I think we are getting closer and closer (to the inclusion), but [it] still has the last mile to go,” she added.

Hu said the biggest remaining hurdle was the required approval from the China Securities Regulatory Commission (CSRC) for the launch of any A-share linked derivatives by foreign institutions in overseas markets.

“The MSCI committee raised the issue last year, but the CSRC has left it unaddressed,” she said.

“This added more counter-market factors and may make the MSCI committee more cautious,” Hu said.

Southbound inflows into the Hong Kong market reached 220 billion yuan last year, and are expected to hit 400 billion yuan for 2017, after the 170 billion yuan recorded for the first five months this year, Hu said.

Asset wise, the UBS analysts said they preferred equities to bonds for 2017.

Regionally, they remain overweight on Asia, particularly China, Thailand and Indonesia. Industry wise, the analysts rate positively on tech stocks, despite the sector’s sharp decline in the last few trading days.

“The intensive sell off of tech stocks in the last two to three trading days is more of profit taking, or rotation.

“The enterprise fundamentals are strong. Consumers’ demand is healthy, and on top of that, monetary policy reversal globally is gradual...that makes us maintain a risk-on (for this sector),” said Min Lan Tan, UBS Wealth Management’s Asia-Pacific regional head.

Tan expected the US Fed to add two more rate hikes this June and September. But she said Beijing had “tremendous power” to keep yuan stable in near term.

Tan said the Chinese government was rational and could loosen the leash on the currency exchange rates after the crucial 19th Party Congress, as “fundamental factors” – including the slowing economy, declining current account surplus and rising household demand to diversify their assets – will weigh on the yuan again.