Federal Reserve, as expected, raises US interest rates by 25 bp

Rates go up for the second time in three months to a range of 1.00 to 1.25 per cent

The Federal Reserve raised interest rates on Wednesday for the second time in three months, citing continued US economic growth and job market strength, and announced it would begin cutting its holdings of bonds and other securities this year.

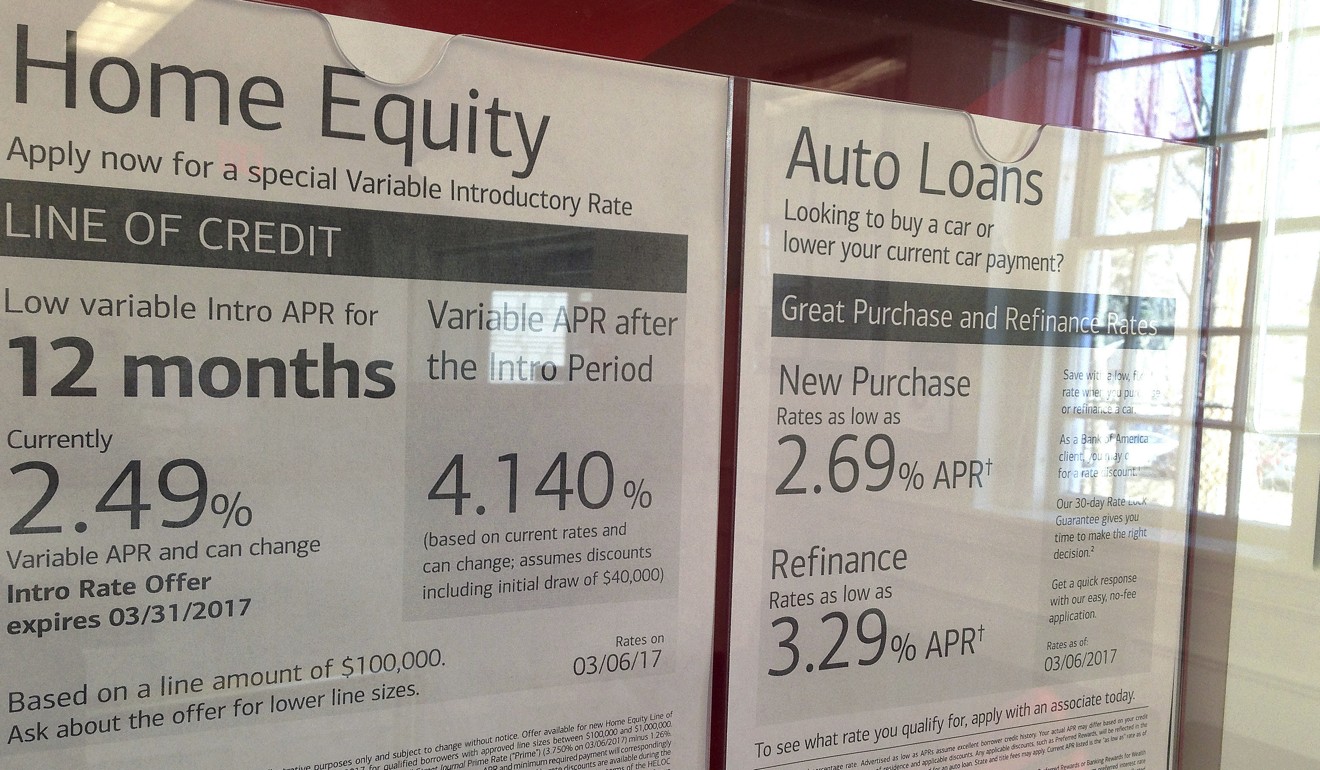

The decision lifted the U.S. central bank’s benchmark lending rate by a quarter percentage point to a target range of 1.00 per cent to 1.25 per cent as it proceeds with its first tightening cycle in more than a decade.

In its statement following a two-day meeting, the Fed’s policy-setting committee indicated the economy had been expanding moderately, the labour market continued to strengthen and a recent softening in inflation was seen as transitory.

The Fed gave a clear outline on its plan to reduce its US$4.2 trillion portfolio of Treasury bonds and mortgage-backed securities, most of which were purchased in the wake of the 2007-2009 financial crisis and recession.

“The committee currently expects to begin implementing a balance sheet normalisation programme this year, provided that the economy evolves broadly as anticipated,” the Fed said in its statement.

According to an addendum released with the policy statement, the Fed anticipates the balance sheet reduction plan would feature halting reinvestments of ever-larger amounts of maturing securities.

The Fed sees the cap for Treasury securities to be US$6 billion per month initially, increasing in US$6 billion increments at three-month intervals over 12 months until it reaches US$30 billion per month.

For agency debt and mortgage-backed securities, the cap will be US$4 billion per month initially, increasing by US$4 billion at quarterly intervals over a year until it reaches US$20 billion per month.

The Fed has now raised rates four times as part of a normalisation of monetary policy that began in December 2015. The central bank had pushed rates to near zero in response to the financial crisis.

Policymakers also released their latest set of quarterly economic forecasts which showed temporary concern about inflation and continued confidence about economic growth in the coming years.

They forecast US economic growth of 2.2 per cent in 2017, an increase from the previous projection in March. Inflation was expected to be at 1.7 per cent by the end of this year, down from the 1.9 per cent previously forecast.

A retreat in inflation over the past two months has caused jitters among some Fed officials who fear that the shortfall, if sustained, could alter the pace of future rate hikes. Earlier on Wednesday, the Labour Department reported consumer prices unexpectedly fell in May, the second drop in three months.

The Fed’s preferred measure of underlying inflation has retreated to 1.5 per cent, from 1.8 per cent earlier this year, and has run below the central bank’s 2 per cent target for more than five years.

Expectations of any fiscal stimulus in the near term from the Trump administration have also waned with campaign promises on tax cuts, regulation rollbacks and infrastructure spending either still on the drawing board or facing hurdles in Congress.

Interest rates are seen rising one more time by the end of this year, according to the median projection of the forecasts released with the Fed’s policy statement, in keeping with the previous forecast.

Estimates for the unemployment rate by the end of this year moved down to 4.3 per cent, the current level, and to 4.2 per cent in 2018, indicating the Fed believes the labour market will continue to tighten.

The median estimate of the long-run neutral rate, which is seen as the level of monetary policy that neither boosts nor slows the economy, was unchanged at 3.0 per cent.

Minneapolis Fed President Neel Kashkari dissented in Wednesday’s decision.