Bond Connect may lead to access for foreign agencies to rate onshore bonds

A PBOC official says that China is currently studying the possibility to allow foreign agencies to rate onshore bonds

The newly-launched Bond Connect will accelerate the pace of reform of China’s domestic onshore bond market, which may also open up access for international credit rating agencies, the South China Morning Post has learnt.

It could be “very soon” that Beijing will allow foreign institutions to rate China’s onshore bonds, a ground-breaking move that has been sought-after by foreign investors for years, Pan Gongsheng, deputy governor of the People’s Bank of China (PBOC) told the Post on Monday.

“We are actively doing research,” Pan said, adding the opening up could be expected “within this year”.

As the rating of bonds by Chinese rating agencies are seen as lenient, international investors have hesitated to rely on them, analysts say.

“The vast majority of bonds in mainland China are rated as triple A by mainland rating agencies. If you ask them why the rating is so high, they explain that it is because these are state-owned giants, with credit underwritten by the government,” said Ding Yuan, vice president and dean of the Shanghai-based China Europe International Business School (CEIBS).

“If foreign investors don’t buy into this pricing mechanism, then China will not see the capital inflow it wants, no matter how the authority designs and promotes the new scheme,” he said.

It was an “early harvest” from the 100-day plan made by China and US to reset the trade relationship since president Xi Jinping and US President Donald Trump met in April.

Pan was in Hong Kong on Monday to attend the launching ceremony of the much-awaited northbound trading of bond connect at the trading hall of Hong Kong Exchanges and Clearing.

If foreign investors don’t buy into this pricing mechanism, then China will not see the capital inflow it wants, no matter how the authority designs and promotes the new scheme

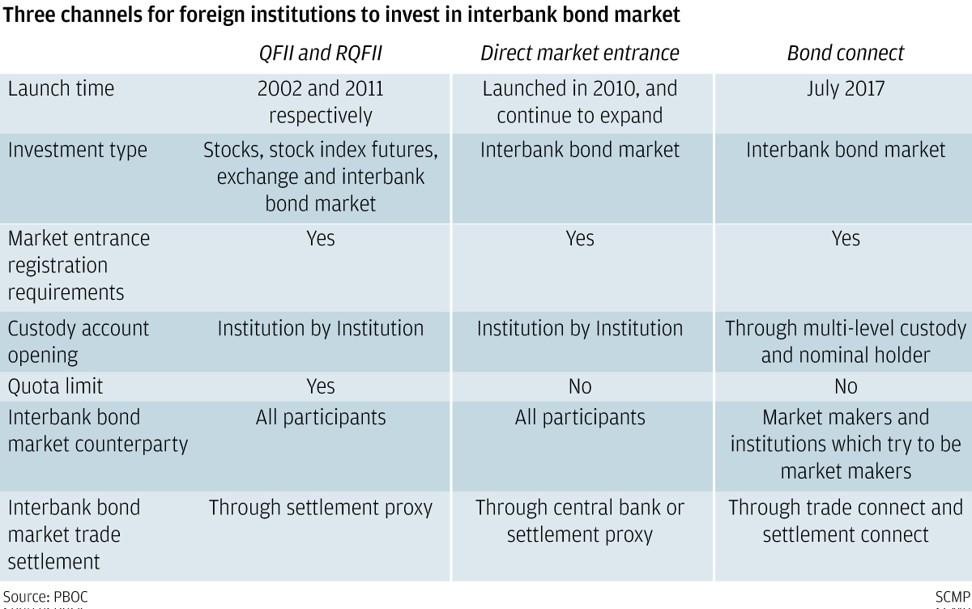

The first day trading has seen 7 billion yuan worth of bonds traded by 89 financial firms via the scheme, which allows international investors to trade mainland bonds via the platforms of HKEX and China Foreign Exchange Trade System. The settlement is handled by Hong Kong Monetary Authority and relevant mainland parties.

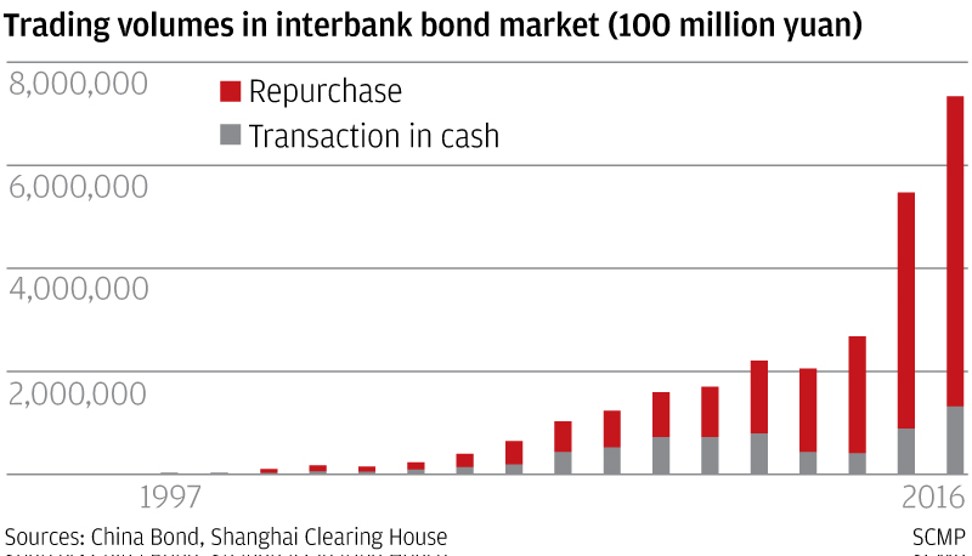

Shen Hua, chief executive of BOCHK Asset Management, a unit of Bank of China Hong Kong, said the first day trading amount exceeded 10 per cent of the daily trading volume of the onshore market that usually hovers at about 60 billion yuan.

“It reflects that the Bond Connect scheme is well-received, and we expect that it will grow significantly soon,” Shen said.

“In addition, as the yuan has already become one of the reserve currencies of the SDR basket, there is an increasing interest in investing in the Chinese onshore bond market,” Shen said.

Lo said turnover via the new connect scheme would increase to US$250 billion in the next two years as predicted by HSBC.

“The rising value of the yuan would attract international investors to trade mainland bonds,” Lo said.

Lo, however, believes that the southbound trading would only be launched next year.

HKEX chief executive Charles Li Xiaoja said the local bourse would introduce southbound trading when there is a market demand for it.

As of 31 December 2016, the outstanding value of the onshore bond market was US$8.1 trillion, making it the world’s third-largest. But international investors now hold only 1.3 per cent of the total.