Are the lights finally out for China’s biggest overseas acquirers?

Flameout for China’s overseas asset acquirers as top leaders step up cracking down on moving fortune offshore

The Chinese government’s National Financial Work Conference on July 14 and 15, which sets the scene for the country’s financial sector for the next five years, was a little different from the last.

The twice-a-decade meeting of China’s top financial regulators and provincial governors – traditionally hosted by the premier – was chaired by Chinese president Xi Jinping.

Xi’s attendance, and his reiteration of the prevention of systemic risk as the “eternal theme,” not just underlined the leadership’s resolve to crack down, but also the severity of the financial risks that threaten the mainland’s economic health.

The meeting was also attended by Wang Qishan, China’s anti-corruption tsar, as a clean up of the financial system is intricately linked to the Communist Party and the government.

“The leaders have been getting tougher and taking direct action against companies,” said Fraser Howie, a former banker in Asia who co-wrote three books on the Chinese financial system.

“What is becoming clear is that the third plenum and serious reform dividing state and corporate is just not happening,” Howie said. “Xi seems to have zero interest in that and instead all are beholden to the Chinese Communist Party and its every narrow leadership.”

The leaders have been getting tougher and taking direct action against companies

China’s over-leveraged troubles and chalked up risks cut across both the public and private sectors. Beijing’s ongoing battle to eliminate risks have begun way before this summer’s high drama, involving four of the country’s biggest private conglomerates – Wanda, Fosun, HNA and Anbang.

Regulators had ordered banks to cut their credit to Wanda’s six overseas projects in mid-June, including the Hollywood production and finance company Legendary Entertainment Wanda acquired in early 2016.

Although AMC Entertainment Holdings, the US cinema chain majority owned by Wanda, later claimed four of the projects were fully funded by the firm’s own funds and loans from US banks, investors remain worried about the company’s well-being, as Beijing cracks down on companies moving their assets overseas.

On July 10, Wanda Commercial announced abruptly that it would offload major assets at discount for US$9.3 billion for cash.

The privatisation was bankrolled by a consortium and Wang, who had vowed to relist the company before August 31, 2018. If he misses the deadline, Wanda will have to pay every offshore consortium member an annual 12 per cent interest, and onshore members, a 10 per cent interest.

To milk the deal to its fullest, one of the consortium companies also hatcheted up a “perfect investment plan” – a fund that will pay investors an annualised return of around 8 per cent, according to two investment bankers familiar with the deal.

What was enticing about the fund, apart from the considerable return, one of the bankers said, was the two names involved - Xiao Jianhua who controlled the consortium company, and Wang Jianlin.

Had it not been vetoed by the manager, the banker said they could have gone ahead to invest.

“Today we all feel lucky we missed the opportunity – this is the first time that I personally experience how things could flip over in China overnight,” the banker said, with a shudder.

In a note placing Wanda Commercial on negative watch following its “unexpected asset sale”, analysts with Standard & Poor’s wrote that they were “unsure if such a sizable asset disposal may complicate and delay the listing timing”.

Wanda isn’t the only high-profile acquisitive Chinese conglomerate on Beijing’s radar.

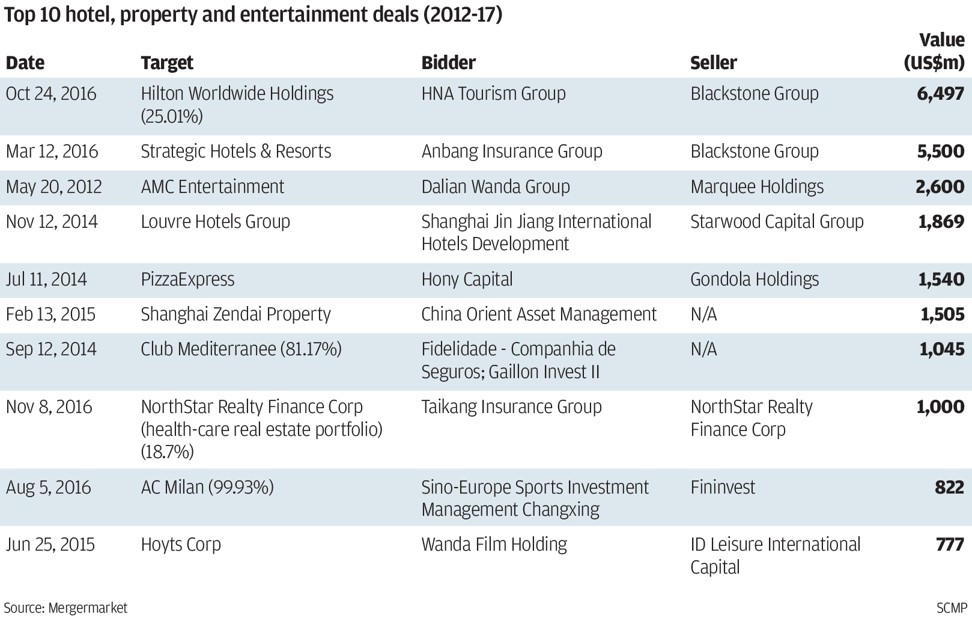

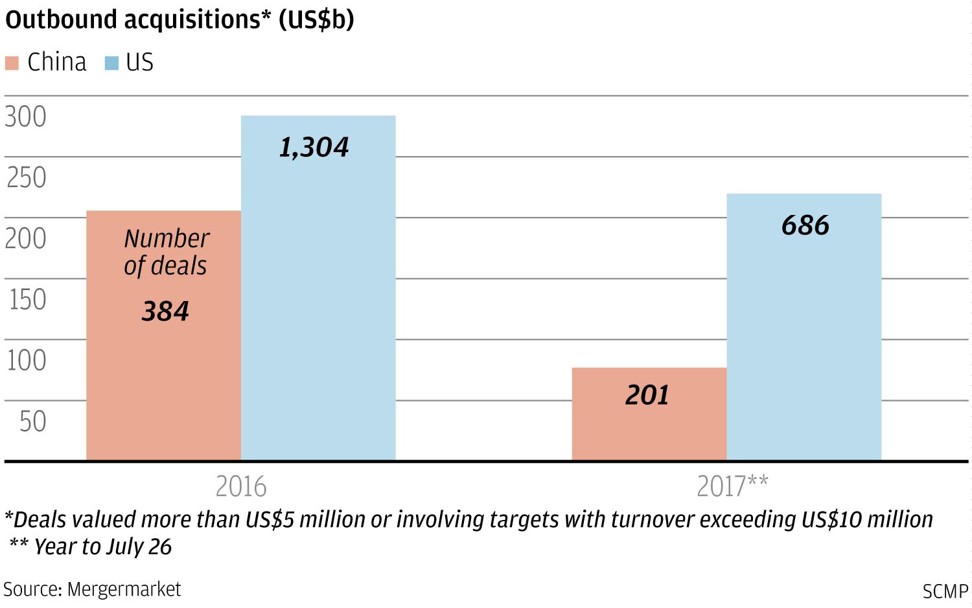

Chinese dealmakers struck US$205.9 billion worth of cross-border mergers and acquisitions in 2016, a record that lagged only the US’ total transactions of US$283.9 billion, according to Mergermarket’s data.

The contrast couldn’t be more stark this year: acquisitions by Chinese firms plummeted to US$77.2 billion by July 26, a mere one-third of the US’ US$219.9 billion.

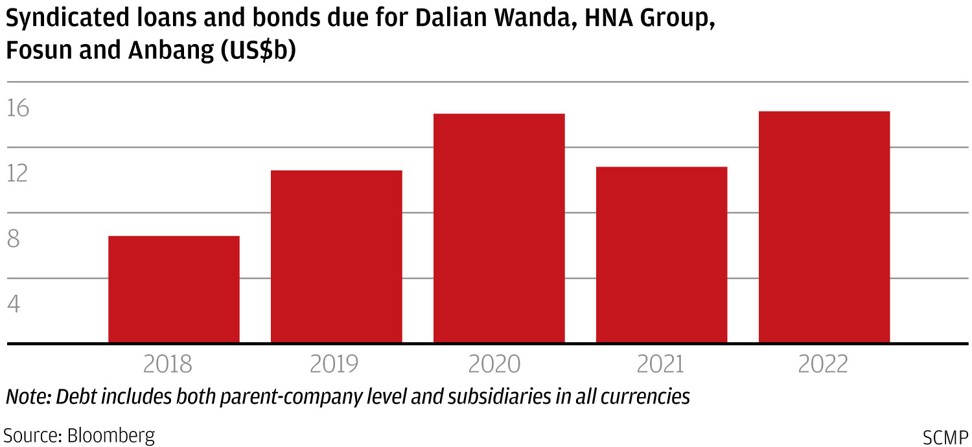

According to Debtwire data, Wanda Group has taken on at least US$2.2 billion in loans and bonds in the past three years to finance its overseas shopping spree.

HNA is further ahead with debt totalling US$19.3 billion, while Fosun borrowed US$1.3 billion.

Beijing’s risk regulators must have been significantly discomforted by their findings

But these numbers are a far cry from the companies’ total debt exposure.

Bloomberg reported last week that the HNA Group has taken out US$73 billion of debt to support the multi-billion dollar stakes in Hilton Worldwide Holdings Inc. and Deutsche Bank AG.

Several banks among the top nine lenders to HNA, all Chinese banks, had halted new loans to the company.

“In the past few years, onshore deposit-backed offshore lending has been widely used to fund the overseas shopping by Chinese acquirers,” said a source close to the China Banking Regulatory Commission (CBRC).

“Regulators are now worried that the tycoons are transferring their assets to overseas market, while leaving the debt and related risks in the mainland.”

The People’s Bank of China (PBOC) and the State Administration of Foreign Exchange (SAFE) have directed Chinese banks to cautiously handle foreign exchange remittance out of China.

In the past few years, onshore deposit-backed offshore lending has been widely used to fund the overseas shopping by Chinese acquirers

Banks are also under pressure to scale back their provision of cross-border security and onshore deposit-backed offshore lending scale.

As banks cut credit and scrutinised the books, dealmakers have reacted swiftly.

After Wanda’s unexpected sale of assets this month to a rival developer, Wang told reporters last Friday that he would “actively respond to the nation’s call and focus his investment inside China in future”, and that Wanda had full competence to repay the debts.

HNA Group, on the other hand, is actively pushing forth its plan to float Pactera, the Beijing-based IT outsourcing firm it bought from private equity firm Blackstone, to ease banks’ concerns of its financial health, according to a Reuters report on Tuesday.

The group also revealed an ownership structure that remains clouded with obscurity as two charity organisations named “Cihang” hold 52.25 per cent stake of the company.

Bankers have also been forced to slow down in the deal-making.

“I have several cross-border M&A cases piled up on my desk, but I dare not proceed at this time, when no one is sure whether Beijing would further squeeze banks’ lending to fund these once popular “go global” projects,” said the banker who was solicited to invest in the Wanda privatisation fund.

Senior officials at Bank of America’s Merrill Lynch unit communicated internally last month that bankers should not pitch for new deals, after they learnt that China plans to cut off some funding for Wanda, concluding that the conglomerate breached overseas investments restrictions, Bloomberg reported last week.

A report issued by Latham & Watkins LLP last week said “acquisitions with a solid rationale that benefit the Chinese economy are unlikely to be rejected outright”.

“So called “irrational” deals (outside of a Chinese buyer’s core sector, particularly in the real estate, media, sports or hospitality sectors) will face greater regulatory hurdles,” the report said.

State-owned China Merchants Port Holdings announced on Tuesday that by investing up to a US$1.12 billion, the company would take over 85 per cent stake of Sri Lanka’s Hambantota Port, which marked the latest milestone on the “Belt and Road Initiative” introduced by Xi.

With Xi convening the recent National Financial Work Conference, the leadership was repositioning the play of “finance”, said Larry Hu, head of Greater China economics at Macquarie Group.

“Compared to five years ago when then leadership attached great hope on financial reform, the current top leaders are having some new understandings about the limitation of financial reform, after the boom-and-bust financial cycles in the country’s equity market, bond market, currency, and shadow banking sector,” he said.

Silvers of Kaiyuan Capital said it was time to evaluate how much [of the recent financial storm] was a precaution ahead of the upcoming 19th Party Congress.

“We’ll see in the coming months, but in the meantime, look for continued capital raising and debt reduction,” he said.