Hong Kong divided over how to remake bourse to lure startups, as consultation draws to a pause

Hong Kong’s financial industry professionals are still divided over how they can remake the city’s stock exchange to make it the world’s most attractive place for startups and technology firms to raise capital, even as the first round of a public consultation process drew to a close on Friday.

Hong Kong Exchanges & Clearing Limited, the operator of Asia’s third-largest equity bourse by market capitalisation and overseer of the consultation, has proposed the establishment of a third board to provide a listing avenue for companies with dual share structures, as well as those with no profit track record. Accountants, bankers, brokers and lawyers are divided over whether a third board is needed, in addition to the existing main board and the growth enterprises market (GEM) for startups.

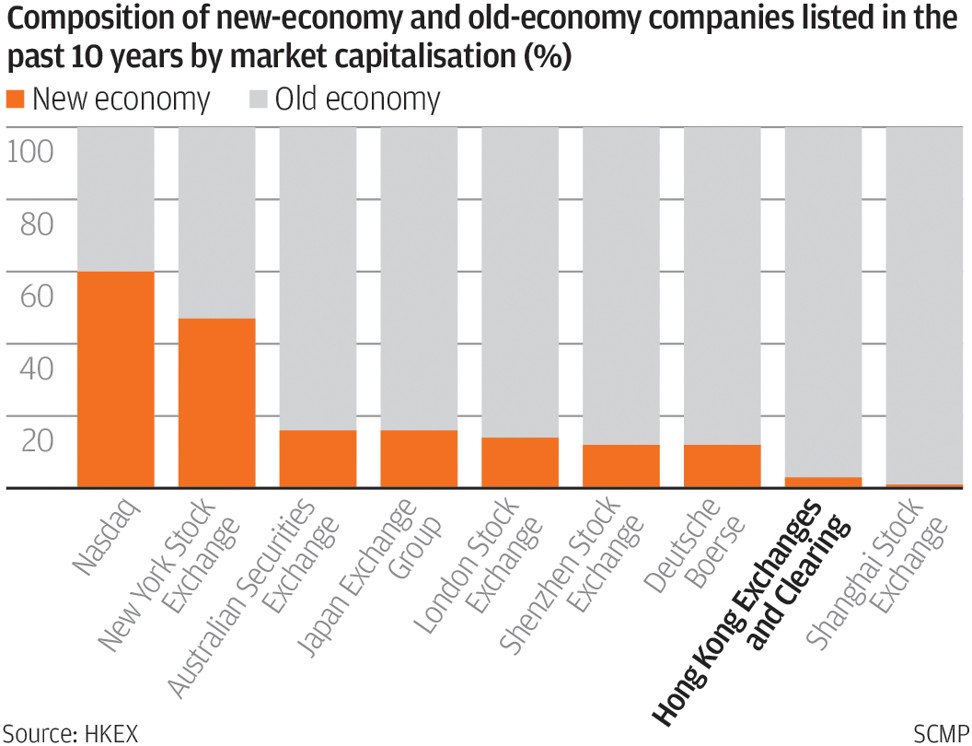

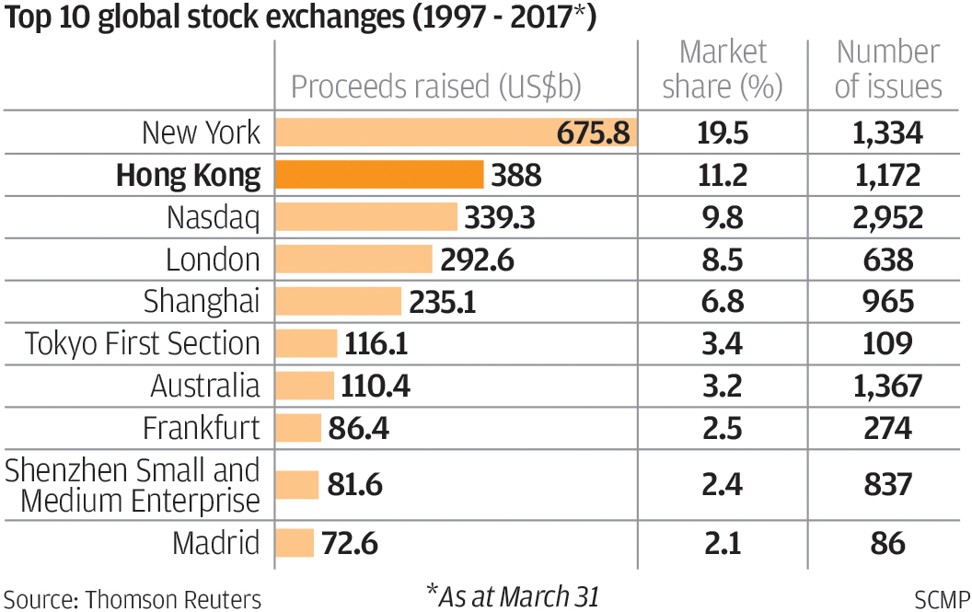

At stake is how Hong Kong can make its bourse attractive enough as a fund-raising destination in competition with New York, Shanghai or Singapore and other global markets, especially for startups and so-called new economy companies in financial technology, e-commerce and biotechnology.

Companies raised US$5.8 billion in Hong Kong through initial public offerings during the first six months of this year, a decline of 19.5 per cent compared with the same period in 2016, when the city was top of the league table for new listings worldwide, according to Thomson Reuters’ data.

The companies that raised funds in the city were dominated by the financial industry, accounting for 59 per cent of funds raised during the period, while technology companies raised the equivalent of 0.8 per cent, the data showed.

Further illustrating Hong Kong’s lack of appeal to new-economy companies, the Shanghai Lujiazui International Financial Asset Exchange, or Lufax, obtained a license to operate its financial technology business in Singapore, instead of Hong Kong, a stone’s throw from the base of its parent Ping An Group.

The proposed third board will comprise two parts. One is a so-called premium market open to all investors, hosting companies that are eligible to list on the main board, but with a dual-class share structure currently disallowed on the main bourse. The second is the so-called pro market focused on startups where only professional investors with higher appetite -- and understanding -- of risks are allowed to invest in.

“The proposals are taking the wrong direction entirely to improve Hong Kong’s markets,” said David Webb, founder of the activist shareholders’ platform Webb-site and former HKEX director. Hong Kong doesn’t need a new board, and he favours “a single board, under a single statutory regulator, combining listing and takeover regulation, and not the four-board mess that HKEX advocates,” he said.

Hong Kong’s stockbroker community support the new board, provided it has enough protections for shareholders, said Benny Mau, chairman of the city’s Securities Association, an industry guild.

The Securities & Futures Commission, the industry watchdog agency, said it’s open minded, either way.

“The SFC keeps an open mind to listen to what the market says about the new board,” the agency’s chairman Carlson Tong Ka-shing said in response to inquiry by the South China Morning Post.