China’s big four state-owned banks set to announce improved first-half profit

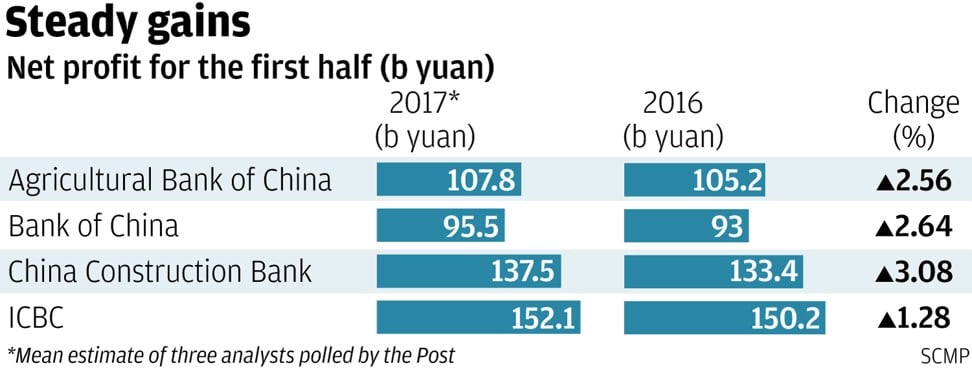

According to a survey of three analysts, China Construction Bank is expected to post the largest increase, of 3.1 per cent, and ICBC the smallest, at 1.3 per cent.

China’s commercial banking sector as a whole increased profits by 7.9 per cent in the first half of the year, according to China Banking Regulatory Commission (CBRC) data, but these figures also include smaller rural and city commercial banks who have more volatile earnings.

Ken Shih, research director at DBS Bank, who was not included in the survey, said he expected the profit rises would have a broad based foundation.

“The CBRC data shows that loan growth was better than expected in the first half of the year, we expect there to have been an improvement in banks’ net interest margins and to see improvements in asset quality,” he said.

Shih said that one reason for the increased loan growth was that the ongoing crackdown on China’s shadow banking system had pushed some corporate borrowers back to the traditional banking sector.

Banks’ net interest margins or NIMs (a measure of the difference between banks’ interest income and the amount of interest they pay out) dropped substantially in 2016, as a result of the decision by the People’s Bank of China to lower the base lending rate and changes in the way the value added tax is calculated.

“The banks’ asset quality risk has come down given the better macro environment,” said Marco Yau a senior analyst at China Everbright Bank International.

‘We expect the improving profitability of the industrial sector, which covered most over capacity industries, will support banks’ asset quality too.”