Hong Kong’s Exchange Fund has a case to answer in its defence of the dollar’s peg

However, the Hong Kong dollar had been trading on the weak side of the peg, i.e. over 7.8 per US dollar, for several months. People are wondering whether the move was in defence of the peg, or with other policy implications. Monetary statistics show that cause for concern is not unfounded.

By definition, M3 of the Hong Kong dollar comprises three elements: (1) domestic credit expansion; (2) net external flows; and (3) other assets less liabilities.

Net external flows are further divided into the banking book (foreign loans less deposits; investments abroad, foreign debts) and the currency book (clearing balance, Exchange Fund debts, bank notes issued). The currency book is actually the monetary base which usually increases with balance of payments surplus. Abnormal changes would reflect activity of hot money.

The currency board system under which the Hong Kong dollar operates, is both rigid and flexible. It is rigid in that rules are defined, but flexible in that a movement of 5 basis points on either side of the official rate of 7.8 per US dollar is allowed.

Thus, the Hong Kong dollar’s market rate fluctuates within the exchange band of 7.75 and 7.85 per US dollar. Deviations from the official rate are not abnormal, and probably seasonal.

As the currency board is supposedly passive, speculative hot money would not be a cause for concern -- as long as the Exchange Fund keeps its promises.

Banks are supposed to settle with the Exchange Fund at the official rate, but the settlement rate practically moves with the market rate.

If there were speculative inflows, the Hong Kong dollar would appreciate above the official exchange rate. The foreign exchange of banks would increase along with their Hong Kong dollar deposits. The clearing balance ratio (in terms of demand and savings deposits) would fall. Banks would sell their foreign exchange to the Exchange Fund, and restore the clearing balance back to within the safety margin.

The strong side of the exchange rate at 7.75 gives banks an arbitraging opportunity when there’s influx of hot money. There are two symptoms of capital inflow. Firstly, the Hong Kong dollar appreciates and stays at 7.75 per US dollar. Secondly, liquidity is excessive, and the clearing balance ratio is high. Conversely, the two symptoms of capital outflow are when the Hong Kong dollar depreciates to 7.85 and there’s tight liquidity with the marginal clearing balance ratio.

A case in point was during the 2008 global financial crisis. The clearing balance ratio jumped to 10 per cent in the last quarter when the US Federal Reserve began what it called quantitative easing of low-interest rates, from the normal level of less than 1 per cent. The Hong Kong dollar appreciated and stayed at 7.75 to the US dollar.

The Hong Kong Monetary Authority (HKMA) estimated that capital inflows into the city amounted to US$640 million in the subsequent 15 months ended December 2009.

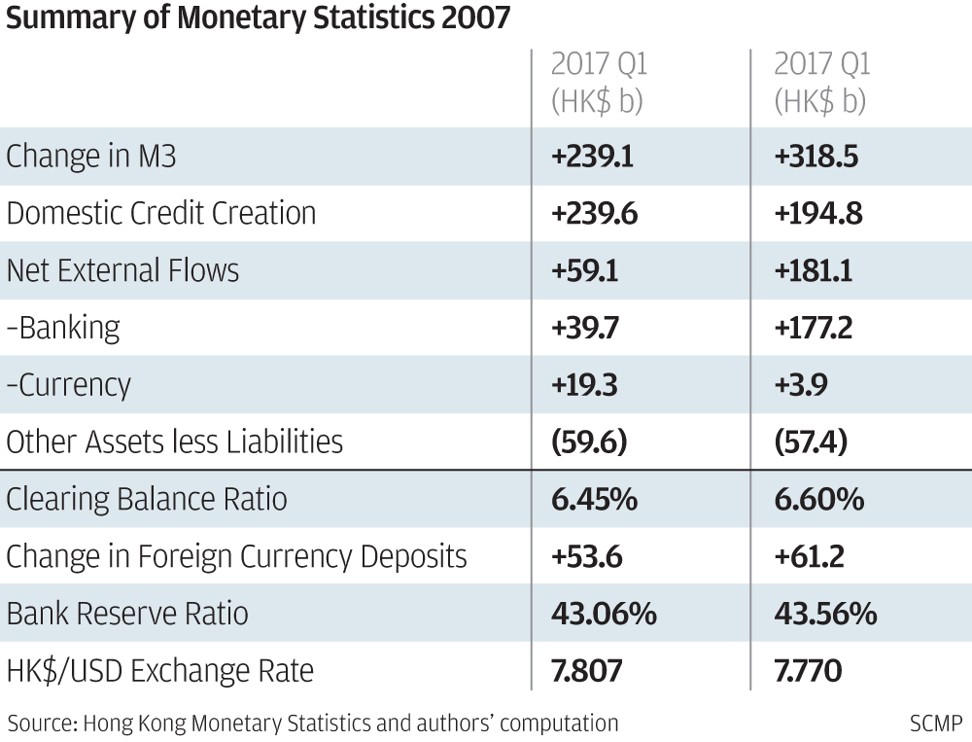

In the second quarter of this year, net external flows increase HK$59 billion, or by 0.9 per cent, also mainly in the banking book (+0.6 per cent).

The quarter-end clearing balance ratio was 6.6 per cent at the end of the first quarter and 6.45 per cent at the end of June, while the HK$/US$ exchange rates were 7.770 and 7.807 during the two periods respectively. Actually, the clearing balance ratio has never fallen below 6 per cent since December 2008, and such level could well be the new norm. Thus, one may conclude that there is no evidence of abnormal inflow or outflow.

In Hong Kong, onshore and offshore banking are not segregated. Foreign currency deposits are offshore banking funded by capital inflow. When the Hong Kong dollar and foreign exchange are involved, the internal shift from onshore to offshore banking is treated as capital “outflow” in monetary analysis.

If the currency book is adjusted for increases in foreign currency deposits, the net capital inflow would be HK$65.1 billion (i.e. 61.2+3.9) for the first quarter and HK$72.9 billion (i.e. 53.6+19.2) for the second quarter. Even with adjustments, the inflow is still far from speculative.

Some critics argue that the Hong Kong government is cautioning banks on mortgage rates. It would squeeze liquidity and push up interest rates to help manage housing prices if required.

Actually, the effort is indirect and its effectiveness is dubious, as the room for manipulation is limited. The clearing balance ratio is still six times more than normal, and the effort would only reduce it marginally. Moreover, bank board rates have been out of line with the market for the last 10 years with the best lending rate (BLR) staying at 5 per cent per annum, while the savings rate hovers at nominal. After all, banks are still prudent with more than 43 per cent in reserves.

The absorption of excess liquidity by way of the Exchange Fund debts is neutral to the monetary base; it is merely varying its composition. Actually, the government did the same in 2009 amid an influx of hot money when the clearing balance ratio was as high as 12 per cent. If it did not work then, how could it work nowadays?

All along, the Hong Kong government has been warning homebuyers of capital outflow on the normalisation of US interest rates, as well as the adverse impact on the housing market by rising mortgage rates.

The Exchange Fund is sending conflicting messages to the market, particularly when the Hong Kong dollar is on the weak side of the peg.

If there were capital outflow, there would not be any excess liquidity to absorb. If there were capital inflow, the Hong Kong dollar would not be weak. The Exchange Fund has a case to answer.

Dr Victor Zheng is assistant director of the Hong Kong Institute of Asia-Pacific Studies at the Chinese University of Hong Kong. Roger Luk is Honorary Research Fellow of the same institute, and a former commercial banker.