Chinese insurer’s US$1.5 billion Hong Kong IPO could put city back on map for tech share offers

Zhong An Online P&C Insurance chose Hong Kong for its international connections and proximity to the mainland China market

A planned US$1.5 billion share offer in Hong Kong by Chinese online insurance broker Zhong An Online P&C Insurance, the largest ever by a fintech company in the city, could help Hong Kong improve its attractiveness as a destination for technology initial public offerings.

The company will offer 199.29 million shares priced between a range of HK$53.7 to HK$59.7 each. If priced at top end, it could raise US$1.5 billion. That would also make it the sixth-largest fintech IPO worldwide this year.

Zhong An is the mainland’s first online-only insurer offering cover for a range of areas from damage to cars, health, travel to the loss of a smartphone.

It launched in 2013 with financial backing from Chinese internet giant Alibaba’s Ant Financial and its close rival Tencent as well as from Ping An Insurance. On completion of the IPO, Ant Financial’s holding in the insurer will be cut to 13.82 per cent, while Tencent and Ping An each will hold 10.42 per cent. Alibaba owns the South China Morning Post.

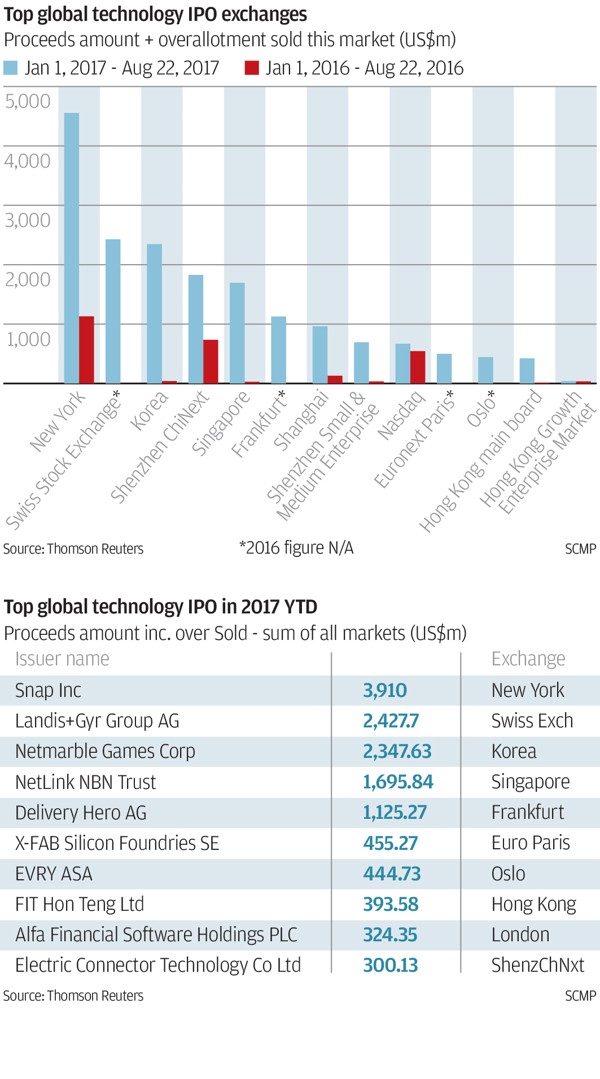

The listing is a boost to the city as a tech IPO hub. Hong Kong recently failed to secure a spot in the top 10 locations worldwide for funds raised from technology companies IPOs. Those funds surged threefold to US$18.87 billion in the first eight months of the year, according to Thomson Reuters data. The city’s IPO market is dominated by the financial industry, which made up 59 per cent of funds raised during the period, while technology plays accounted for 0.8 per cent.

Hong Kong’s main board ranked the world’s 12th largest market in terms of IPO funds raised by technology companies, while the second board, the Growth Enterprise Market, ranked 19th behind New York, Switzerland, Singapore and South Korea.

The Hong Kong exchange plans to reform its listing rules and to propose a new board for dual class shares and new start-ups to try and boost its standing as a destination for tech IPOs.

Analysts said the Zhong An IPO should be successful, given its financial component.

“Insurance stocks usually are popular among Hong Kong retail investors, and the Zhong An IPO should be the same,” said Joseph Tong Tang, chairman of Morton Securities.

Japanese billionaire Masayoshi Son’s SoftBank Group has agreed to be a cornerstone investor, taking 36.08 per cent of the offered shares, or 4.99 per cent of the total issued share capital.

The company had a net profit of 37 million yuan (US$5.64 million) in 2014, 44.3 million yuan in 2015 and 9.4 million yuan in 2016, earned mainly from investment income.

But it reported a net loss of 202.1 million yuan in the first three months of this year and is expected to report a significant net loss in 2017 as a whole due to increasing costs and commission payments.

About 95 per cent of the IPO is for international investors, while 5 per cent is reserved for Hong Kong retail investors who can subscribe from Monday until Thursday. Shares will begin trading on September 28.

“We opted to list in Hong Kong because it is close to the mainland market where we operate. It was also because Hong Kong is an international financial centre, which would help us to capture more international investors,” said Jeffrey Chen Jin, chief executive of the company, on Sunday.

Chen said the company’s backers and other e-commerce partners in the travel, health, auto and lifestyle businesses had provided a lot of cross-selling and cooperation opportunities. Zhong An has sold over 7.2 billion insurance policies and has 492 million policy holders in mainland China.

“Looking ahead, we are seeking to enhance our profitability by expanding and optimising our product mix to capture the business opportunities from tech-savvy customers,” Chen said

The use of big data and other new technology would also allow the company to have more information to price its products and better match risks and prevent fraud, he said.