Advertisement

The Insider | Hongqiao’s founder raises his stake to 82 per cent, over single-ownership limit

Reading Time:2 minutes

Why you can trust SCMP

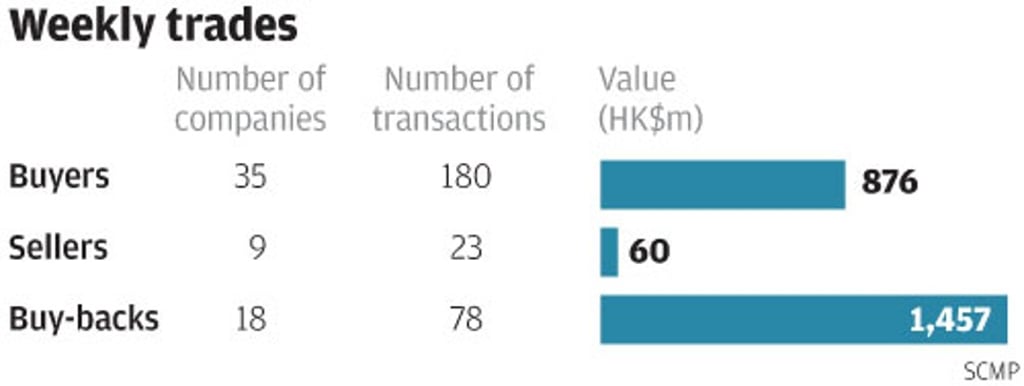

Insider activity plunged during the week of October 30 to November 3, with fewer company executives and controlling shareholders buying stocks, while disposals also fell sharply compared with the previous week.

The number of companies that exercised buy-backs was little changed last week, although their buy-back value rose 27 per cent compared with the previous period, with 18 of them filing 78 buy-backs valued at HK$1.457 billion (US$186.8 billion).

Advertisement

Wong’s Kong King International (Holdings), a maker of electronic components, bought back its stock for the first time since 2000, spending HK$1.75 million on 1.532 million shares at an average price of HK$1.14. The stock fell 0.8 per cent to HK$1.19 on Friday.

Zhang Shiping, founder and chairman of China Hongqiao Group, which produces aluminium products, made the biggest insider purchases of the week, spending HK$568.5 million in 12 transactions buying his own stock, at an average price of HK$10.14 per share, 23 per cent lower than the stock’s Friday closing price. His purchase raised his personal holdings in Hongqiao to 5.945 billion shares, or almost 82 per cent of the company’s issued capital, exceeding the private shareholder limit by almost 7 percentage points.

Advertisement

Significant Points

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x