Shenzhen tech company the latest victim of China’s 100 trillion yuan wealth management market

Shenzhen-based Nationz Technology plunges by daily limit after failing to chase 500 million yuan investment

China’s sprawling but loosely regulated 100 trillion yuan (US$15.2 trillion) wealth management product sector just reported its latest casualty. A Shenzhen-listed technology company plunged by the daily limit for a second day after reporting that a 500 million yuan investment with a wealth management company was unrecoverable.

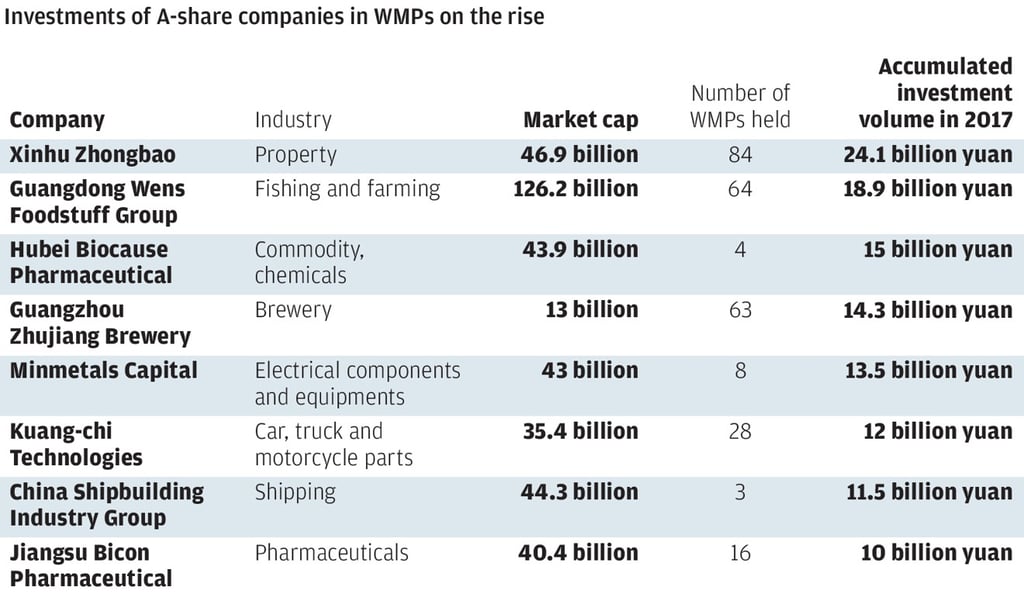

The company’s loss sheds light on a problem shared by China’s 3,400 listed companies: with investments in their core businesses having failed to generate decent returns, many are putting money they have earned or raised from the capital markets into wealth management products in the search for higher interest rates.

Shares in Nationz Technology, a Shenzhen-based producer of Chip products and internet authentication service provider with a market cap of 7.1 billion yuan, tumbled by 10 per cent, the daily downwards limit, as trading started on both Wednesday and Thursday.

The company had announced in a Tuesday night filing to investors that an investment made by them, worth 500 million yuan, might cause “significant losses to the listed company”, as executives of the fund management company were “out of contact”.

“The outstanding investment in wealth management products by listed companies has surpassed one trillion yuan this year. It shows listed companies are not confident in their core businesses,” said Guo Shiliang, a financial columnist based in Guangzhou.

“On the other hand, we keep witnessing wealth management institutions without formal licences raising and managing billions of yuan in assets, largely above the registered capital, which cries for tighter regulation,” he added.