Make hay - and hedge - while the sun shines on our markets, as change may arrive in a heart beat

Rising US rates and bond yields, plus a strengthening US dollar will sound the death knell to Asia’s equities bull market.

Among even the most contrarian of investors, there’s a grudging acceptance that the fundamental, valuation and technical architecture framing Asia’s current bull market is broadly sustainable, at least for the next quarter or two.

Indeed, standing in front of price momentum year to date, particularly in North Asia, has been like standing in front of a train. Bears have been crushed.

But averages can be deceiving. Asia’s longest rally - between April 2003 and October 2007 - comprised fully 55 months and returned an impressive 315 per cent. Similarly, averages have been rendered moot in the United States with the S&P’s 106-month rally now the second-oldest bull market on record since 1928.

In other words, beyond framing broad expectations, setting investment strategies based on cyclical averages can be misleading and unprofitable. Yet, markets do not go up forever. And typically, the higher they rise, the harder they fall. What should we be looking for, therefore, in order to step out of the way?

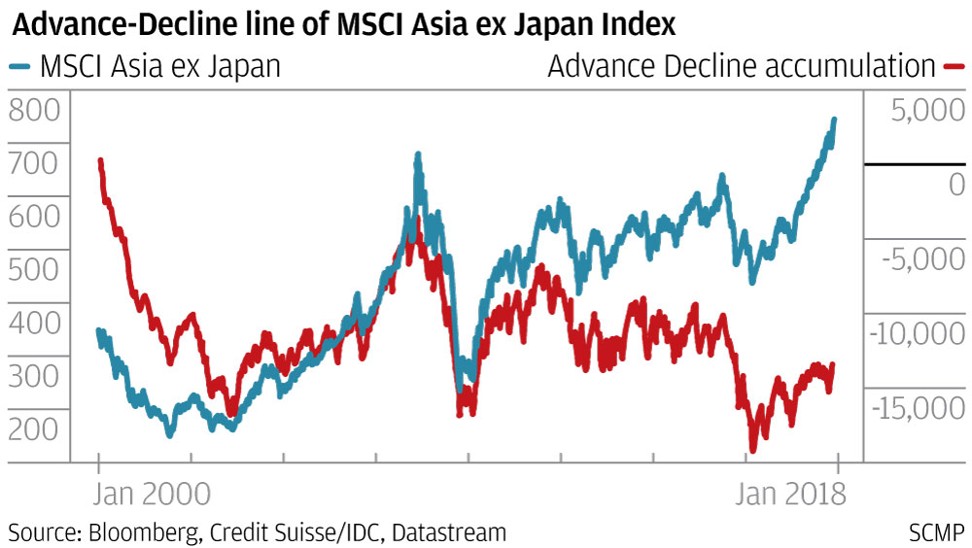

Typically, for near term indications of a price reversal, analysts will turn to technical analysis. Each analyst may have a favourite set of indicators; I prefer to focus on just two: the rate of change in price appreciation - which tends to accelerate irrationally as a blow off top forms; and the Advance-Decline measure, which tends to lose breadth in the late stage of bull market.

Notwithstanding January’s rally, both indicators still remain within normal bounds, suggesting little risk of an imminent correction.

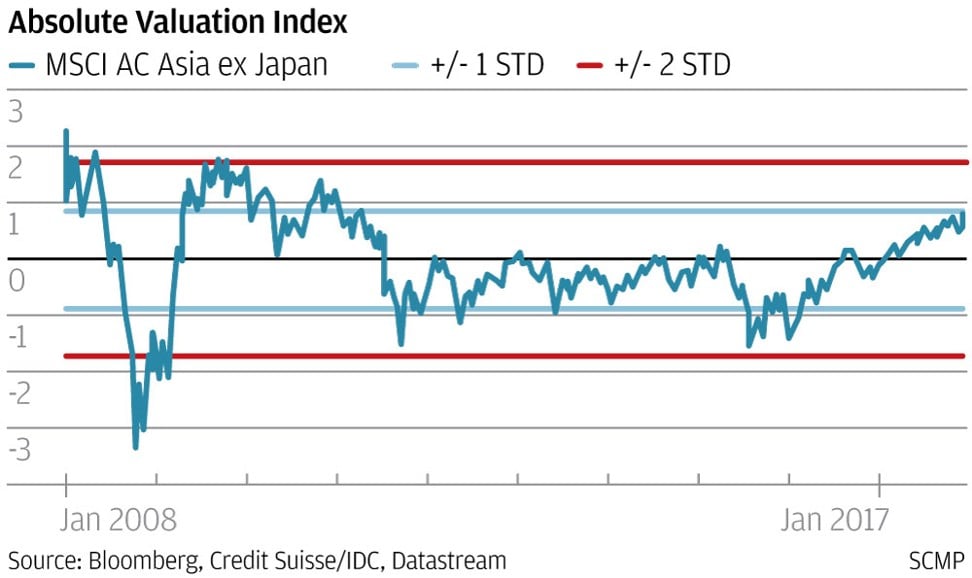

Albeit a longer term risk to equity markets, Asia’s increasingly frothy fundamentals are beginning to concern me however.

Export growth is now at a five-year high, increasingly unbalanced, and at risk of correcting. I cannot see how simultaneously surging export growth and rapidly appreciating currencies can continue indefinitely. At a certain point, the latter will render the former uncompetitive, and export volumes ultimately will diminish.

Weakened external demand will shift the onus for growth to the still fragile domestic sector, which is at a very early stage of recovery and could experience challenges from rising interest rates and a cooling property market. Indeed China’s ongoing slowdown reflects precisely this combination; a situation also likely to be experienced later this year by the property-heavy economies of South Korea and Hong Kong, in my view.

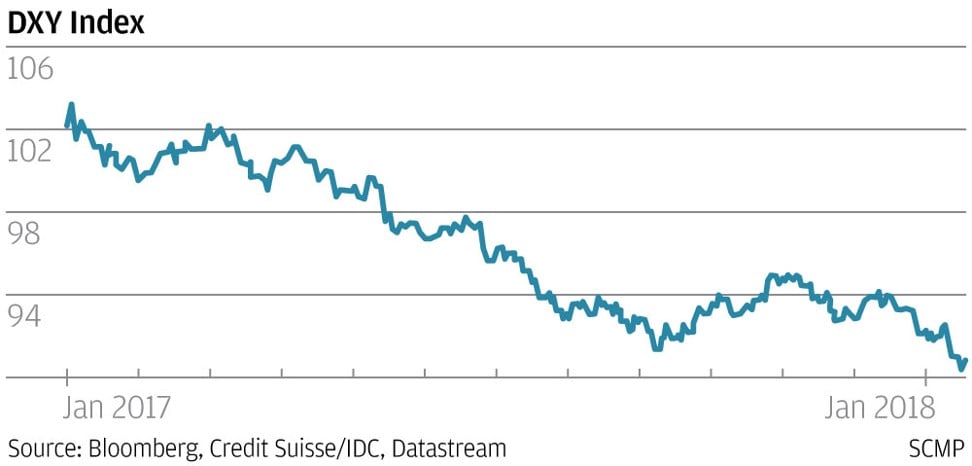

But the real risk to Asia’s growth - and by extension, the equity market rally - is hiding in plain sight; the spectre of rising interest rates in the US and the withdrawal of central bank liquidity globally. Indeed, such is the rapid pace of US growth, analysts are forecasting three - possibly four - rate increases during 2018. But you’d be hard pressed seeing that risk in the US dollar which - over the last few weeks - has actually collapsed in value.

Why the US dollar has failed to respond to tightening monetary policy is a bit of a mystery. Possibly political instability is being punished; perhaps there are better investment opportunities elsewhere, such as Europe. I happen to think the market has become so used to ultra-lose monetary policy that it’s having trouble changing its mind.

But we misprice growth at our peril. Once US interest rates and bond yields start rising and the US dollar starts strengthening, a scary sucking sound will reverberate across Asian markets as risk is unwound, and capital flows head back to the US. Absolutely, the strengthening US dollar will sound the death knell to Asia’s bull market in equities, and as such, is the single most important signal to monitor for futures indications of change.

But that is for the future. Today the focus is on making hay whilst the sun still shines. I anticipate markets will move higher in the coming months and the day of reckoning will be put off. Cross asset risk premia - such as credit spreads, commodity prices, and currency volatility - appear to agree, remaining at both benign and supportive levels.

But don’t be fooled. The smart money will already be seeking ways to hedge existing gains via ultra cheap options strategies, aware that sentiments can turn ugly in a heart beat. You have been warned.

John Woods is the chief investment officer, Asia-Pacific, at Credit Suisse.