Will a bite-size nibble be the best approach to get a taste of a cryptocurrency?

Were the WASPish Winklevoss twins actually onto something? Their general unlikeability, as portrayed in the movie The Social Network, made them a topic of mirth, but they did develop the concept behind Facebook.

They were also the first public faces to extol the virtues of bitcoin. People scoffed and waited for the demise. After all, they were tangled up in a set of lawsuits surrounding the origins of Facebook, which was unseemly. How could bitcoin be worthy of attention?

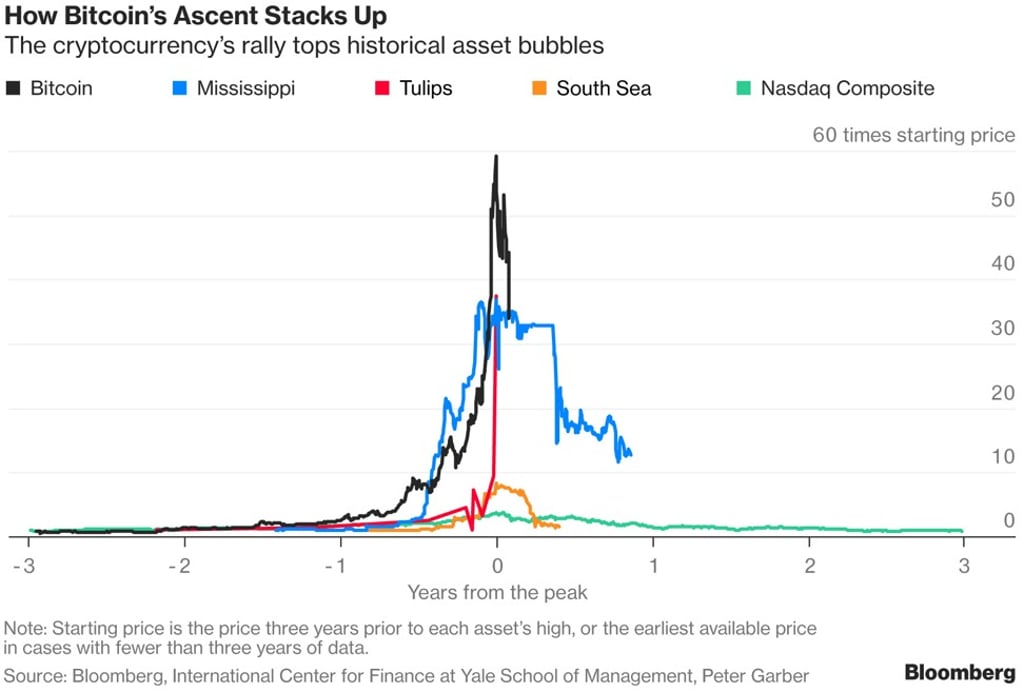

But bitcoin hit an all-time high in December, after undergoing some ups and downs that had seemingly spelt its end. Had you bought a bitcoin for US$967 on January 1, 2017, you would have realised a huge gain. By January 2 that same bitcoin would have been worth over US$14,000, though that was after a precipitous drop off from US$19,000 just before Christmas. In the summer of 2010, one bitcoin was worth just six US cents.

There are plenty of options, with over 1,400 cryptocurrencies in existence and a total market value estimated at US$550 billion, according to the latest Coinmarketcap data.