As M&A deals for Hong Kong insurers triples in 2017, all eyes are now on MetLife

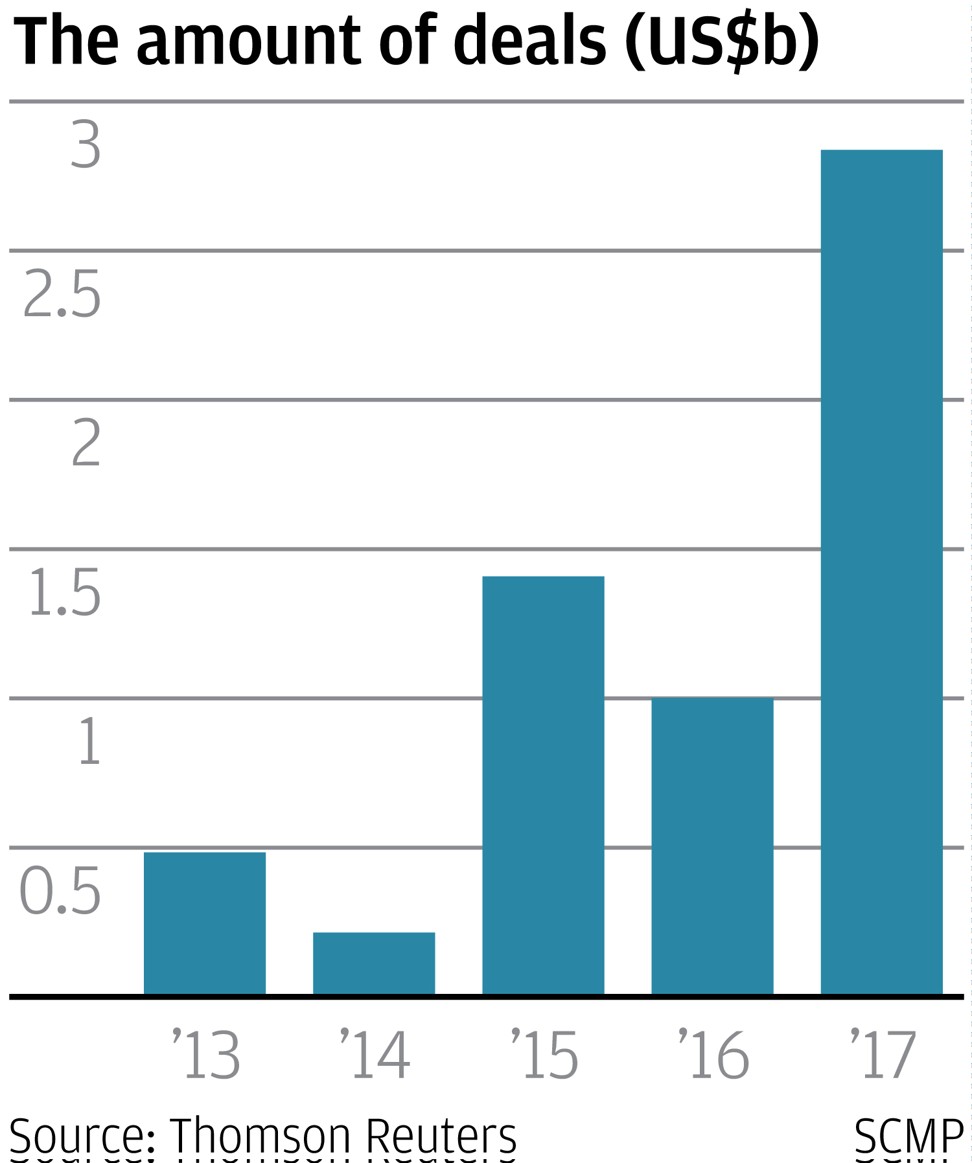

Deals involving Hong Kong insurers topped US$2.84 billion in 2017, up from US$1 billion in the previous year

MetLife is rumoured to be selling its Hong Kong arm, the latest in a spate of mergers and acquisitions among the city’s insurance companies that led to a near tripling in deal value last year.

M&A involving Hong Kong insurers reached US$2.84 billion in 2017, up from US$1 billion recorded in 2016, according to data from Thomson Reuters.

“The insurance products that are available in the mainland and those in Hong Kong are different,” said Keith Pogson, a senior partner at accounting firm EY. “This makes the ability to own a Hong Kong operation very appealing to mainland investors.”

He said the mainland companies who own a Hong Kong insurer could sell products to mainland Chinese individuals in the city while at the same time learning more about their products and technology, as these companies are usually owned by international players with a strong history and knowledge of the sector.

“The insurance market continues to be both appealing and a growth sector especially with regards to mainland related business. The trend for Hong Kong insurers to be takeover targets will continue,” Pogson said.

MetLife Hong Kong is reportedly the latest target, with the New York-based parent seeking about US$600 million, according to a Bloomberg report quoting people with knowledge of the matter.

MetLife Hong Kong declined to comment on queries from the South China Morning Post.

A spokeswoman for Hong Kong Insurance Authority said that deals in the sector would help to support for the expansion of business in Hong Kong or in neighbouring markets and also provide companies with technical know-how for insurtech initiatives.

“Having strong business fundamentals, Hong Kong is an ideal place for insurance companies to set up regional headquarters,” she said.

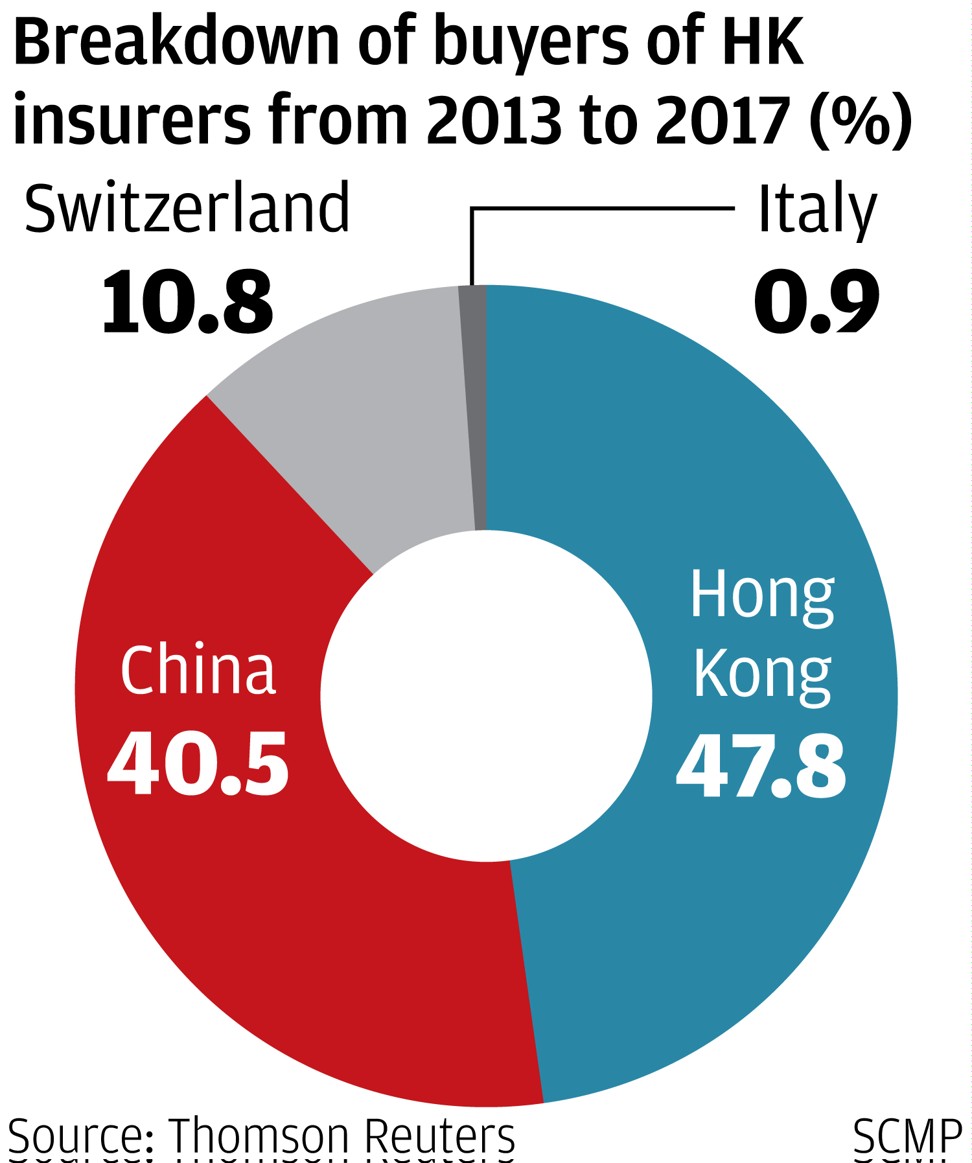

The top four deals in Hong Kong in the last five years involved buyers from the mainland, according to data from Thomson Reuters.

The biggest deal last year was made by Yunfeng Financial Group, the company backed by Alibaba Group Holding founder Jack Ma Yun, which agreed to buy MassMutual Asia – the Asian unit from US-based Massachusetts Mutual Life Insurance for HK$13 billion (US$1.7 billion). Alibaba owns the South China Morning Post.

Another major deal involved the acquisition of Hong Kong Life by a consortium led by mainland investment firm UCF Capital for HK$7.1 billion in March last year.

Dah Sing Life Assurance and related companies were sold to Fujian Thai Hot Investment for HK$8.03 billion. The deal, announced in June 2016, was completed exactly a year later in June 2017.

In August 2015, JD Capital, also known as Beijing Tongchuang Jiuding Investment Management, agreed to pay US$1.4 billion to acquire Ageas, which has since been renamed as FTLife Insurance Company.

Axa agreed last month to sell its Hong Kong wealth management unit to a local family office for US$281.3 million, Thomson Reuters data showed.

“The desire of institutions to buy Hong Kong insurance companies is largely driven by two forces: asset under management and premium and financial product portfolio enhancement,” said Brett McGonegal, chairman and chief executive of Capital Link Investment.

“Insurance premium is a very stable cash flow that results in deployable investment funds which is of interest to financial platforms looking to scale. Most insurance companies have a large diversified product offering which is extremely important to mangers looking to augment and enhance their own product portfolio and distribution,” he said.

He, however, warned that the takeover price was getting too high.

“Some of the prices paid last year on a price to book comparison were very high and should be watched closely. Many traded above four times, which is very expensive. I would say anything below 2.5 times is very well priced and would suggest a high chance of success upon integration,” McGonegal said.

Mainland individuals, meanwhile, have slowed their buying of Hong Kong insurance policies as Beijing tightened its grip on capital flight. Their outlay of US$5.17 billion in the first nine months of last year was 17 per cent lower than a year ago.

McGonegal believes this would not affect the attractiveness of Hong Kong insurers.

“The current capital control restrictions will not be in place forever and as many invest with a much longer term view the current obstacles are really not material when compared with long term business strategies,” he said.