Hong Kong pensions regulator steps in to prevent speculative activity through Mandatory Provident Fund

Mandatory Provident Fund Schemes Authority asks providers to review special voluntary contribution regulations

Hong Kong’s pensions regulator has warned all 14 Mandatory Provident Fund providers to tighten control over their schemes to prevent abuse by clients who are gambling on the stock market through their retirement savings, the South China Morning Post has learned.

The providers have also been told to review their controls system to prevent any money laundering through the MPF, several fund managers told the Post, which also saw a circular to that effect issued by the Mandatory Provident Fund Schemes Authority. The regulator met them around the Lunar New Year holiday to discuss such concerns.

“The MPFA has recently noticed significant fluctuations in the amount of special voluntary contributions,” the authority said in a reply to an enquiry by the Post. “In particular, they are required to establish control measures to avoid any voluntary contributions being used for short-term speculative activities.”

The authority urged all service providers to review their current arrangements for special voluntary contributions to ensure that withdrawal mechanisms complied with applicable legislation and objectives under the system.

Manulife, the largest single MPF provider in the city, said it had decided to cease accepting special voluntary contributions.

“We noted that the primary objective of launching this service [special voluntary contribution] has not been generally achieved in view of the withdrawal frequency, transaction pattern and trend,” a Manulife spokeswoman said. “In view of this, we will cease accepting new applications with effect from April 3, 2018. We will also cease to accept any new payment from our existing special voluntary contribution members after March 2018.”

The MPFA is currently reviewing the policy over special voluntary contributions but has yet to decide whether to abolish it.

The MPF, launched in 2000, requires employers and employees to each pay 5 per cent of a staff member’s salary to the MPF up to a combined HK$3,000 (US$383) a month. This compulsory contribution can only be withdrawn when the employee retires at the age of 65.

However, employees can voluntarily contribute more every month through their monthly contribution as a voluntary contribution, or they can pay directly to their MPF provider as a special voluntary contribution. Both these contributions can be withdrawn any time.

A few MPF providers told the Post that some special voluntary contributions can be as high as several million dollars and they can be withdrawn very quickly, usually within a year. The providers said these employees were using their special voluntary contributions to bet on the market.

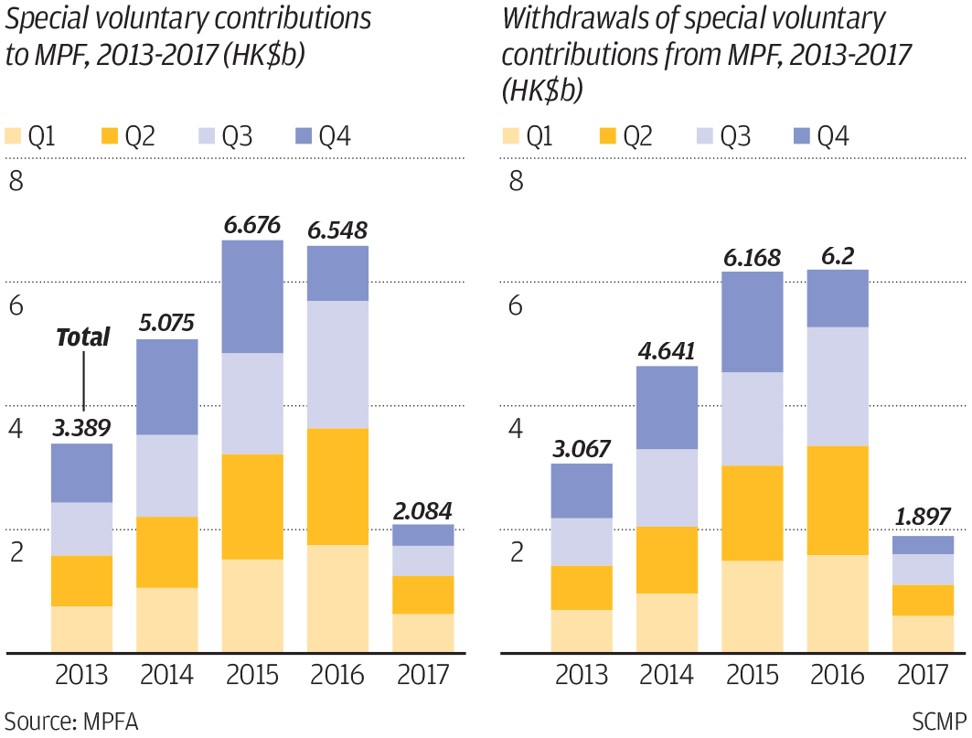

MPFA data shows special voluntary contributions and their withdrawals have fluctuated over the five year period between 2013 and 2017. The amount of such contributions reached its highest in 2015, at HK$6.67 billion, or about 10 per cent of all contributions.

The biggest withdrawal of special voluntary contributions was recorded in 2016, at HK$6.2 billion, or about 28 per cent of all withdrawals.

The amount of contributions and withdrawals declined last year, with total special voluntary contributions at HK$2 billion, or 3 per cent of all contributions, and withdrawals at HK$1.87 billion, or about 8 per cent of all types of withdrawals.

Fund managers have different explanations for this occurrence, with some saying this might involve money laundering as investors might be parking excess cash with the MPF for the short term instead of putting the money in banks, where the interest rate is close to zero.

There has not been any evidence suggesting there are money laundering issues in relation to special voluntary contributions, since contributions are mainly received through the banking system

But the MPFA denied this was possible. “There has not been any evidence suggesting there are money laundering issues in relation to special voluntary contributions, since contributions are mainly received through the banking system,” an authority spokesman said.

The authority has, however, told the 14 providers they also need to review their systems, including due diligence such as client profiles, checks on sources of funds and investment patterns to make sure these clients have complied with the amended anti-money-laundering regulation implemented last month.

Voluntary contributions on top of compulsory retirement schemes are common abroad, as people can enjoy tax incentives by putting more money into their pension plans, according to CitiTrust chairman Stewart Aldcroft.

“However, Hong Kong does not have much tax incentives for the MPF, so there is no point in people doing so,” said Aldcroft.

He said people should make voluntary contributions for longer terms of more than 10 to 20 years, to prepare for their retirement instead of treating these as short-term speculative investments.

“Short-term speculation violates the mission of the MPF, which is supposed to be long-term investment for retirement protection. The MPFA has taken the appropriate action to stop anyone from abusing the MPF system,” Aldcroft said.