Explainer: What ails the Hong Kong dollar? It is the carry trade

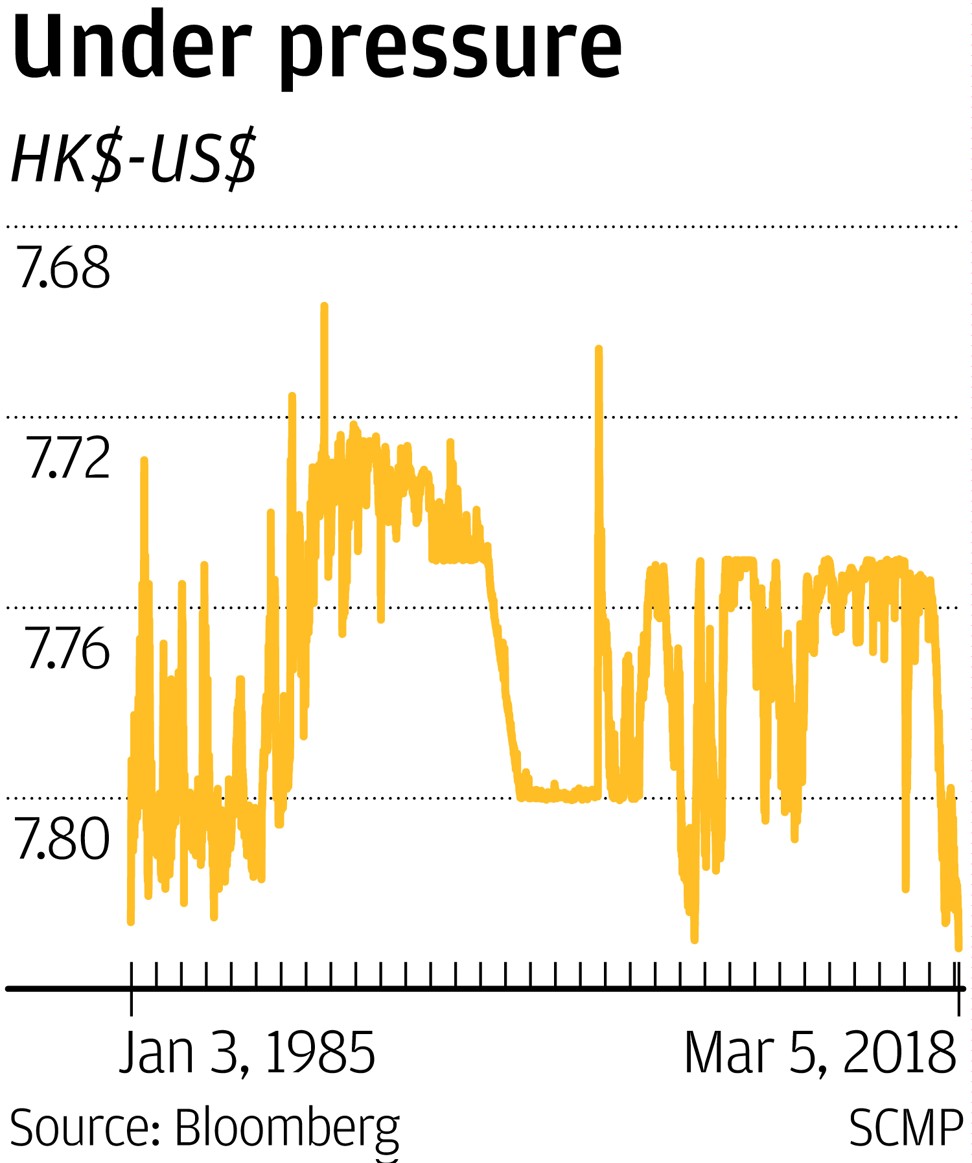

The Hong Kong dollar, the fourth biggest loser among Asian currencies this year against the US dollar, strengthened for the first day in six on Thursday, as it crawls its way out of the lowest end of a trading band in more than three decades.

The currency, which has been pegged at 7.8 per US dollar since October 1983, is supposed to move with the greenback. Yet, it recently traded at 7.8339 per US dollar, approaching the lower limit of the trading band.

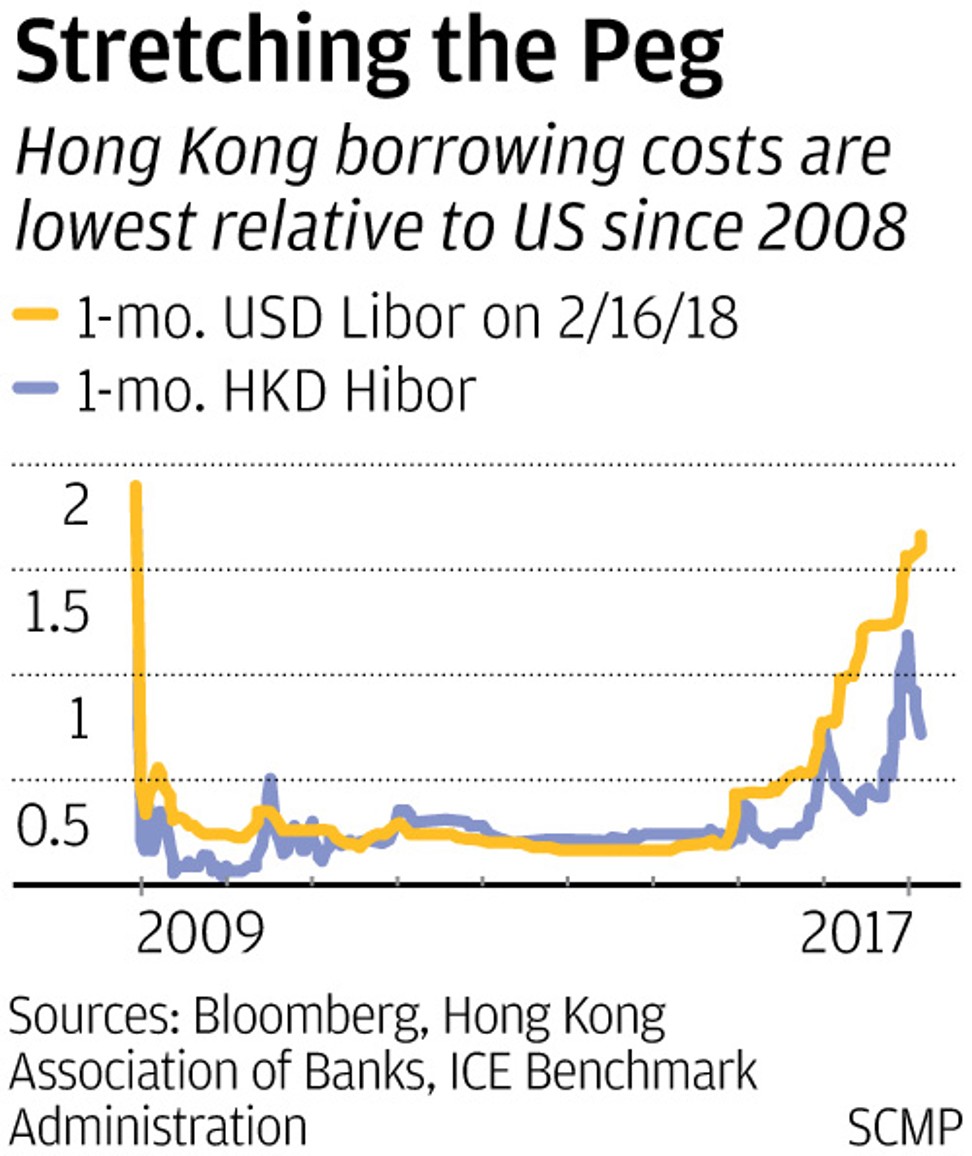

The main culprit behind the local currency’s slump is the carry trade, an arbitrage whereby investors borrow low-yielding currencies to buy high-yielding currencies.

What is a carry trade?

This is an arbitrage, where traders take advantage of differences in prices, selling a low-yielding product (the Hong Kong dollar) to buy a high-yielding product (the US dollar).

In this case, the price difference is between the local borrowing cost known as the Hong Kong interbank offered rate (Hibor) and the US borrowing cost known as the Libor.

As more traders pile on to the carry, more pressure is placed on the Hong Kong dollar, causing it to weaken further against the US currency.

What is the Hong Kong government’s stance on the carry trade?

A minor adjustment was made to the currency board arrangement, whereby a trading band of between 7.7500 and 7.8500 per US dollar was put around the Hong Kong currency, obliging the monetary authority to intervene when the local currency trades higher or lower the band limits.

Howard Lee, deputy chief executive of the Hong Kong Monetary Authority, said on Tuesday that while the Hong Kong dollar had reached its weakest level in more than 30 years, this valuation was “well within the design of the system.”

“Since the global financial crisis, we have seen large amounts of funds flow into Hong Kong, and now we are seeing these same funds flow out,” Lee said.

Financial Secretary Paul Chan Mo-po was also reported this week as saying he expected some funds to exit Hong Kong, causing weakness in the currency. However, capital outflow are good for the city, helping to “normalise” Hong Kong’s market rates at a more ideal pace.

Hong Kong’s de facto central bank probably would not take additional steps - such as issuing extra Exchange Fund bills - to soak up the abundant liquidity to curb depreciation pressure.

What are analysts saying?

While the stock market becomes more volatile this year, demand for Hong Kong dollar-denominated assets remain relatively supported and capital outflows are well-contained, said OCBC-Wing Hang Bank’s economist Carie Li. So any further declines in the Hong Kong dollar will be very slow.

Under Hong Kong’s linked exchange rate system, the HKMA is mandated to sell US dollars at HK$7.85 when necessary to protect the peg.

Frances Cheung, head of macro strategy, Asia at Westpac Banking Corp said that the HKMA probably was not taking the more flexible approach of issuing extra Exchange Fund bills, preferring the harsher measure of conducting foreign exchange operations when the weak-side convertibility undertaking is triggered with the aim of shrinking the monetary base. It may think liquidity is too loose and banks rates too low, that is encouraging excessive risk taking investor behaviour, Cheung said.

What stands behind the Hong Kong dollar?

The Hong Kong dollar is backed by the HK$4 trillion (US$513.5 billion) Exchange Fund, one of the world’s largest foreign exchange reserves. The fund, established as an asset war chest for defending the currency’s value, also makes investments, earning a record HK$252 billion in 2017 income.