Exclusive | Hong Kong’s currency to remain pegged to the US dollar in the near future, IMF’s Lagarde says

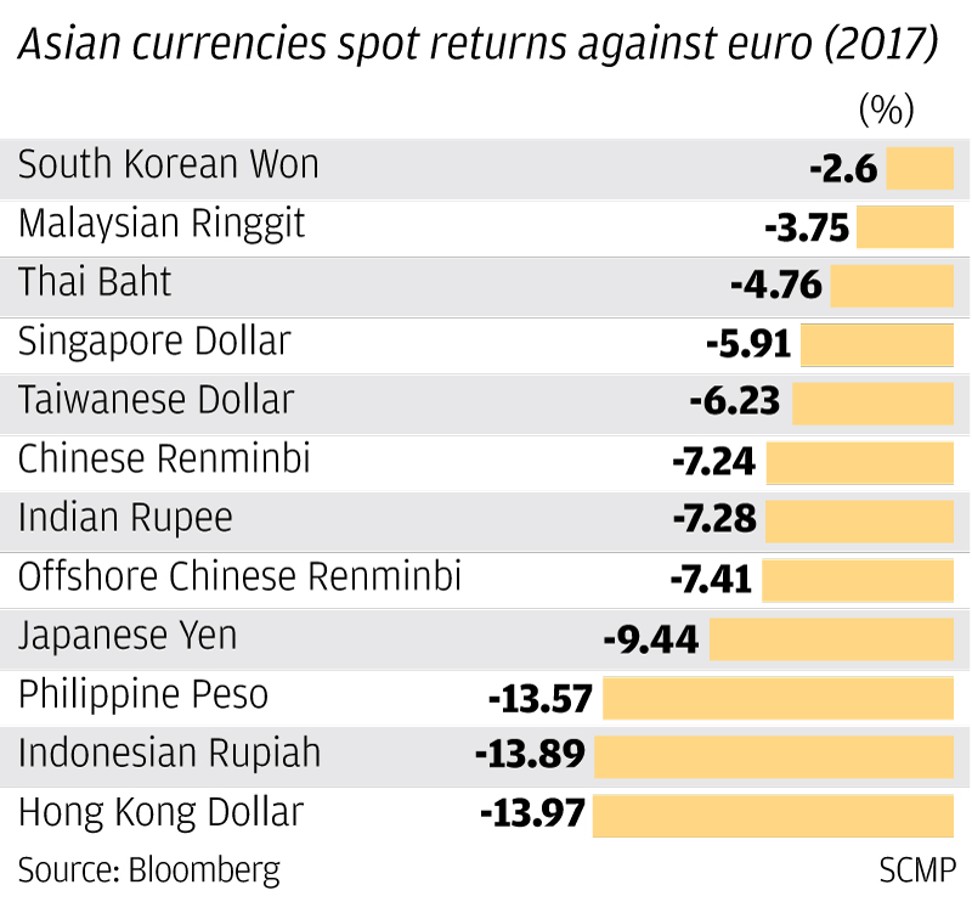

The Hong Kong dollar, the biggest loser among a dozen Asian currencies against the euro last year, weakened to 7.8499 per US dollar on Wednesday, the weakest level since 1983

Hong Kong’s currency should remain pegged to the US dollar, said the International Monetary Fund’s Managing Director Christine Lagarde, even if it has weakened to the lowest level in 35 years, barely 0.01 cent from touching a red line that triggers an intervention by the city’s monetary authority.

“The pegging mechanism in place is consistent with the fundamentals of the economy,” Lagarde said in an interview with the South China Morning Post, after delivering a speech at the Hong Kong University. “We certainly don’t see in the near future the pegging of the Hong Kong dollar to another currency, other than the US dollar.”

Lagarde’s comment comes as the city’s currency deteriorated to 7.8499 per US dollar on Wednesday, the weakest since the two currencies were pegged at 7.8000 in 1983. Under a trading band created in 2005, the Hong Kong Monetary Authority is compelled to step in to buy the local currency to prop it up once it reaches 7.8500 per dollar, or to do the converse if the city’s currency strengthens to 7.7500 per dollar.

For more than a year, traders had been actively selling Hong Kong dollars and buying the US currency in an arbitrage called the carry trade, which sells a low-yielding asset to buy another with higher returns, as they took advantage of the price difference between their borrowing costs.

The local monetary authority raises the city’s key interest rate in lockstep with the US Federal Reserve to maintain the peg’s value. However, the gap between the local cost of borrowing capital, known as the Hong Kong interbank offered rate (Hibor), and US rate is at its widest in months, fuelling the arbitrage.

The Hibor has been rising across all maturities this year, reflecting an overall tightening of funds in the city. For example, one-month Hibor has risen to 0.86 per cent while the three-month Hibor increased to 1.21 per cent. But the US borrowing cost, known as the Libor, rose at a faster pace, up 13 basis points. This has widened the Hibor-Libor spread, allowing traders to continue making the arbitrage trade, which in turn exerts depreciation pressure on the local currency.

Supporting the value of the Hong Kong dollar is the Exchange Fund, one of the world’s biggest war chests at HK$4 trillion (US$513.5 billion).

The last time the HKMA was engaged in defending the Hong Kong dollar in 1997, it allowed overnight interest rates to climb to 300 per cent, enough to kill off hedge fund attack as local banks could only raise funding for their own needs, so there were no Hong Kong dollars left to finance short sellers.

The currency peg exposes Hong Kong’s economy to the ups and downs of the US economic cycle as the US Fed’s interest rate policies will have to be matched in Hong Kong. Some economists argue that Hong Kong’s economy should be synchronised with mainland China, with which the city conducts the bulk of its trade and investments.

“The fact that Hong Kong’s interest rates must move in line with US monetary policy is dangerous, because of the city’s excessively high levels of debt,” said Caitong International Securities’ head of research Henry Chan. “Hong Kong’s debt-to-GDP ratio is over 400 per cent, due to an abnormally low Hibor. Once the economy shrinks, and corporate profits slow on higher interest rates and slower exports, then there will be capital outflows that will, cause non-performing loans to surge.”

Is there an optimum time when the Hong Kong dollar should be pegged to the renminbi?

“These transitions take place over decades and decades,” Lagarde said. “Somebody else could be in charge by then, not me.”

With additional reporting by Karen Yeung in Hong Kong