Chinese insurers emerge stronger after tougher regulations, improved investment returns

Life insurance companies’ solvency ratios show marked improvement after China Insurance Regulatory Commission implemented stricter rules on short-term products, says Moody’s report

Tighter regulations and solid investment returns helped Chinese life insurers improve their long-term debt repayment abilities last year but general insurers struggled because of lower profitability of their car insurance products, according to a report by Moody’s Investors Service.

The credit rating agency’s report released on Wednesday showed all insurers in the mainland had strong solvency ratios – a key indicator of an insurance company’s ability to repay long term liabilities and debts.

The Moody’s report showed the insurance sector in general had a solvency ratio of more than 200 per cent in 2017, double the regulatory requirement of 100 per cent.

Life insurers’ core solvency ratio stood at 214 per cent at the end of December 2017 compared to 204 per cent in 2016, while for general insurers it declined to 231 per cent from 249 per cent in 2016.

Moody’s said general insurers reported a decline in their solvency ratios because of lower profitability of their car insurance products.

“The average solvency ratios for Chinese life insurers continued to show mild gains in the second half of 2017, while those for property and casualty insurers declined further but stayed well above the regulatory minimums,” said Edwin Liu, a Moody’s associate analyst.

Reinsurers’ solvency stabilised, mainly reflecting a slowdown in the growth of short term savings-type products amid regulatory clampdown, Liu added.

Life insurance companies’ solvency ratios improved after China Insurance Regulatory Commission (now called China Banking and Insurance Regulatory Commission after the recent merger of CIRC and China Banking regulatory Commission) last year implemented tougher regulations on short-term products. As a result mainland insurers shifted to selling more long-term protection products, which are more profitable and require less capital support than short-term products or universal life products.

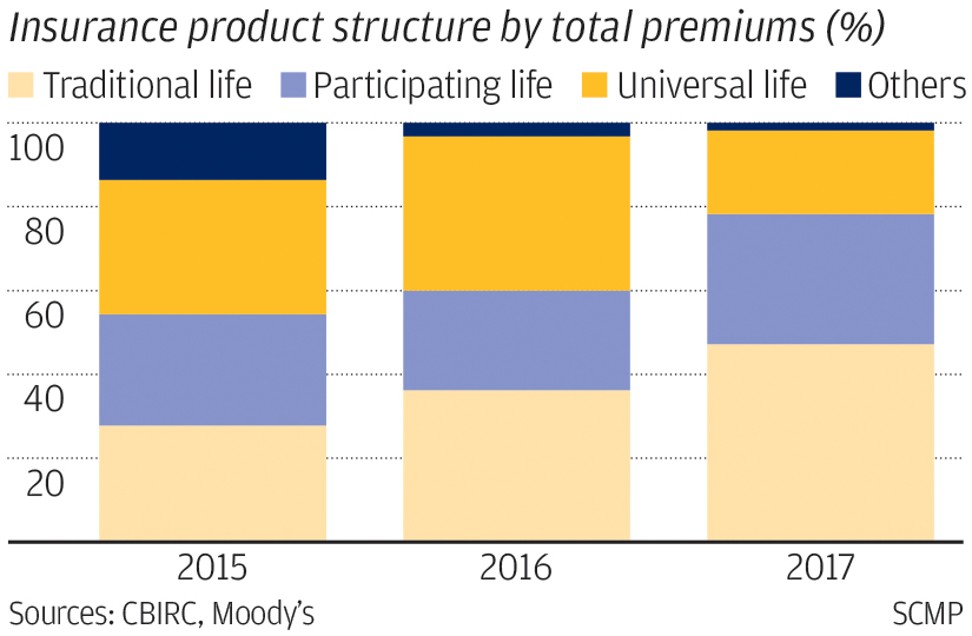

Total premium from the sale of traditional life products rose 20 per cent in 2017 from a year earlier. Traditional life insurance products accounted for 47 per cent of overall sales, compared with 36 per cent in 2016 and 28 per cent in 2015, according to Moody’s.

In contrast, universal life products dropped to represent only 20 per cent of all products last year, compared with 37 per cent in 2016 and 32 per cent in 2015.

“The shift to protection-type products supported insurers’ solvency because these products are usually more profitable than savings-type products. In addition, protection-type products have lower interest-rate risk because they are less reliant on spread gains, and have lower capital requirements as a result,” the Moody’s report said.

The report added that the regulatory environment will continue to encourage a shift from savings products to protection-type products, which will support life insurers' solvency in the coming year.

In addition, the strong stock market performance last year – a 36 per cent jump in the Hang Seng Index – also helped lift life insurers’ investment income.