One company wants to sign up your cat (or dog) for insurance that helps protect against pricey vet bills in Hong Kong

Only 3 per cent of Hong Kong’s half million dogs and cats are insured against costly veterinary expenses, compared to 20 per cent in the UK

Home-grown fintech company OneDegree sees opportunity in the more than half a million underinsured dogs and cats in Hong Kong, as the company races to be among the first batch of pure online insurers in the city.

The company, whose insurance products range from pets to travel, is among the first generation of companies seeking to be fast-tracked for an operating license under the Insurance Authority’s guidelines unveiled last October.

“There are over 510,000 dogs and cats that are kept as pets in Hong Kong but only 3 per cent of them are covered by pet insurance. This is much lower than 30 per cent in Sweden, 20 per cent in Britain and 10 per cent in Japan,” said Alvin Kwock Yin-lun, co-founder and chief executive of OneDegree.

“Many people are keeping their pets as part of their family. The ageing population in Hong Kong means more people will keep dogs and cats as companions.”

Rising pet ownership in Hong Kong opens host of retail opportunities

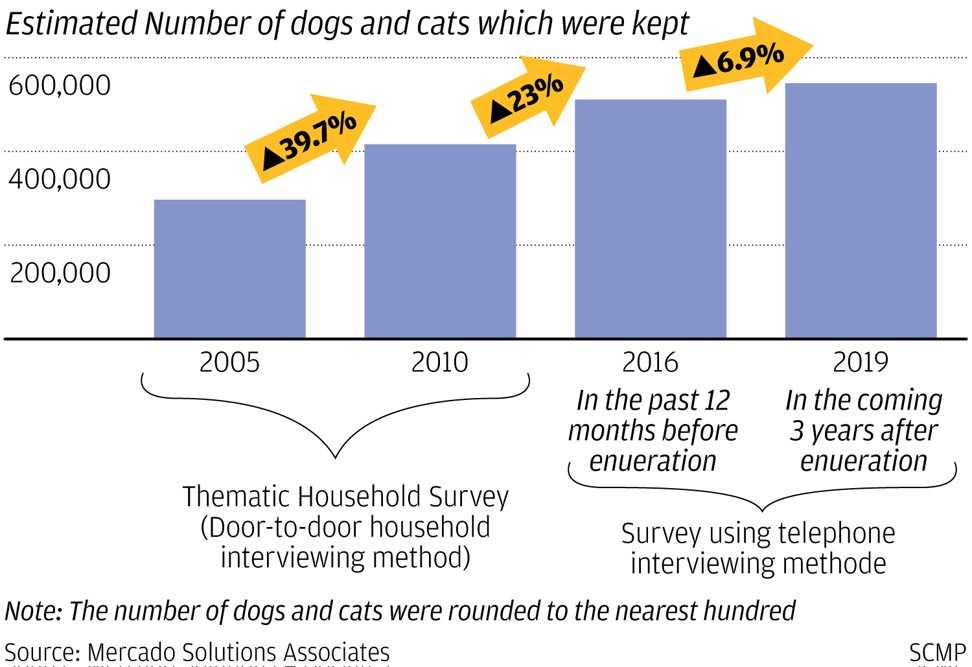

He added that the population of dogs and cats in Hong Kong has grown by 60 per cent during the past 10 years.

“We believe the demand for pet insurance would be huge,” Kwock said in an exclusive interview with the South China Morning Post.

Dogs in summer: five things Hong Kong owners should not do

The company, which has an business application pending, had been in talks with the Insurance Authority since 2016.

“We are keen to be among the first batch of online insurance companies in Hong Kong for a general insurance license to sell pet, car, travel and other products,” he said.

Pet insurance will be designed to cover veterinary bills and other expenses, with premiums ranging from a few hundred dollars to several thousand. Factors affecting the premium will depend on the particular breed of the animal, health history and the scope of coverage.

If an operating license is approved, OneDegree will launch a mobile app whereby pet owners can apply for coverage.

Hong Kong’s Isle of Dogs and how volunteers care for dumped pets

All payments and claims would be done through online automated processes accessible by smartphone or computer.

“The claims could be handled within one day without any paper work which is faster than the traditional method which can take up to 30 to 90 days and a lot of paperwork to complete a claim process,” he said.

Taking pets to work can relieve stress in frenetic Hong Kong

Kwock, 35, a former investment banker at JPMorgan, turned to online insurance after an experience dealing with medical insurance claims while caring for an ailing parent.

“Back in 2015, my mother was suffered the final stage of cancer. The whole family was worrying about her health but we still needed to fill in a lot of forms and paper work for medical insurance. I decided to introduce an online insurance solution to find an easy and simple way for policyholders to apply policies and seek claims,” he said.

It would definitely be helpful if there are pet insurance policies for my dogs, they are part of my family

Co-founder and chief insurance officer Alex Leung Te-yuan, also 35, said the company’s business model was unlike that of traditional insurers which are burdened by high operating costs owing to a cumbersome sales and claims process which requires excessive paperwork. As a result, traditional insurance companies focus on higher premium products such as life insurance, and tend pay little attention to smaller markets such as pet insurance.

“Online insurance companies in the US or Europe have proven they can hire fewer people to handle application, administration and claims. They use a lot of automation, AI and other technologies which allows them to operate in a cost effective manner. A claim department in a traditional insurance company may need 50 people while an online insurer may need only 15 to 20,” Leung said.

Pugs vs sausage dogs: ultimate face-off in Hong Kong charity race

Pet owner Cherry Lai said she would like insurance coverage for her four dogs.

“The medical cost for the dogs is very expensive. Some simple surgery costs several thousands of dollars. It would definitely be helpful if there are pet insurance policies for my dogs, they are part of my family,” Lai said.