HSBC strikes back in mobile payment war, lifts PayMe monthly top-up limit to HK$50K

HSBC plans to increase the top-up limit of its e-payment app PayMe by 10 times to HK$50,000 (US$6,370) as early as this week, at it prepares to expand the app’s purchase utility among merchants this year, the bank said on Tuesday.

The biggest bank in Hong Kong will also allow customers to transfer money from their personal bank account with HSBC to their PayMe e-wallet, broadening a service that was previously only available by credit card top-up.

Customers from later this week will be able to transfer to their PayMe e-wallet from their HSBC personal bank account up to HK$30,000 per month, or HK$50,000 if they can provide a Hong Kong residential address. The current limit is HK$5,000 from any credit card per month.

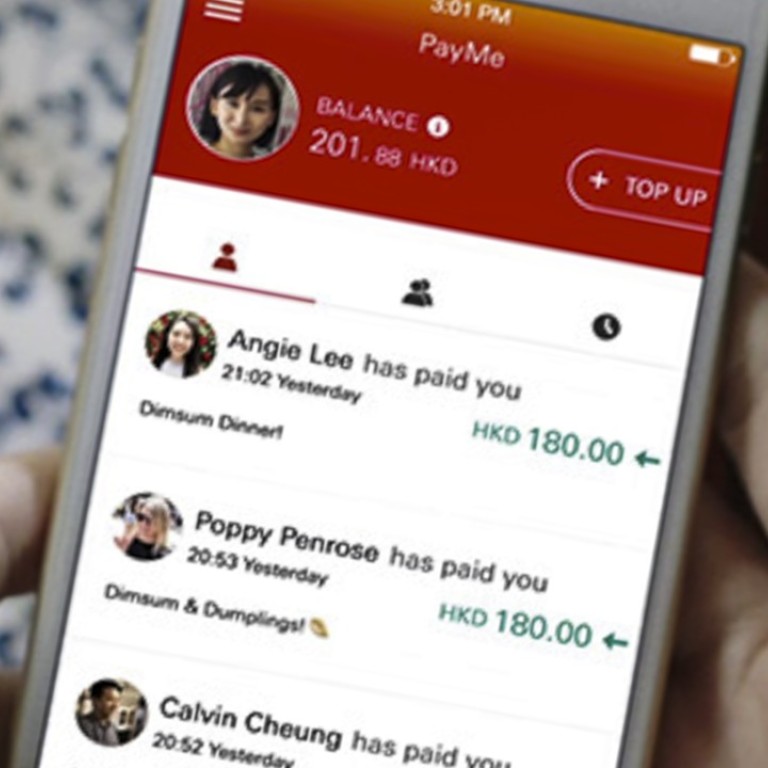

Launched early last year, PayMe is used mainly by customers to transfer small amounts of money to settle restaurant bills among friends or offer laisee.

The change means PayMe will compete directly with other mobile payment operators such as Octopus, Alipay, WeChat Pay or Apple Pay, which are frequently used to make purchases at supermarkets, shops or restaurants as well as paying taxi fares.

Andrew Eldon, head of digital of retail banking and wealth management of Hong Kong at HSBC, said the bank will announce “in the not distant future” plans to allow PayMe to be used for purchase at merchants. The system is likely to involve QR code technology, which is a common method for merchants to accept payment by mobile phone.

“I am confident PayMe could give customers a great experience in making purchases in future,” he said when asked if the app could compete with other e-payment operators.

Eldon said the bank would first develop PayMe in Hong Kong before any overseas expansion.

He said the credit card top-up cap would remain unchanged at HK$5,000.

Ben Kwong Man-bun, a director of KGI Asia, said the latest move showed HSBC has to prepare its fintech capability to compete with new players.

“Traditional banks such as HSBC and other lenders need to increase their mobile payment and other internet banking facilities to compete with other new e-payment operators. They have to offer these mobile payment services, or the young and tech-savvy customers would shift to new financial players,” Kwong said.

“The latest efforts in PayMe would help HSBC to keep its customers and enhance its market position in mobile payments. It is hard to predict if it would help its bottom line. It may take a long time to see any profitability from these fintech investments,” Kwong said.

“We are pleased that PayMe is fast cementing its position as one of the most popular mobile payment apps in Hong Kong since we launched early last year,” said Greg Hingston, head of retail banking and wealth management of the Hong Kong office of HSBC.

“By enabling users to top-up their PayMe wallet from their HSBC bank account, we hope to provide our existing users with more choices and flexibility, as well as cater to customers who might not have a credit card,” Hingston said.

He added that the bank would allow customers to transfer money from other personal bank accounts to top-up their PayMe wallet at a later stage.

The HSBC move came as e-payment operators have aggressively expanded into Hong Kong.

About 3,000 Hong Kong taxi drivers accept Alipay or WeChat Pay. Alipay earlier this year teamed up with partners to accept payment in six fresh vegetable markets in Hong Kong.

Alipay is operated by Ant Financial Services Group, a unit of Alibaba Group Holding, which is also the owner of the South China Morning Post .