Hong Kong fintech fundraising slows down to a trickle as China steals the show in the first half

Hong Kong fintech start-ups raise US$23 million in first half versus US$17 billion garnered by Chinese firms

Investments into Hong Kong-based fintech companies fell 84 per cent in the first half even as funding in other Asian markets including China rose manifold, according to New York-listed consulting firm Accenture.

With only US$23 million raised by Hong Kong fintechs in the first half compared with US$148 million a year earlier, the growing trend of fintech investments in the city could be snapped, which has risen every year since 2014 and reached US$546 million last year.

As part of the plans to turn the city into a fintech hub the Hong Kong Monetary Authority last September said it would issue the first virtual bank licence for lenders to operate purely online without a branch.

Industry watchers however were quick to point out that the decline in fintech investments was likely to be temporary.

“The fall was due to many Hong Kong start-ups having already raised funds last year,” said Joseph Tong Tang, chairman of Morton Securities, who also invests in fintech start-ups, adding that the lull could be due to the fact that the start-ups are focusing on business development.

Tong and expects fundraising to pick up in the second half.

“The virtual bank licence could be the driving force as HKMA has indicated there are 60 companies planning to apply for the licence. If each of them raised HK$1 billion (US$127 million), it would be huge,” he said.

Hong Kong prepares to usher in virtual banks, as 60 firms apply to be pioneers in financial revolution

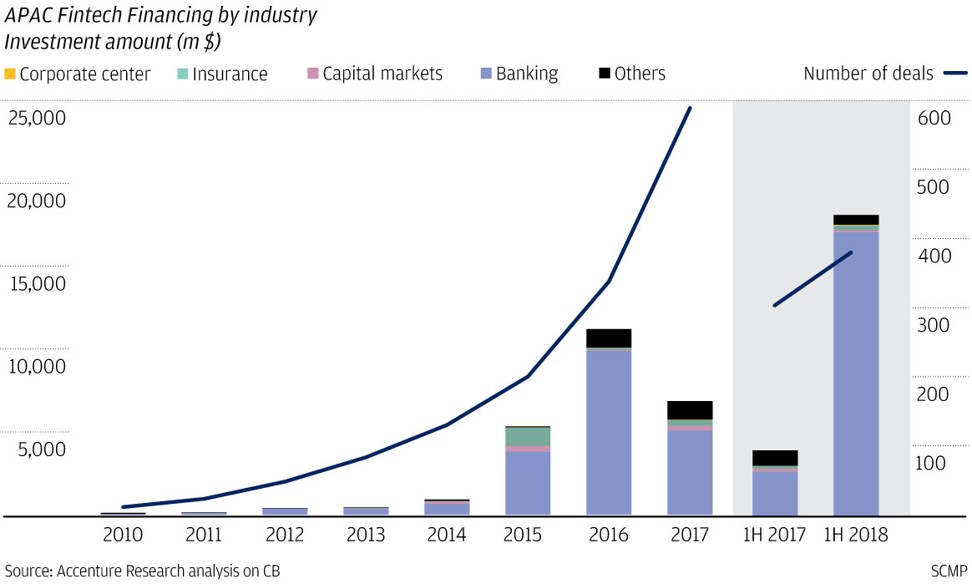

The declining trend in Hong Kong is in contrast to the Asia-Pacific, which saw funds raised by start-ups rise 362 per cent to US$19.4 billion in the first half from US$4.2 billion a year earlier, according to Accenture.

The number of deals in the region also rose 27.3 per cent to 373 in the first six months of the year.

Asia-Pacific represented 62 per cent of the US$31.2 billion fintech companies raised globally in the first half of 2018, with North American start-ups accounting for US$8.4 billion while those in Europe mopping up US$2.9 billion, the Accenture data showed.

Chinese companies took the top three positions in terms of funds raised in the first half. The US$14 billion raised by Ant Financial Services Group in June, which operates China’s biggest online payment platform, was the largest ever in the history of fintechs. The company is part of Alibaba Group Holdings, which owns the South China Morning Post.

Ant Financial raises $14 billion in latest funding round as it seeks to expand Alipay globally

It was followed by Ping An Insurance Group’s financial platform OneConnect, which raised US$650 million while Hangzhou-based fintech platform CGTZ.com collected US$360 million.

China also ranked as the top destination for fintech investments in Asia, raising US$17.7 billion in the first half, up from US$1.8 billion a year earlier.

India, the second largest start-up market, however saw fundraising slump 40 per cent to US$1.1 billion in the first half. Still, two Indian start-ups squeezed into the top 10 in Asia, including insurance comparison platform PolicyBazaar, which raised US$200 million and US$125 million by payments processor Pine Labs.

In Hong Kong, the largest deal was the US$12.7 million raised by artificial intelligence start-up Trend Lab and US$10 million raised by robo-adviser Quantifeed.