China may well offer financial help to Turkey, but it will not turn around the troubled lira

The Chinese government may well offer help to Turkey to build a bridge to another country hit by US trade sanctions

There is a decent chance that China will offer some financial assistance to Turkey, including buying some yuan-denominated bonds that it is expected to issue, as Ankara reaches out for “new friends” to defend its currency and economy amid an escalating conflict with the United States, analysts said.

However, Beijing will carefully weigh its options in assisting Turkey and will not offer a major bailout package due to the risk to broader support would further provoke the US.

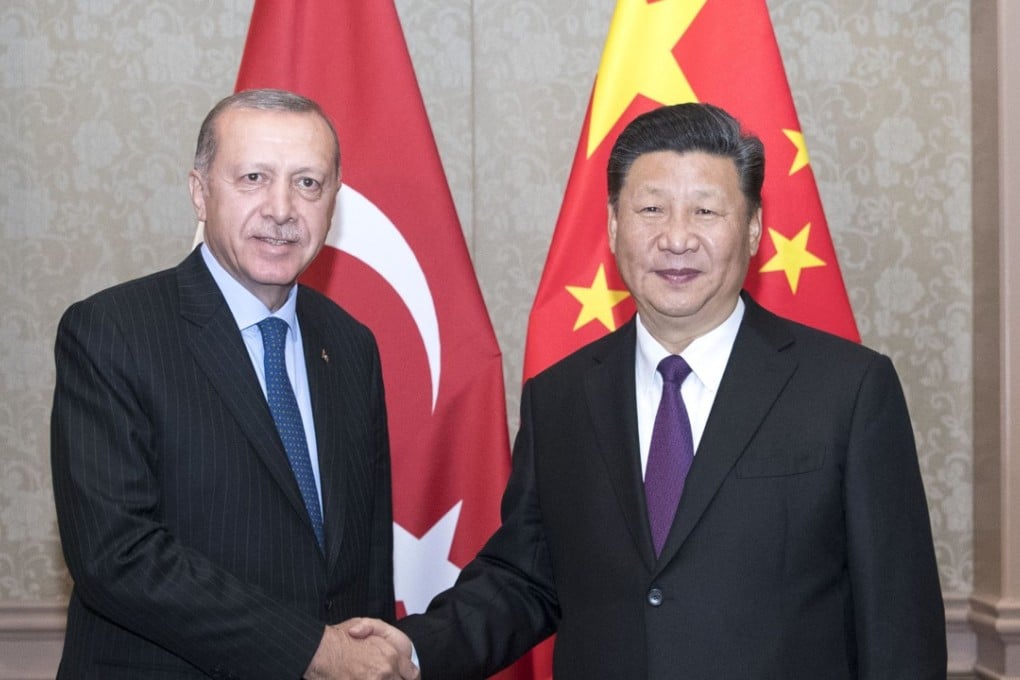

Turkish President Recep Tayyip Erdogan said on Saturday that his country was now looking to form alternative economic alliances from “Iran, to Russia, to China and some European countries”, after the US “upset and annoyed” its Nato ally with sanctions that greatly exacerbated the lira’s existing troubles.

US President Donald Trump has demanded that Turkey release a US pastor being held on charges of aiding terrorists. Turkey has so far refused to comply, prompting Trump on Friday to double the tariffs on US imports of Turkish steel and aluminium, causing the lira to plunge.

The Turkish currency lost almost 20 per cent of its value against the US dollar last week and is down 40 per cent since the start of the year.