Exclusive | Chinese arms dealer Norinco tussles with Jiangsu’s richest man for a portion of Abu Dhabi oil in CEFC’s fire sale to pare debt

One of the world’s biggest arms dealers is competing with Jiangsu’s richest man for a strategic stake in the United Arab Emirates’ largest crude oil producer

A strategic stake in the United Arab Emirates’ largest crude oil producer is up for grabs in a fire sale that is underway half a world away in Beijing, where CEFC China Energy is being broken up in the Chinese government’s campaign to pare back private sector debt.

CEFC’s main creditor China Development Bank is putting the Chinese company’s 4 per cent stake of Abu Dhabi National Oil Corporation (Adnoc) up for sale, according to three sources familiar with the plan.

Two front runners are competing for the stake: the Hengli Group, owned by Jiangsu’s wealthiest man, and China North Industries Group Corporation (Norinco), one of the world’s biggest arms dealers, the people said, declining to be named for disclosing private conversations.

Citic Group, the biggest among China’s state conglomerates and a buyer of CEFC’s assets in the Czech Republic, has withdrawn from making an offer, after having conducted due diligence on the Abu Dhabi stake, the sources said.

Oil giant CEFC China’s debt woes widen as unit defaults on commercial paper

The fire sale at CEFC kicked off in earnest after its chairman and founder Ye Jianming was taken away in mid-February by Chinese authorities to help with investigations into the circumstances that led to his company’s explosive, debt-fuelled growth into China’s largest privately owned energy conglomerate.

CEFC is not the only Chinese company under scrutiny by the government of President Xi Jinping in it campaign to rein in loans and protect the country’s financial system.

Anbang Group and HNA Group, two of the most aggressive global shoppers for assets in the past few years, have also been forced to dispose of their property and businesses to avoid going under.

CEFC bought 4 per cent of Abu Dhabi’s state oil producer in February 2017 for US$888 million, and pledged US$1.8 billion of spending in the venture.

That would be the Chinese company’s most valuable offshore energy asset until its US$9 billion plan last year to buy 14 per cent of Rosneft, which had to be abandoned and offloaded to Qatar’s sovereign wealth fund after Ye’s fall from grace.

Abu Dhabi National Oil’s chief financial officer, Mark Curtis, did not respond to questions sent to him by email, while the company’s spokesman could not be reached for comment.

Norinco, a state-owned company based in the Chinese capital, is one of the world’s biggest defence contractors, producing a wide variety of weapons including small arms and submachine guns, tanks, military drones, artillery, anti-missile systems and ballistic missiles.

Hengli is building a new petrochemical plant in the northeastern port city of Dalian to process 20 million tonnes of crude oil per year. The firm in April received state approval to import 400,000 barrels per day of crude oil, or 20 million tonnes a year – the largest quota ever given to a private refiner in China. In June, it set up an oil trading company in Singapore called Hengli OilChem.

China’s leveraged asset buyers must now brace for discounts in their forced fire sales

A stake in Abu Dhabi National Oil could entitle Hengli to more than 3.2 million tonnes of crude a year at the current level of production – and the size could exceed 4 million tonnes a year if that output increases.

According to its website, Hengli had more than 60,000 employees on staff at the end of last year, with total revenues of 308 billion yuan. That puts it at No 235 on the list of the world’s top 500 companies by revenue.

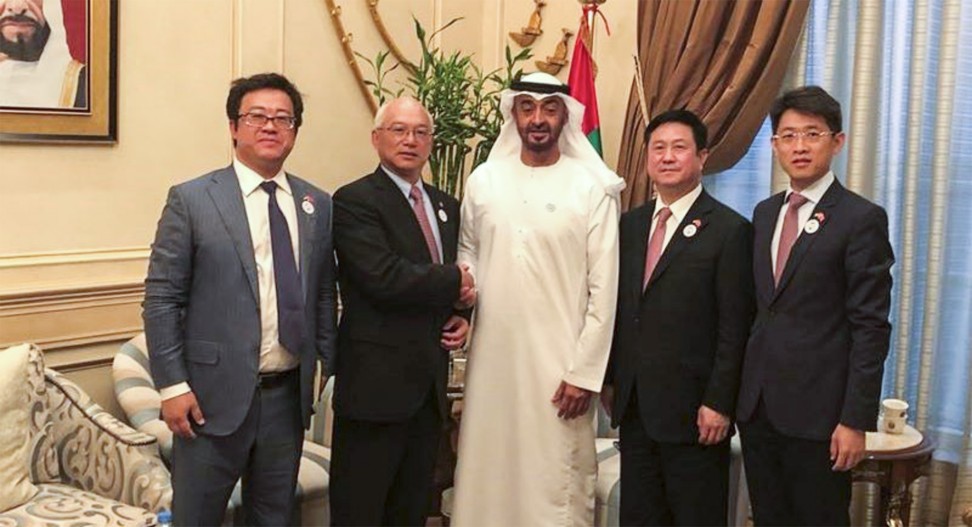

Like CEFC China under Ye, Hengli is also owned and run by a rags-to-riches tycoon. Chen, 47, is both Hengli’s chairman and president, and was ranked 40th on the Hurun China Rich List last year with his wealth estimated at 46.5 billion yuan.

The previous year, according to Caijing magazine, Chen was questioned by the Communist Party’s discipline officials about his involvement with Wang Min, a former official who was jailed for life for bribery and dereliction of duty. Chen has since been released from questioning and was not charged with any wrongdoing. He could not be reached for comment, and company officials declined to comment.

Hengli controls two Shanghai-listed companies: Hengli Petrochemical and Jiangsu Hengli Hydraulic.