Yuan in biggest weekly gain since January as Trump asks cabinet to draft possible China trade deal

- But analysts believe Trump is merely attempting to influence US equities rally before the midterm elections on Tuesday

The yuan rebounded for a second day on Friday. The currency traded in Hong Kong headed for its biggest weekly gain since January after US President Donald Trump reportedly asked his administration to start drafting the terms of a possible trade deal with Beijing and the central bank set a stronger daily yuan reference rate.

China to sell new yuan bills in Hong Kong – a new tool to control the currency now at a 10-year low

Onshore yuan that is traded in China jumped 1.2 per cent in the past two days to 6.8898 against the US dollar, moving away from the psychologically important level of 7 to the US dollar, which has not been breached since the global financial crisis a decade ago.

Offshore yuan that is traded outside the mainland rose 0.48 per cent on Friday, contributing to a weekly advance of 0.96 per cent – the biggest weekly increase since January 26.

Earlier on Friday, the People’s Bank of China had set a stronger midpoint fixing, its first rise in four days. The onshore yuan is allows to trade up to 2 per cent on either side of the fix.

But analysts believed the news suggested Trump was merely attempting to ensure equities rally ahead of the US midterm elections on Tuesday. The possibility of the Republicans losing control of the Senate and the House would mean Democrats take control of the policy agenda on a wide range of issues, making it more difficult for Trump to pass legislation.

“This seems a perfect way to put Xi into a box of what is expected of him in terms of the deal,” said Michael Every, head of Asia financial markets research at Rabobank in Hong Kong. “[Trump can also] then have someone to blame when the deal falls through, providing the US with a green light to proceed with more tariffs.”

Mixed October data this week in the official and Caixin manufacturing purchasing managers indices pointed to an overall softening of growth momentum in China’s manufacturing sector. And Chinese authorities are expected to move quickly to implement more measures to support the private sector, said Yu Song, chief China economist at Goldman Sachs.

The PBOC’s decision to sell yuan bills in Hong Kong next Wednesday, its first sale of such debt also paves way for a regular programme and create another monetary policy tool to help defend the yuan’s exchange rate.

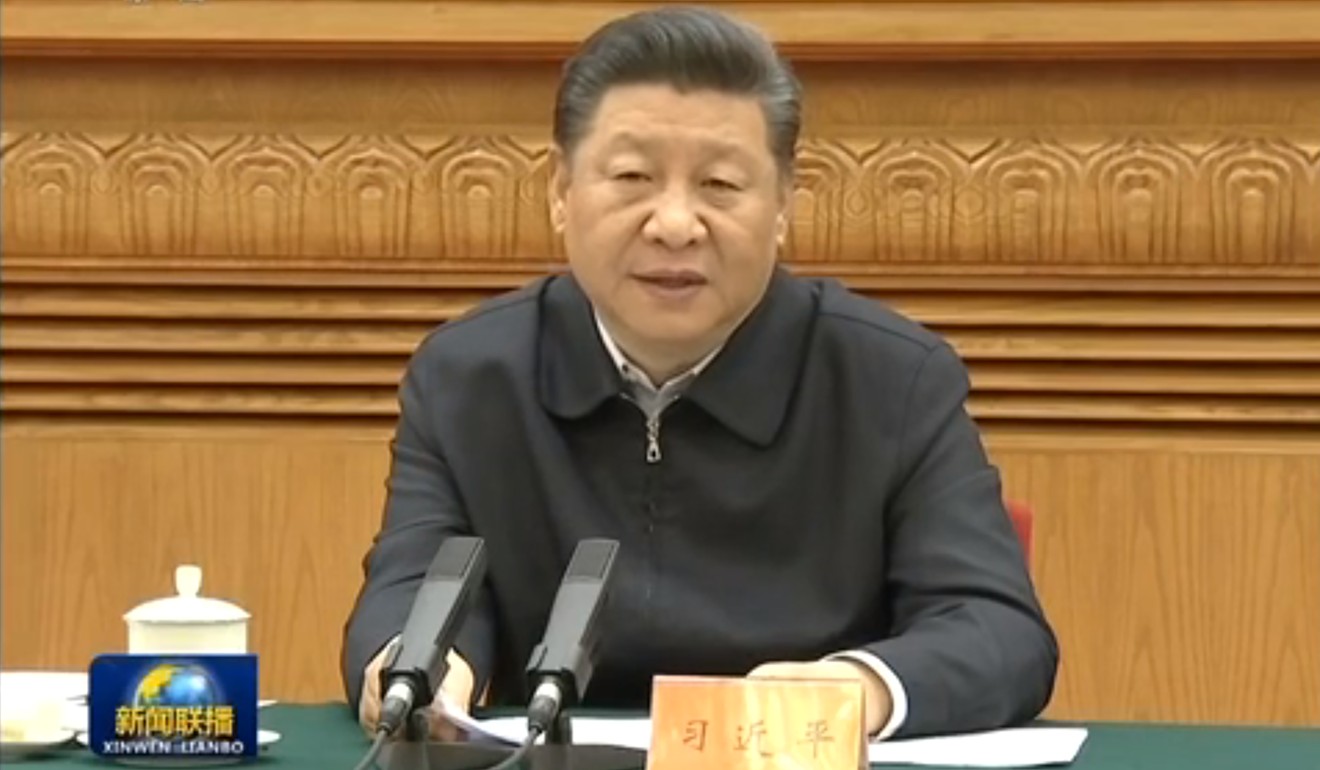

Xi Jinping tries to give private business a ‘confidence boost’ as economic slowdown bites

“Since last week authorities have been trying to stabilise market expectations. Yesterday’s stronger than expected PBOC mid-point and its decision to sell bills in the city to make it more costly to short the yuan suggest a determination to defend the stability of the exchange rate,” said Carie Li, a Hong Kong-based economist with OCBC Wing Hang Bank.

On Thursday President Xi held a meeting with entrepreneurs, telling them the government would aim to reduce the corporate VAT tax burden and address the issue of high financing costs, alleviating concerns about a more interventionist and state-dominated economy which had been a major drag on business confidence and financial markets.

While Xi’s public comments were seen as encouraging with measures becoming more specific, the extent of their implementation is still to be worked out, Yu said.