China’s bankers grapple with new credit rules to private borrowers as officials sow confusion with flip-flopping policies

- At least a third of new loans should go to private companies, with the ratio going up to 50 per cent in three years, the bank regulator said last week

- In a country where the state’s influence is felt everywhere, what exactly is a private company, bankers ask

Some Chinese banks are struggling to comply with unprecedented regulatory targets for credit to private companies because they aren’t sure who to lend to, a sign that authorities’ urgency to reverse an economic slowdown is muddying policy.

The problem, according to senior executives at three banks who spoke on condition of anonymity for fear of alienating regulators, largely boils down to this: In a country where the state’s influence is felt everywhere, there remains little consensus on what, exactly, defines a “private” company. That leaves the new policy open to misinterpretation and even potentially to gaming, they said.

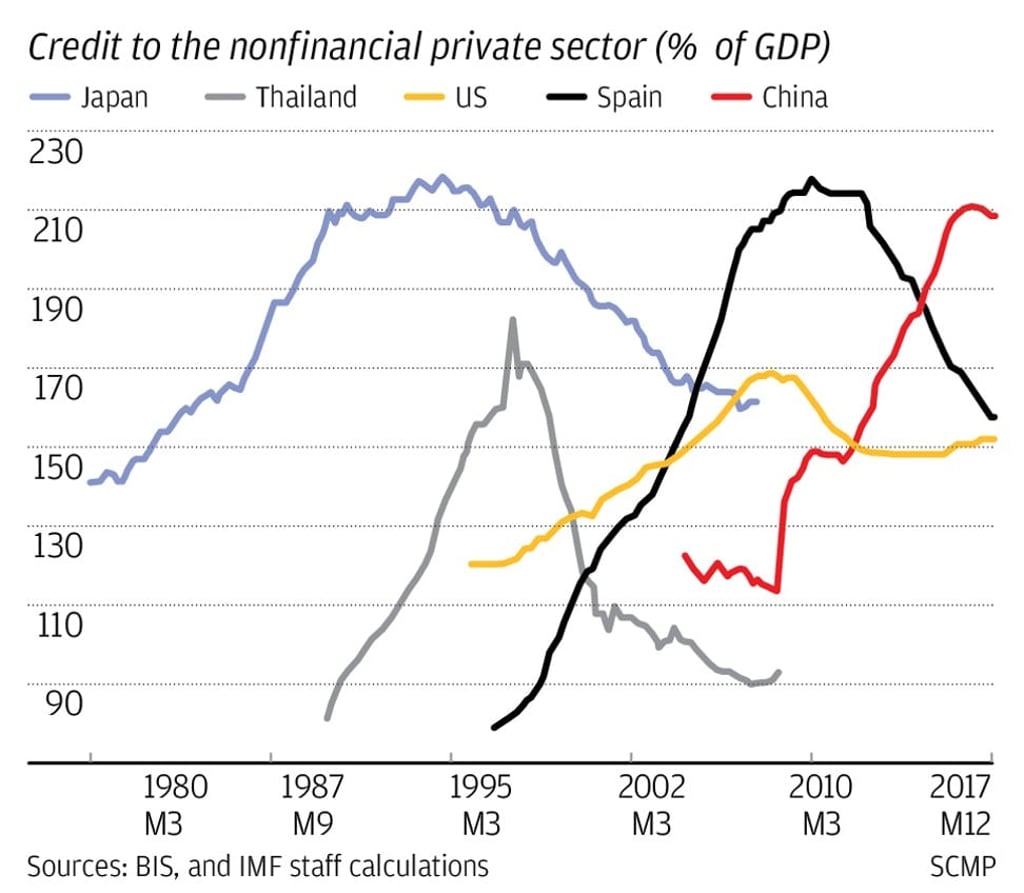

Investors and bank executives alike are concerned that setting specific targets for lending to private businesses - something authorities refrained from even during the height of the 2008 financial crisis - could result in a pile-up of bad debts.

Bond defaults by non-state companies, an indicator of stress in the private sector, jumped fourfold this year from 2017, Bloomberg-compiled data show.