China’s cash-starved companies offer their prized assets at garage sales to dress up their books and avoid stock market expulsion

- As many as 72 companies have warned investors to expect net profit to plunge by more than 100 per cent

- Another 10 of these said they’re likely to face more than 1 billion yuan in losses

Dozens of Chinese companies, pressed by a slowing economy and tighter bank loans, are putting their prized assets on sale to raise money to dress up their books as the year end approaches, in a desperate move to avoid expulsion from the stock exchanges.

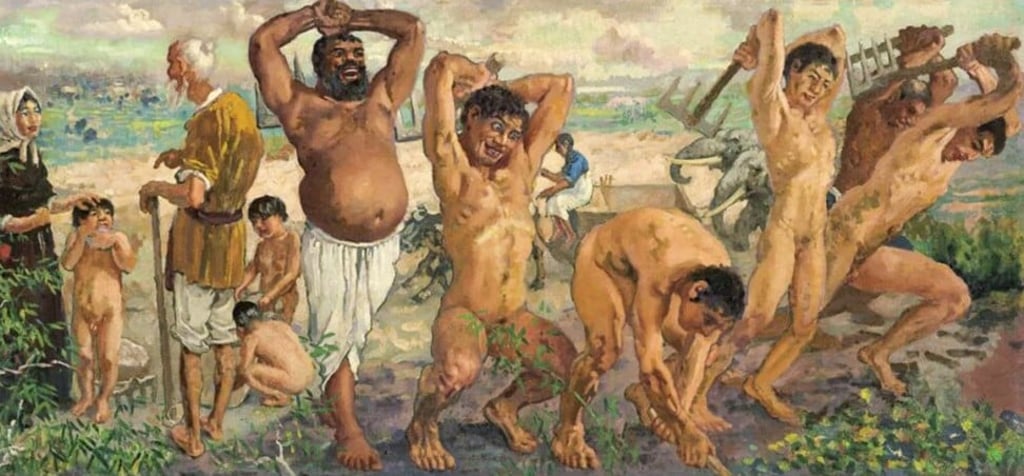

Hunan TV & Broadcast Intermediary, the operator of China’s second-most watched television network, last week sold an oil painting for a record 208.8 million yuan (US$30 million) to its largest shareholder, raising enough cash to cover a nine-month loss of 130 million yuan and avoid a designation for possible expulsion from the Shenzhen Stock Exchange.

The broadcaster, whose coverage extends to 1 billion people, wasn’t alone in holding a garage sale of assets, as a US-China trade war disrupted profit prospects amid the slowest economic growth pace in decades, making 2018 one of the worst years in the Chinese capital market.

China’s global asset shoppers brace for haircuts in forced fire sales

The economy’s M2 money supply has fallen every month since March 2017, while November’s total lending grew by a mere 9.9 per cent, the slowest year-on-year increase on record, as banking regulator continued to crack down on risky loans.

As many as 72 of China’s 3,550 listed companies have warned investors to expect net profit to plunge by more than 100 per cent. Another 10 of these said they’re likely to face more than 1 billion yuan in losses.

“The priority for A-share companies is still to avoid delisting, because the listing status is a precious resource that could be monetised,” said Guo Shiliang, a financial columnist based in Guangzhou.