Extended trade war will strangle growth at China’s busiest ports, Moody’s says

- Tit-for-tat tariffs, lower handling charges to further squeeze port operators in China in the next 12 to 18 months, says the US financial services company

- Rating agency highlighted negative impact on credit profile of China Merchants Port Holdings, Hutchison Port Holdings and Shanghai International Port

The escalation and extension of the year-long trade war between the two largest economies on Earth will choke the growth of China’s container shipping business over the next 12 to 18 months, according to a report by Moody’s Investors Service.

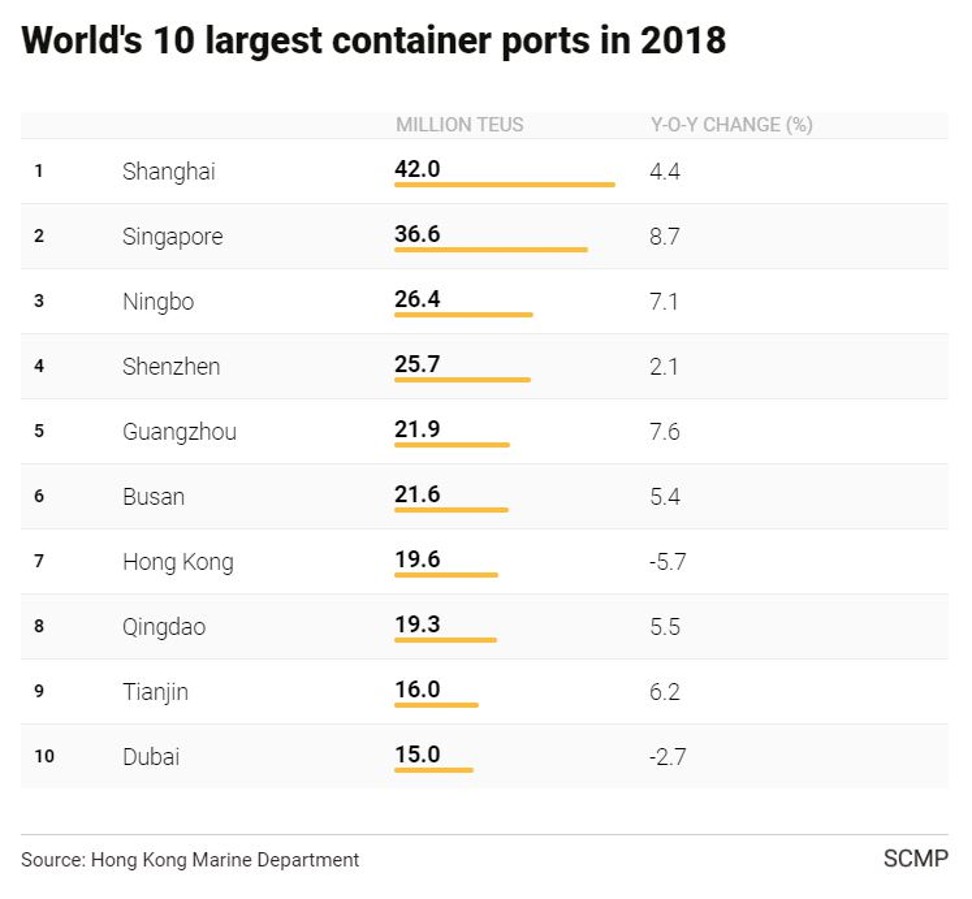

Annual growth rate in container throughput may be knocked down to zero or a low single-digit percentage, from 4.7 per cent in 2018, and 8.3 per cent in 2017, Moody’s said.

Port handling charges, measured by the average revenue per 20-foot equivalent unit (TEU), are also expected to decline, which will erode the total revenue and profit margins of China Merchants Port Holdings, Hutchison Port Holdings and Shanghai International Port, three port operators whose debt are rated by Moody’s.

“We expect US-China relations to remain contentious and trade negotiations to continue for some time even if the two countries reach a trade agreement, resulting in a difficult operating environment for China’s port sector,” said Moody’s analyst Ralph Ng.

The decline in container throughput will further squeeze Chinese port operators that are already under pressure from overcapacity and consolidation, while possible economic stabilising policies that require cutting handling charges may further weigh on their credit profiles, Ng said.

The US-China trade war reached an impasse when months of negotiations failed to reach a resolution, and a 25-per cent US tariff on US$200 billion of Chinese goods went into effect on May 10, provoking the Chinese government to impose a 25 per cent tax on US$60 billion of US products.

The New Export Orders Index, an indicator of export demand, has weakened to below 50 per cent since June 2018 and was at 45.2 per cent in February 2019, the lowest level since February 2009.

A reading below 50 per cent indicates weakening export demand for Chinese goods. The index had risen to 49.2 per cent in April, amid optimism that the US and China were close to a resolution.

Container throughput growth surged for Chinese port operators during the fourth quarter of 2018, but that was caused by “front-loading”, as US importers brought forward their purchases to avoid the tariff on US$200 billion Chinese goods originally due to take effect on January 1, Moody’s said.

“Container throughput also increased in the first quarter of 2019, possibly a carry-over of the front-loading,” Moody’s said. “We do not expect front-loading to continue during the remainder of 2019.”