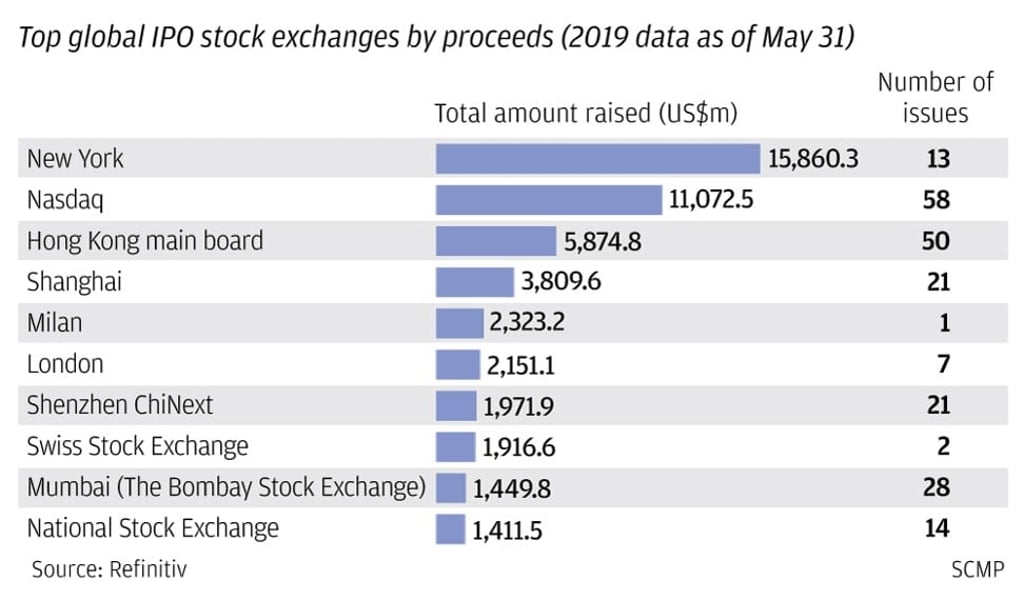

Hong Kong slips behind New York and Nasdaq in five-month global IPO rankings, as trade war takes a toll on sentiment

- Hong Kong was the third biggest IPO market by proceeds raised in the first five months of 2019, according to data from Refinitiv

- The city failed to attract blockbuster IPOs while its US rivals bagged ride-hailing giants Uber and Lyft

A lack of blockbuster listings has seen Hong Kong slip to third place in the worldwide IPO rankings, according to data provider Refinitiv.

In terms of total proceeds, it was overtaken by the Nasdaq and New York stock exchanges in the first five months of the year after the American bourses managed to attract some mega listings by global technology giants.

Analysts said the US-China trade war had dented the appeal of Hong Kong as an IPO destination, and the outlook remained uncertain.

New York Stock Exchange was ranked the world’s top IPO market by value, raising US$15.9 billion between January 1 and May 31, representing 29.5 per cent of the global market. It benefited from the US$8.1 billion IPO of Uber, the world’s biggest ride-hailing company, whose shares debuted in May, according to Refinitiv.

Hong Kong, which has been the top IPO market six times in the past decade, succeeded in attracting a large number of biotech firms, but raised only US$5.87 billion, 10.9 per cent of the global total.