China’s government sets up Dajia Insurance to take over Anbang’s assets as the disposal of former asset buyer nears

- Dajia Insurance, established this week in Beijing, has an identical structure and shareholders as Anbang, albeit with smaller capitalisation

- The finance ministry’s China Insurance Security Fund owns 98.2 per cent of Dajia, as it does Anbang

China’s government has established a new insurer to take over the operations of Anbang Group, more than 16 months after one of the country’s biggest asset buyers was put under state ward and its chairman was jailed for fraud.

Dajia Insurance Group was registered on June 25 in Beijing with 20.4 billion yuan (US$3 billion) of capital put up by identical shareholders as Anbang, according to documents published by the business registrar.

The move is the clearest sign that the China Banking and Insurance Regulatory Commission (CBIRC) is moving ahead with its programme to transfer Anbang’s business operations. The insurer, which began as a regional seller of car insurance founded by Wu Xiaohui in 1994, had 1.9 trillion yuan in assets as of February 2017, before Wu’s fall from grace.

China Petrochemical Corporation, the country’s state oil monopoly, owns 0.55 per cent of Dajia, as it does in Anbang. Shanghai Automotive Industry Corporation (SAIC), the largest state-owned Chinese carmaker, owns 1.2 per cent in both insurers.

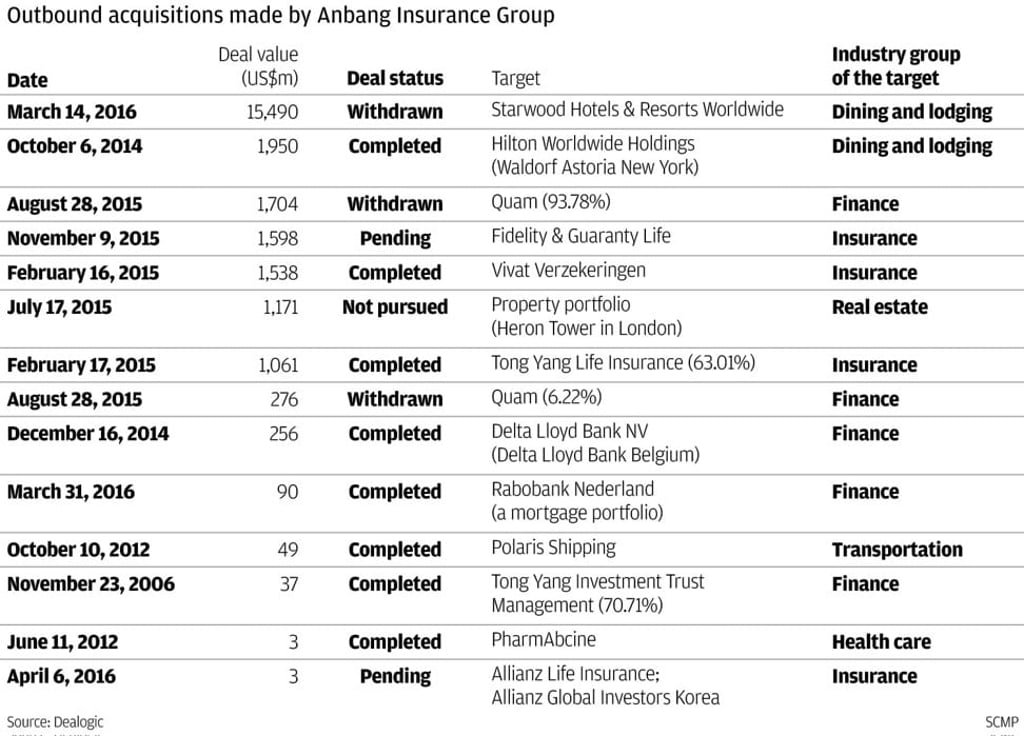

Anbang was one of China’s most aggressive asset buyers, building its war chest from billions of yuan of savings provided by investors of its high-yield “universal life insurance,” a variant of wealth management financial product.