Vietnam’s April trade deficit widens, showing country’s commerce actually deteriorated amid US-China trade war

- Vietnam’s net export position has deteriorated since the US-China trade war escalated, a Bank of America Merrill Lynch study has found

- Vietnam saw a trade deficit of around US$600 million in April

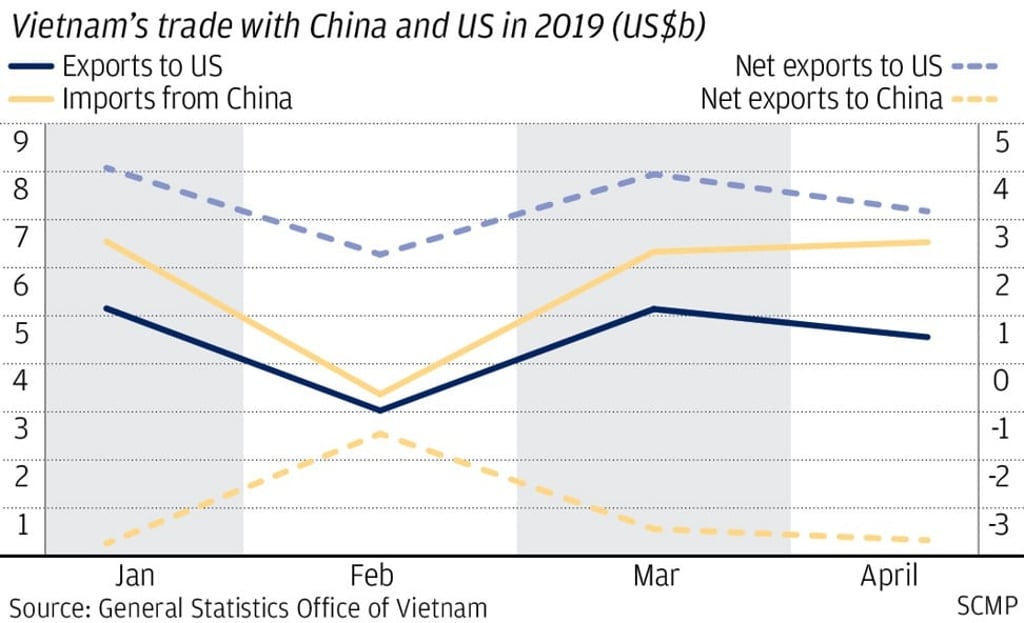

Vietnam’s imports from China are growing at a much faster rate than exports to the US, as manufacturers in the Southeast Asian country rely heavily on final-stage assembly or re-exports, tapping opportunities in the trade war between the world’s two largest economies, a study by Bank of America Merrill Lynch showed on Wednesday.

“Vietnam’s net export position has deteriorated since the US-China trade war escalated. Exports to the US have risen, but these have more than been compensated by imports from China,” the report said.

The preliminary figures published by Vietnam’s General Statistics Office for the first four months of the year showed that exports were valued at US$20.4 billion, while imports stood at US$21 billion, resulting in a trade deficit of around US$600 million. This was in contrast to a US$1.4 billion trade surplus in March.

Vietnam’s exports to the US resulted in a trade surplus of US$3.2 billion in April. However, the trade deficit with China widened to US$3.7 billion with China. It has climbed from US$1.5 billion in February to US$3.4 billion in March.

“Between April 2018 and April 2019, exports of computers, electronic parts, phones and textiles have grown the most in US dollar terms. Yet, the country has also seen sharp increases in imports of computers, electronic goods and machinery over the same period,” said the BofA report, led by Sanjay Mookim.

He said there were two explanations to make sense of the numbers.