Hong Kong promotes Eddie Yue to lead monetary authority, taking no chances on its choice amid turbulent economic times

- Eddie Yue Wai-man, 54, will assume the post of chief executive at Monetary Authority from October 1

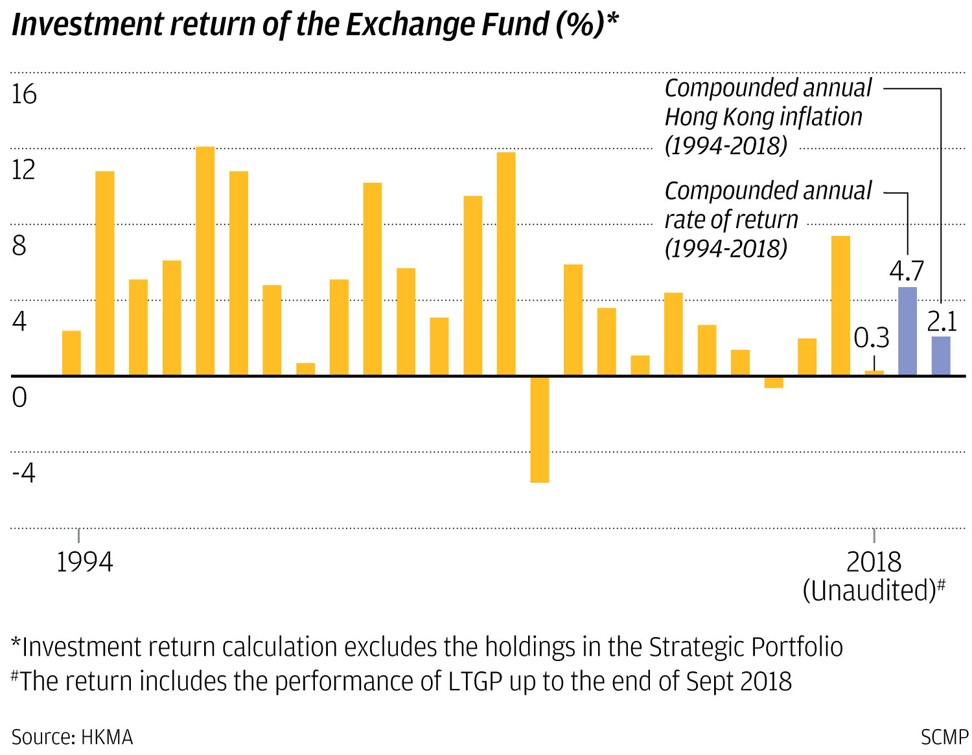

- Yue, architect of alternative investment strategy for Exchange Fund, contributed to the 10-year era of 12.9 per cent average annualised returns

Eddie Yue Wai-man, who joined the Hong Kong Monetary Authority (HKMA) from its establishment in 1993, has been promoted to head the de facto central bank, as the government looks to the veteran insider to help the city chart a steady course through unprecedented turbulence.

“His achievements in promoting the HKMA’s reserve management and financial market development in recent years are well recognised,” Chan said. “He is the person best suited for this position.”

Yue’s resume will also be instrumental in honing Hong Kong’s role in several of China’s large-scale and long-term strategic projects: the Greater Bay Area (GBA) of 11 southern Chinese cities including Hong Kong and Macau, and as a so-called super connector in the Belt and Road Initiative of infrastructure projects from China to Europe and Africa.

The monetary official “had been instrumental during his tenure as the HKMA’s deputy chief executive in fostering Hong Kong’s financial collaboration with the rest of the world, building Hong Kong into the largest offshore renminbi trading centre, and developing the city’s role as a super connector in the Belt and Road Initiative,” the Hong Kong Association of Banks said.

The new HKMA chief will be appointed for a term of five years, with an annual remuneration fixed at HK$7 million and a performance-linked variable pay capped at HK$2.3 million throughout his tenure. The package, less than the HK$10 million earned by his predecessors, still makes him one of the highest-paid central bankers worldwide.

His promotion suggests that Hong Kong’s government is taking no chances in its choice for the guardian of the city’s currency and one of the world’s largest reserves. Still, the chief executive designate will be constrained in his policy tool kit when it comes to the cost of money, and how that affects property ownership in land-scarce Hong Kong.

Housing affordability, especially among school leavers and first-home buyers, had been a political challenge for successive Hong Kong administrations, spilling over into expressions of public discontent in nearly two months of unprecedented street protests around the city.

“The HKMA will closely monitor the market situation to determine if it is time to change the [city’s] mortgage policies,” Yue said at a press conference today.

The city of 7 million people has also been squeezed by a year-long trade war between the two largest economies on earth.

“We now face tremendous complexities and uncertain financial markets” brought on by factors including the US-China trade war, Britain’s exit from the European Union and the interest rate policies of the world’s central banks, Yue said.

“Eddie has extensive experience in managing the reserves and the linked exchange rate system,”

said Chan Ka-keung, chairman of WeLab Virtual Bank, who is also the former head of Hong Kong’s Financial Services and the Treasury Bureau. “This should assure the market,”

Yue's career path traced his two predecessors as head of the monetary authority. He joined the government as an administration officer in 1986 after graduating from the Chinese University of Hong Kong. In 1993, he joined the HKMA and has since worked in a range of different departments, including bank regulation, external relationships, research and reserve management.

Joseph Yam Chi-kwong, the first chief executive for 16 years, began his career in Hong Kong’s civil service before helping to establish the HKMA in 1993. Norman Chan was an administrator in the civil service for more than a decade before joining the nascent HKMA.

Yam, who was Yue’s mentor at the HKMA, is part of the search committee for the role of the monetary authority’s chief.

“Eddie is a capable and professional person,” Yam said in a statement. “He has my support.”

“With his breadth and depth of knowledge and experience, we are fully confident that he will not only provide continuity to a robust monetary system, but also help Hong Kong navigate the challenging global and local environments with dexterity,” said Sally Wong, chief executive of the Hong Kong Investment Funds Association. “He also plays a pivotal role in fostering sustainable green finance, further bolstering the role of Hong Kong as a key financial hub.”

Unlike Yam and Chan – both outspoken, with high public profiles – Yue tends to shy from the limelight, avoiding media interviews and eschewing posts or blogs on social media.

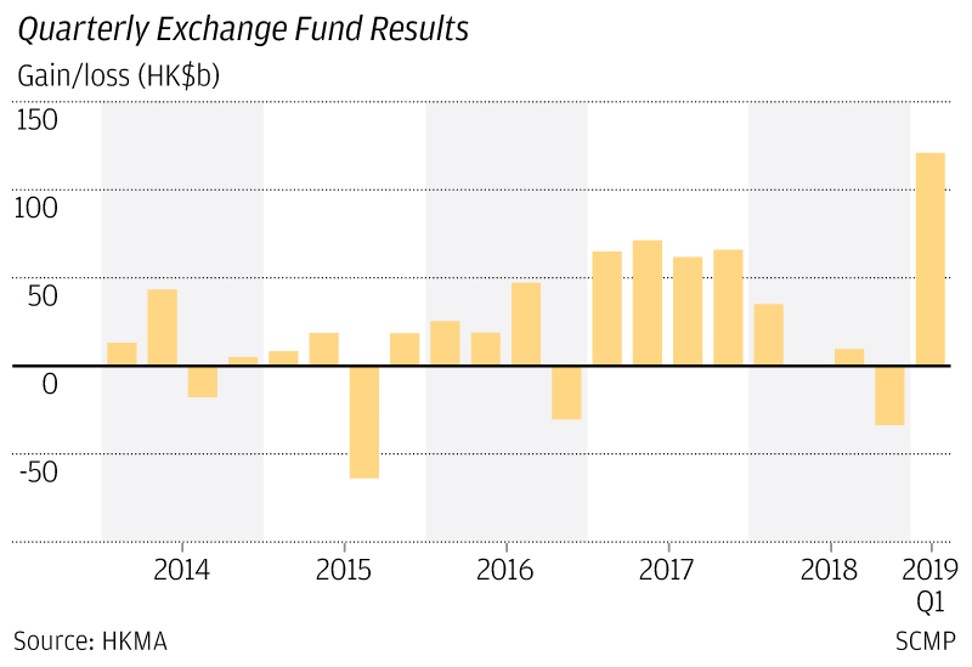

Yue helped oversee changes in 2009 that allowed the Exchange Fund to make alternative investments involving private equity, real estate and infrastructure projects.

The move was aimed at helping to diversify the range of investments possible for the Exchange Fund, which had until then been limited to traditional products such as bonds and equities in Hong Kong and overseas.

The strategy had its risks, but also allowed the Exchange Fund to tap into high annual returns over a decade, Yue said.

“When making investment decisions, one should consider not only the returns, but also risks,” Yue wrote on the HKMA’s website last October. “Some may think that infrastructure investment is risky, but empirical data show that infrastructure investment, in general, outperforms traditional assets on a risk-adjusted basis.”