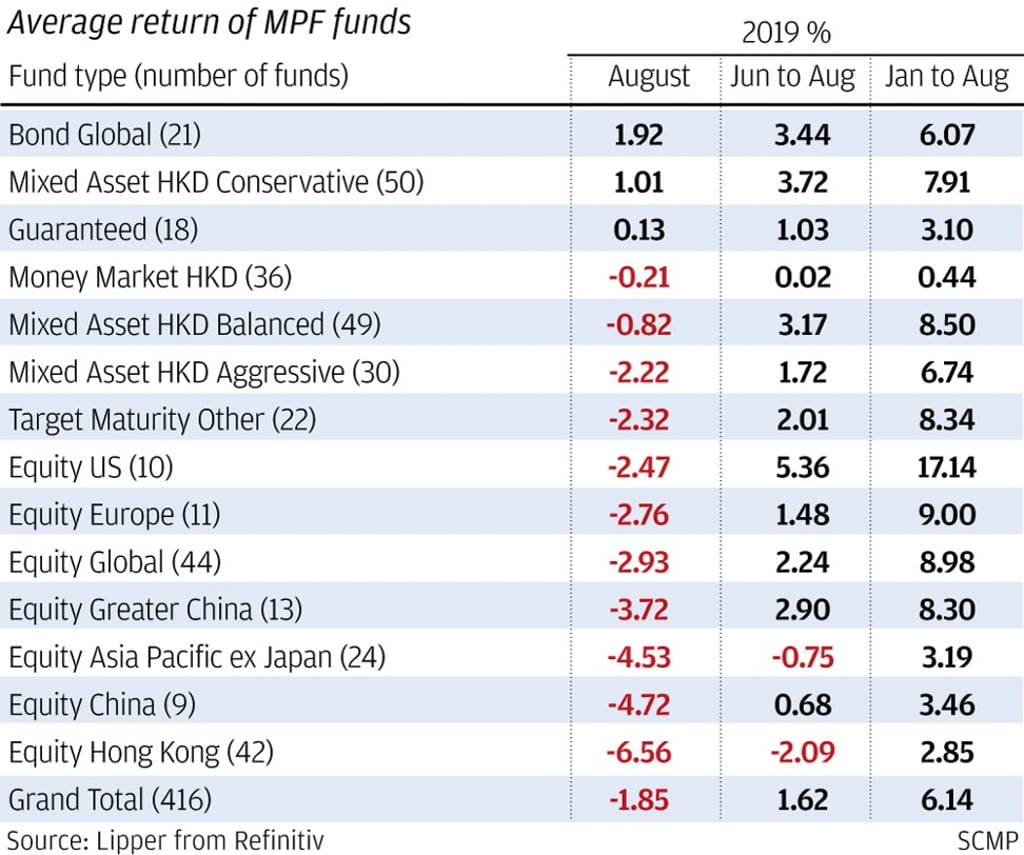

MPF’s stocks funds returned 7 per cent average loss in August as Hong Kong’s market was buffeted by trade war and street rallies

- The MPF’s Hong Kong equity funds returned 6.6 per cent in average losses last month, the worst performers out of all the pension fund’s asset-allocation options

- Bonds outperformed all options, as investors sought refuge in fixed-income financial instruments amid a turbulent equities market

The average loss in the Hong Kong stock funds, tracking a 7.4 per cent plunge in the key Hang Seng Index, was worse than the China fund’s 4.7 per cent drop, a 4.5 per cent decline in the Asia-Pacific excluding Japan fund, and bigger than the 2.9 per cent dip in the global equity fund, Lipper’s data showed.

“Bonds provide a safe haven in times of volatile stock markets, due to the escalating trade war between the US and China,” said Elvin Yu, chief executive of pension consultancy Goji Consulting. “US equity funds are still in favour given the decent economic data in recent days. While some analysts are expressing concerns of a possible US recession, it won’t come any time soon.”

Hong Kong’s economy, on track to a technical recession in the third quarter as it’s been squeezed by a year-long trade war between the world’s two largest economies, has been put under further pressure as 13 weeks of street rallies since June have deterred visitors and investments in the city.