Hong Kong-China ‘insurance connect’ plan on hold as trade war, protests hit business environment

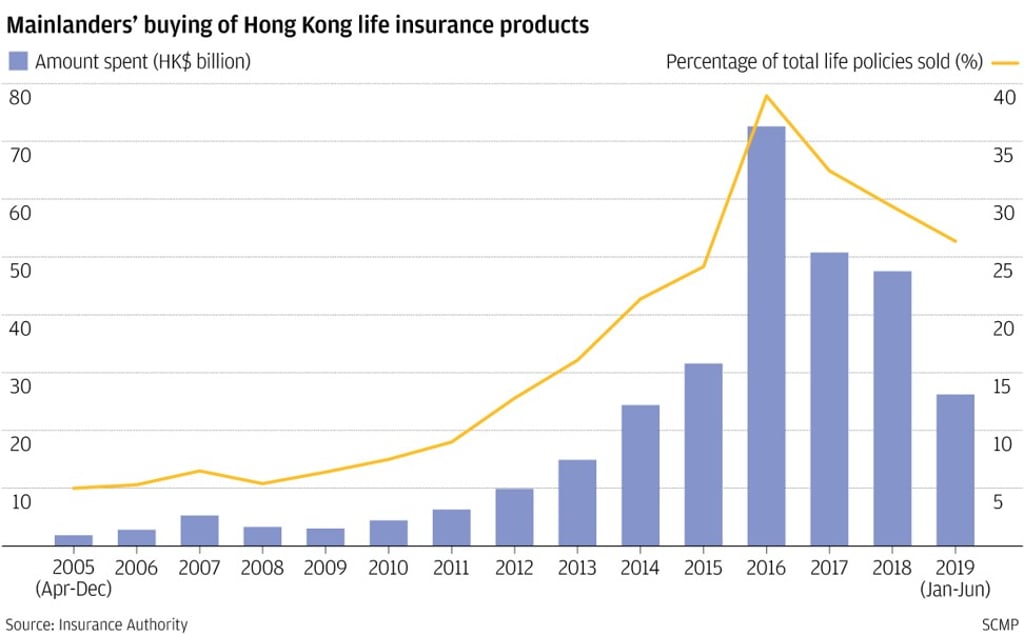

- Sales of Hong Kong insurance policies to mainlanders have fallen as the protests have hit tourist numbers

- The Insurance Authority had been in talks with its mainland counterparts to establish a channel modelled on the stock connect schemes

A proposed new “insurance connect” scheme to allow cross-border sales of insurance products between Hong Kong and mainland China is on hold because of economic uncertainties arising from the trade war and the unprecedented social unrest that has rocked Hong Kong for the last three months.

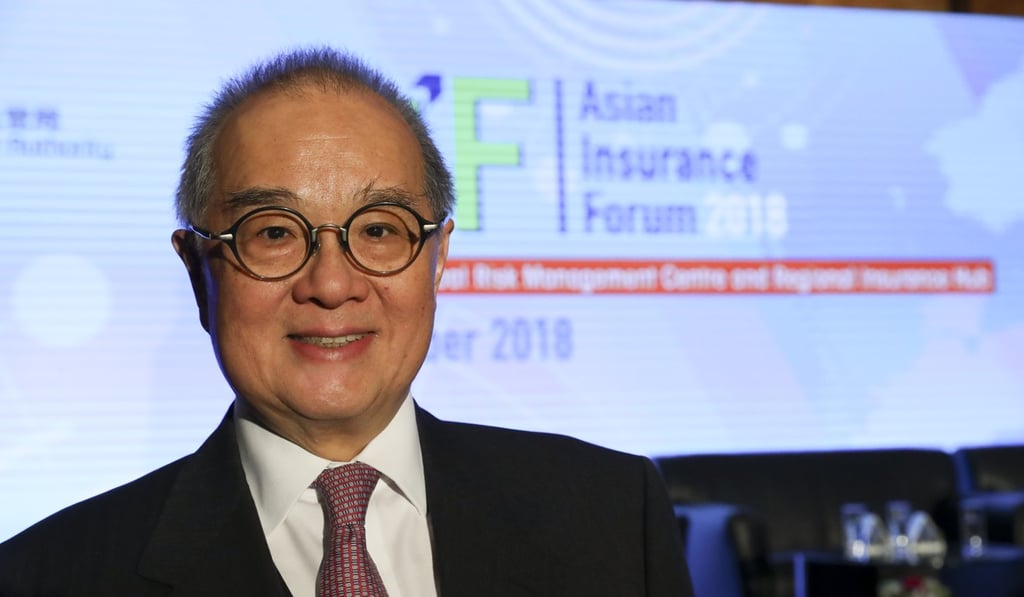

“The talks about setting up an insurance connect scheme will definitely be delayed as a result of the challenges of international business operating environment as a result of the ongoing US-China trade war. It would be hard to launch a new connect scheme under the current economic situation,” said Insurance Authority chairman Moses Cheng Mo-chi on Monday.

Cheng revealed in June last year that the authority has been in talks with its mainland counterparts to establish a special channel for the marketing, sale and processing of insurance products, using a model pioneered in the stock connect schemes that now link the stock markets of Shanghai and Shenzhen with Hong Kong. A bond connect scheme was added in 2017.

Cheng said while the service centres in the bay area remain on the agenda, a full-scale insurance connect would be delayed. The trade war has dragged China’s economic growth down to 6.2 per cent in the second quarter, its weakest pace in at least 27 years.

The unprecedented anti-government protests in Hong Kong, which started peacefully on June 9 in opposition to a now withdrawn extradition bill, have turned increasingly violent and led to a sharp fall in tourist numbers.