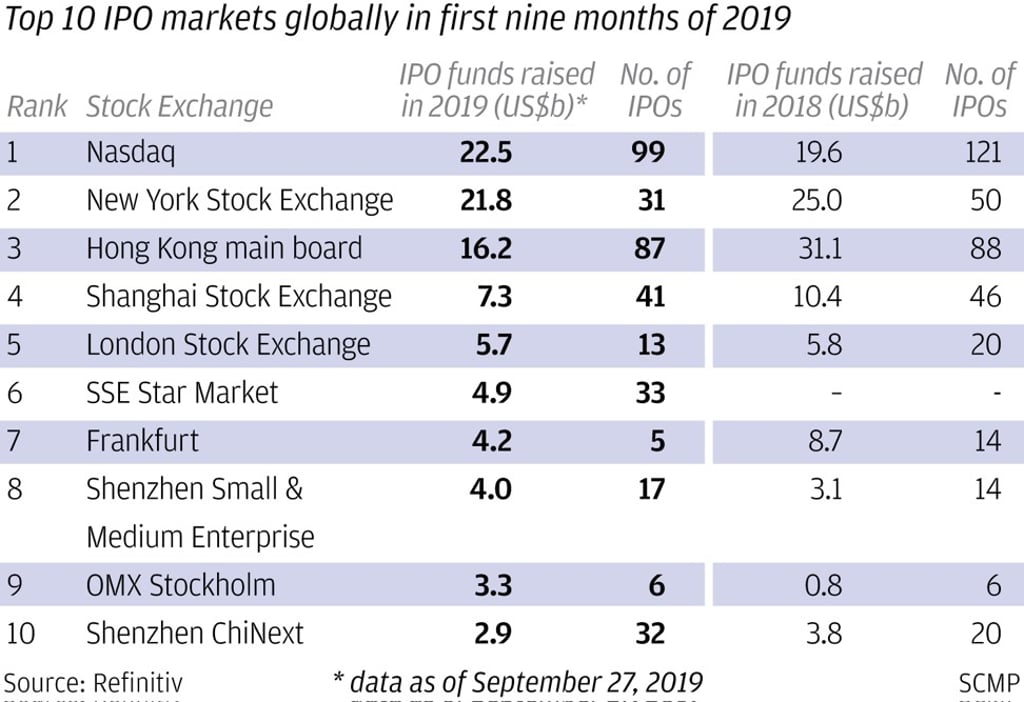

Hong Kong edges past Nasdaq as the world’s third-quarter IPO hub as companies returned to one of Asia’s deepest markets for funds

- The total value of first-time share sales in Hong Kong since September 1 is US$7.9 billion, overshadowing Nasdaq’s US$7 billion and US$3 billion at the New York Stock Exchange, according to Bloomberg

- Anheuser-Busch InBev NV’s US$5.8 billion IPO of its Asian unit and another billion-dollar-plus deal contributed to the lead held by the Asian financial centre

Defying the intensifying protests that have hurt the city’s economy from trade to tourism, Hong Kong’s has led the world in initial public offerings since the start of September.

“The market has been volatile and challenging this year but we are now in a good window for IPOs in Hong Kong, ” said Alex Abagian, co-head of Asia-Pacific equity capital markets at Morgan Stanley. “We are seeing a significant amount of quality capital being deployed towards good assets, primarily companies that are market leaders in their sector.”

While summers are typically quiet for first-time share sales in Hong Kong as bankers and investors go on holidays, the escalation of the pro-democracy protests and the trade war between China and the US damped companies’ enthusiasm further this year. The total raised in IPOs plunged to US$1.5 billion for the July-August period from US$11.6 billion a year earlier, which was the busiest summer on record with listings of China Tower and Xiaomi.