Alibaba shares rise in Hong Kong debut, creating city’s biggest stock with HK$4 trillion market capitalisation

- Shares close at HK$187.60 on first day of trading in Hong Kong, handing investors a 6.6 per cent gain over the HK$176 offer price

- Alibaba is the most traded stock with HK$14 billion of shares changing hands, accounting for 10.5 per cent of main board turnover

Alibaba Group Holding’s shares rose on their Hong Kong market debut after the Chinese technology company completed the world’s biggest stock offering this year.

The shares closed at HK$187.60 or 6.6 per cent above the offer price of HK$176, creating the city’s biggest stock with a market value of HK$4 trillion ($513 billion). It was the most traded stock with HK$14 billion worth of shares changing hands, making up 10.5 per cent of turnover on the main board, according to exchange data.

The gain ranks among the best first-day performances involving the biggest IPOs in the city since 2005, after AIA Group (17.1 per cent), Bank of China (15.3 per cent), Industrial and Commercial Bank of China (14.7 per cent) and China Unicom (8.9 per cent).

Alibaba, which trades under stock code 9988, invited 10 customers and partners from eight markets in four continents to strike at the gong in the traditional opening ceremony, a move to symbolise the global nature of the company’s operations.

Financial Secretary Paul Chan Mo-po and Hong Kong Exchanges and Clearing chairwoman Laura Cha Shih May-lung, attended the listing ceremony. Alibaba chairman and chief executive Daniel Zhang, executive vice-chairman Joe Tsai and chief financial officer Maggie Wu were also present, while founder Jack Ma delivered a video message preceding the debut.

There are now five companies with a trillion-dollar capitalisation in local currency terms on the local bourse. The other four are Tencent Holdings, HSBC, China Mobile and China Construction Bank, according to stock exchange data.

China’s onshore funds emerge as ‘buying force’ in Alibaba’s Hong Kong IPO

The Alibaba listing is a shot in the arm for Hong Kong at a time when the city is seeking to rebound from its worst political crisis in history, with the economy in a technical recession. The local bourse has recouped some of the losses since its worst drubbing in four years last quarter, and companies including Budweiser Brewing Company APAC have revived and completed their stock offerings to help the exchange climb to the top of global IPO league table this year.

“The listing of Alibaba today is a milestone,” Charles Li Xiaojia, HKEX’s chief executive, said before the trading. “It is better late than never. It needed to wait for five years but finally, the company is listing here and we see a family member finally coming home.”

Alibaba, which operates the Taobao and Tmall online trading platforms, made its primary listing in New York in September 2014 as HKEX’s restrictions on companies with unconventional voting rights scuppered its plan. That US$25 billion offering still stands as the largest IPO globally.

Alibaba’s IPO attracts 200,000 retail applications, including one for HK$1.1 billion worth of shares

Alibaba raised HK$101.2 billion (US$12.9 billion) by selling 575 million new shares to investors. The deal surpassed Uber Technologies’ US$8.1 billion offering in May, and represents the largest in Hong Kong since insurance group AIA’s HK$159 billion raised in 2010.

“On this important milestone, I want to thank our customers first and foremost,” Zhang said at the ceremony. “I want to especially thank Hong Kong and the Hong Kong stock exchange. As a result of the continuous innovation and changes to the Hong Kong capital market, we are able to realise what we regrettably missed out on five years ago. Today, we realised what we said then, when conditions allow, we will come back to Hong Kong.”

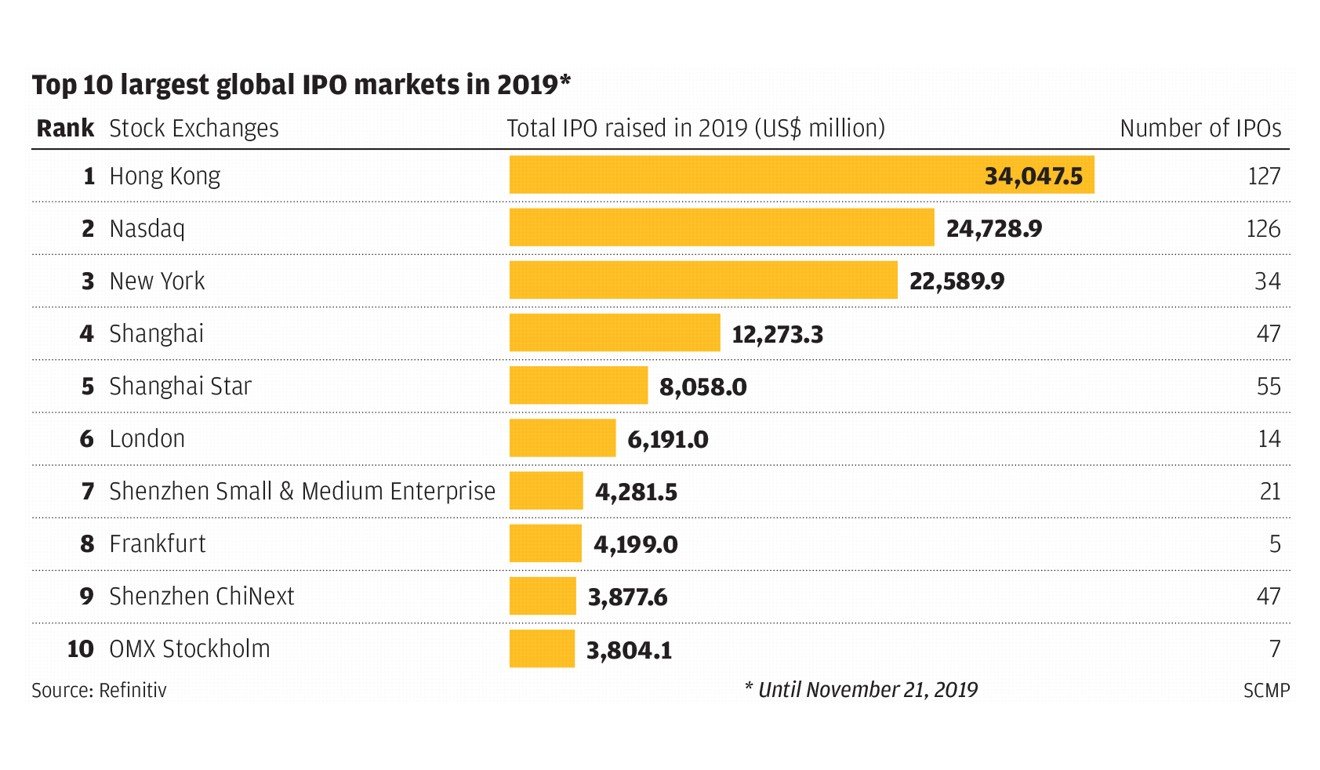

With the listing, the Hong Kong exchange has climbed to the top of the IPO league table. Companies have raised US$34.05 billion from share sales this year through November 21, outpacing the volume on Nasdaq and the New York Stock Exchange, according to data from Refinitiv.

Alibaba’s shares may have more upside if investors closer at home are willing to pay a higher valuation accorded to other technology companies, according to Eastspring Investments. Alibaba traded at 26 times current earnings in New York, versus 86 times for Amazon, according to Bloomberg data. In Hong Kong, Tencent Holdings traded at about 30 times.

Alibaba quarterly revenue jumps 40 per cent ahead of Singles’ Day shopping festival

“Alibaba might be hoping for a higher valuation multiple being given to the company as we have seen previously that mainland Chinese retail stock investors are more than willing to pay a higher premium to invest in stocks that they are bullish on,” said Ken Wong, client portfolio manager for equities, wrote in a research note.

Louis Tse Ming-kwong, managing director of VC Asset Management, expects Alibaba’s shares to trade in a range of HK$170 to HK$185 in the near term. The long term outlook will depend on whether it can become a constituent member of the benchmark Hang Seng Index, or join the Stock Connect schemes, he added.

Alibaba and other companies with so-called weighted voting rights will not be able to join the Hang Seng Index until at least May next year at the earliest, according to index compiler Hang Seng Indexes chief executive Vincent Kwan Wing-shing. Results from its first-quarter consultation on index membership are likely to be announced in May.